- Law 4864/2021 governs the "Fast Track" process, providing legal certainty and expedited licensing for large-scale projects in Greece.

- Strategic investments can benefit from a 12-year tax stability guarantee, protecting the project from future changes in corporate tax rates.

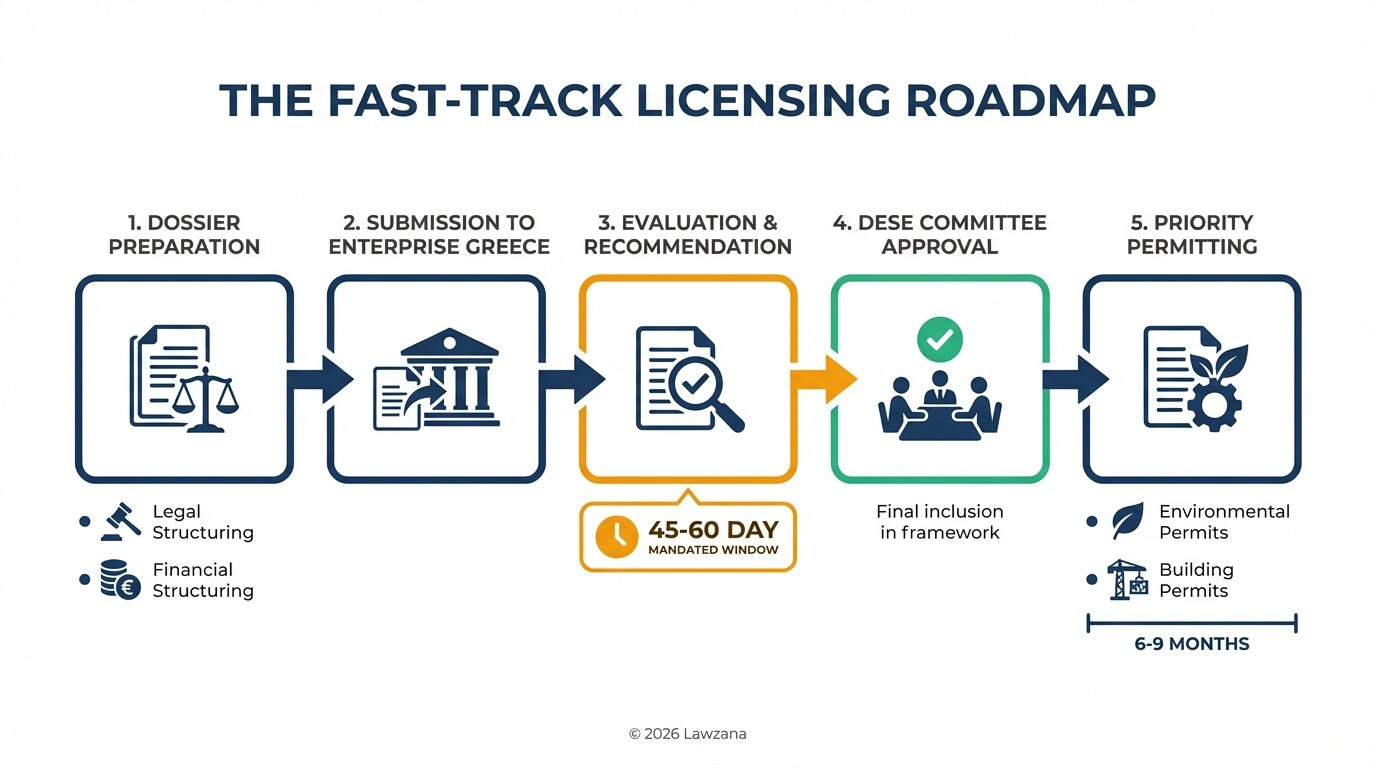

- The approval timeline for entering the Strategic Investment framework is reduced to a maximum of 45 to 60 days following a completed application.

- Minimum investment thresholds range from €30 million to over €100 million depending on the project type and the number of jobs created.

- Legal advisory and professional filing fees for these complex applications typically start at €10,000, excluding government management fees paid to Enterprise Greece.

Strategic Investment Framework for Foreign Capital in Greece

The Greek strategic investment framework is a specialized legal regime designed to accelerate high-value international projects by bypassing traditional bureaucratic bottlenecks. Managed primarily by Enterprise Greece, this framework offers a "one-stop-shop" service for licensing, urban planning, and environmental permitting. By granting projects the status of "Strategic Investment," the Greek state provides a fast-track pathway and various fiscal incentives to ensure project bankability and speed to market.

