- International holding companies in Ireland must comply with updated Beneficial Ownership Register (RBO) requirements, including identity verification through Personal Public Service (PPS) numbers.

- The 2026 regulatory landscape introduces the EU Anti-Money Laundering Authority (AMLA), which will directly supervise high-risk entities and standardize enforcement across Ireland and the EU.

- Every Irish holding company classified as a "designated person" must appoint a qualified Money Laundering Reporting Officer (MLRO) to oversee internal reporting and external disclosures.

- Non-compliance with Irish AML laws can result in corporate fines of up to €10 million or 10% of annual turnover, alongside potential imprisonment for company directors.

- Enhanced Due Diligence (EDD) is mandatory for any transactions or relationships involving jurisdictions identified as high-risk by the European Commission or FATF.

AML Compliance for International Holding Companies in Ireland

Anti-money laundering (AML) compliance in Ireland requires international holding companies to implement rigorous risk-management frameworks to prevent financial crime. Under the Criminal Justice (Money Laundering and Terrorist Financing) Acts 2010 to 2021, these entities must perform comprehensive due diligence, maintain transparent ownership records, and report suspicious activities to the Financial Intelligence Unit (FIU) and Revenue Commissioners.

For international holding companies, the complexity arises from cross-border structures. Ireland's position as a premier global hub for intellectual property (IP) and multi-jurisdictional holdings means that compliance is not merely a formality but a core component of corporate governance. As the EU transitions toward the 2026 AMLA framework, Irish firms must shift from a "check-the-box" approach to a proactive, risk-based strategy.

AML Compliance Checklist for Irish Holding Companies

Irish holding companies must establish a robust compliance program to meet both national and EU standards. Use this checklist to audit your current standing and prepare for the 2026 regulatory shifts.

- [ ] Identify Beneficial Owners: Determine every individual who owns or controls more than 25% of the shares or voting rights, directly or indirectly.

- [ ] Register with the RBO: Ensure all beneficial ownership data is filed with the Central Register of Beneficial Ownership of Companies and Industrial and Provident Societies (RBO).

- [ ] Appoint an MLRO: Formally designate a senior official as the Money Laundering Reporting Officer with sufficient authority and resources.

- [ ] Conduct a Business-Wide Risk Assessment: Document the specific AML risks associated with your holding company's geography, services, and transaction types.

- [ ] Implement Customer Due Diligence (CDD): Verify the identity of all business partners and subsidiaries before establishing a relationship.

- [ ] Establish EDD Protocols: Create a trigger system for Enhanced Due Diligence when dealing with high-risk jurisdictions or Politically Exposed Persons (PEPs).

- [ ] Draft an AML Policy Manual: Maintain a written internal policy that is reviewed and updated annually by the board of directors.

- [ ] Employee Training: Provide documented AML/CTF training to all relevant staff and board members at least once a year.

- [ ] Independent Audit: Schedule periodic external audits of your AML framework to ensure effectiveness and identify gaps.

Beneficial Ownership Register (RBO) Updates for 2026

The Central Register of Beneficial Ownership (RBO) serves as Ireland's primary mechanism for corporate transparency. By 2026, the RBO requirements are expected to integrate more tightly with the EU-wide interconnected register (BORIS), requiring Irish holding companies to ensure their data is not only accurate but also formatted for cross-border digital verification.

A critical update involves the validation of beneficial owners. In Ireland, individuals must provide their PPS numbers for verification against Department of Social Protection records. For international directors without a PPS number, a Form V3 (Declaration of Verification of Identity) must be filed. Holding companies must update the RBO within 14 days of any change in ownership structure. Failure to maintain an accurate RBO filing is a criminal offense, and the 2026 updates will likely include higher automated flagging for discrepancies between RBO filings and annual tax returns.