Strategic Investment Eligibility Checklist

To qualify for Fast Track status under Law 4864/2021, a project must meet specific financial and social criteria. The following checklist outlines the primary categories for eligibility in Greece.

| Investment Category | Minimum Budget | Employment Requirement |

|---|---|---|

| Strategic Investment 1 | €100 Million+ | N/A |

| Strategic Investment 2 | €40 Million+ | 75+ new permanent jobs |

| Iconic Investments | €200 Million+ | High impact/Innovation focus |

| R&D or Biotech | €20 Million+ | N/A (Focus on innovation) |

| Green Transition | €30 Million+ | N/A (Focus on decarbonization) |

Mandatory Documentation for Filing:

- Business Plan: A comprehensive 10-year financial projection and operational strategy.

- Impact Assessment: Documentation proving the project's contribution to the national economy and local employment.

- Proof of Funds: Evidence of the investor's ability to cover the equity portion of the project.

- Legal Entity Status: Updated corporate documents of the Greek Special Purpose Vehicle (SPV) or the parent company.

- Fee Payment: Proof of payment of the "Management Fee" to Enterprise Greece (0.2% of investment, capped).

Eligibility for Fast Track Licensing Under the Strategic Investment Law

Fast Track licensing in Greece is a specialized legal status that grants priority to large-scale projects throughout the entire public administration. Once a project is approved by the Inter-Ministerial Committee for Strategic Investments (DESE), all relevant ministries are legally required to process the project's permits with absolute priority. This system effectively circumvents the standard administrative queues that often delay smaller commercial ventures.

The eligibility hinges on the project's "strategic" nature, which is defined by its ability to generate significant quantitative and qualitative benefits for the Greek economy. While the €100 million threshold is the standard for automatic eligibility, projects as low as €30 million can qualify if they focus on specific sectors like digital transformation, green energy, or if they create at least 50 new jobs. The legal framework ensures that once these criteria are verified by Enterprise Greece, the project moves into a streamlined regulatory environment.

Tax Stability Guarantees and Cash Grant Incentives for 2026 Projects

Greece offers robust fiscal incentives for strategic investments, including a 12-year tax stability guarantee and direct cash grants for specific sectors. The tax stability incentive "locks in" the corporate income tax rate at the time of the investment, shielding the investor from any tax hikes for over a decade. This is particularly valuable for Private Equity firms and international funds looking for long-term predictability in their Internal Rate of Return (IRR) calculations.

For projects aiming for completion by 2026, additional incentives from the Recovery and Resilience Facility (RRF) and the Greek Development Law may apply. These include:

- Tax Exemptions: A total exemption from paying corporate income tax on profits until a certain percentage of the investment cost is recovered.

- Cash Grants: Direct subsidies for projects located in specific geographical regions or those focusing on R&D and digital manufacturing.

- Fast-Track Depreciation: Accelerated depreciation of assets (up to 200%) to reduce the taxable base in the early years of operation.

Environmental and Archaeological Permitting: Navigating Local Bureaucracy

Environmental and archaeological clearances are historically the most complex hurdles for foreign capital in Greece, but strategic investments benefit from a unified licensing process. Under the Strategic Investment Law, projects can utilize the "ESCHASE" (Special Plan for the Spatial Development of Strategic Investments). This tool allows the government to issue a Presidential Decree that defines the land-use rights and building terms specifically for that project, providing high-level legal protection against local administrative challenges.

Navigating the Central Archaeological Council (KAS) remains a critical step, as Greece's rich history often leads to discoveries during excavation. However, for strategic projects, the coordination is handled at the ministerial level, ensuring that archaeological excavations are conducted with strict timelines. The legal framework mandates that environmental impact assessments for these projects are processed through a "fast-lane" department within the Ministry of Environment and Energy, significantly reducing the risk of "permit drift."

Legal Advisory Costs for Strategic Filings

Entering the Greek strategic investment regime requires sophisticated legal and financial structuring, with initial legal advisory costs for filings starting at approximately €10,000. This baseline fee typically covers the initial feasibility legal audit and the preparation of the application for Enterprise Greece. For larger, more complex projects involving multiple stakeholders or cross-border financing, total legal and consulting fees can range from 0.5% to 1.5% of the total project value.

Investors must also account for the mandatory Management Fee paid to Enterprise Greece. This fee is non-refundable and is used to cover the administrative costs of evaluating the dossier. It is calculated as 0.2% of the total investment cost, with a minimum floor of €10,000 and a maximum cap of €100,000. Working with a law firm that has a dedicated "Government Relations" or "Public Law" department is essential for managing these costs and ensuring the dossier meets the strict requirements of the Inter-Ministerial Committee.

Timeline: Fast-Track Approval Reduced to 45 to 60 Days

The primary legal advantage of the Strategic Investment Law is the drastic reduction in the approval timeline, which is now mandated to be between 45 and 60 days for qualified projects. This period begins once Enterprise Greece has officially confirmed that the application dossier is complete. During this window, the investment agency evaluates the business plan and submits its recommendation to the Inter-Ministerial Committee for Strategic Investments (DESE) for final approval.

Once the DESE issues its positive decision, the project is officially included in the Strategic Investment framework. Following this, the "fast-track" effect kicks in for all subsequent operational licenses. While the initial entry into the framework is swift (within 60 days), the issuance of building permits and environmental licenses typically takes an additional 6 to 9 months, which is still significantly faster than the 2 to 3 years often seen in the standard licensing route.

Common Misconceptions About Investing in Greece

Myth 1: Greek bureaucracy will always stall the project for years.

While standard administrative procedures in Greece can be slow, the Strategic Investment Law (4864/2021) was specifically created to bypass these layers. By centralizing the licensing at the ministerial level and utilizing Presidential Decrees for land use, the state provides a legal "shield" that protects the project from local-level delays and municipal-level bureaucratic hurdles.

Myth 2: Only investments over €100 million are eligible for incentives.

This is no longer true under the revised legal framework. While €100 million is a threshold for "Strategic Investments Type 1," the law now includes provisions for "Strategic Investments Type 2" starting at €40 million and "Special" categories (like R&D or Green Transition) starting as low as €20 million to €30 million.

Myth 3: Foreign investors cannot own land near borders or coasts.

There are restrictions regarding "border areas" in Greece (which include many islands), but these are not prohibitions. Foreign investors simply need to apply for a specialized permit from a regional committee. For strategic investments, this process is integrated into the fast-track filing, making it a routine administrative step rather than a barrier to entry.

FAQs

What is the "One-Stop-Shop" for Greek investments?

The One-Stop-Shop is a service provided by Enterprise Greece where a dedicated project manager handles all interactions with different ministries. Instead of the investor visiting multiple departments for energy, environmental, and building permits, the agency coordinates the entire process on their behalf.

Can I get a Golden Visa through a Strategic Investment?

Yes, investors and their key executives involved in a Strategic Investment are eligible for residence permits. Under Law 4864/2021, up to 10 "executives and experts" per project can receive Greek residence permits, which also allow for family reunification and travel within the Schengen Area.

What happens if the government changes during my project?

The Strategic Investment framework provides "Legal Certainty" through the 12-year tax stability clause. Additionally, many land-use terms are codified via Presidential Decrees, which are much harder to overturn than simple administrative decisions, providing a high degree of protection against political shifts.

When to Hire a Lawyer

Navigating the Greek Strategic Investment framework requires specialized legal counsel from the earliest stages of the project. You should engage a legal team if you are planning an investment exceeding €20 million, if your project requires complex land-use changes, or if you intend to apply for RRF funding. A lawyer is essential for drafting the Special Purpose Vehicle (SPV) bylaws, conducting due diligence on Greek real estate, and representing the project before the Inter-Ministerial Committee.

Next Steps

- Conduct a Pre-Feasibility Audit: Determine if your project meets the €20M-€100M thresholds defined in Law 4864/2021.

- Consult Enterprise Greece: Initiate informal discussions with the national investment agency to gauge the "strategic" appeal of your project.

- Structure Your SPV: Establish a Greek legal entity (usually an IKE or AE) to serve as the vehicle for the investment.

- Prepare the Dossier: Work with legal and financial advisors to draft the 10-year business plan and impact assessment required for the 45-60 day fast-track approval.

- Secure Legal Representation: Appoint a Greek law firm to manage the "Management Fee" payment and the formal submission to the Ministry of Development.