Enhanced Due Diligence for High-Risk International Jurisdictions

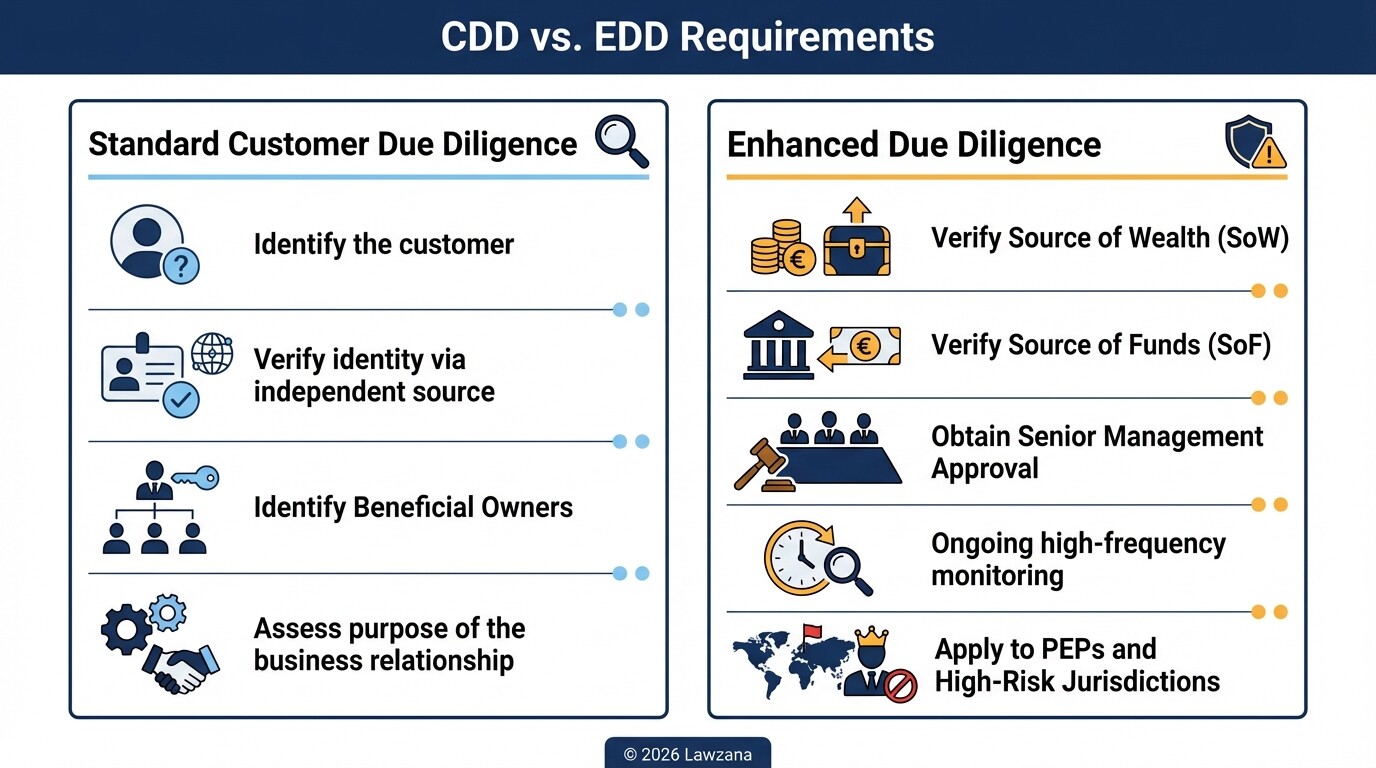

Enhanced Due Diligence (EDD) is a mandatory, high-intensity verification process required when a holding company engages with "high-risk" third countries. Ireland follows the list of high-risk jurisdictions identified by the European Commission, which often aligns with the Financial Action Task Force (FATF) "grey" and "black" lists.

When a transaction involves a high-risk jurisdiction, the Irish holding company must:

- Obtain additional information on the customer and the beneficial owner.

- Investigate the source of funds and source of wealth of the beneficial owner.

- Understand the reasons for the intended or performed transactions.

- Obtain senior management approval for establishing or continuing the business relationship.

- Conduct enhanced monitoring of the business relationship by increasing the frequency and timing of controls.

Holding companies often fail this requirement when they rely on simplified due diligence for subsidiaries located in jurisdictions with perceived low corruption but high financial secrecy. The 2026 standards will require a more granular analysis of the "middle layers" in corporate structures.

Internal Reporting and the Role of the Money Laundering Reporting Officer

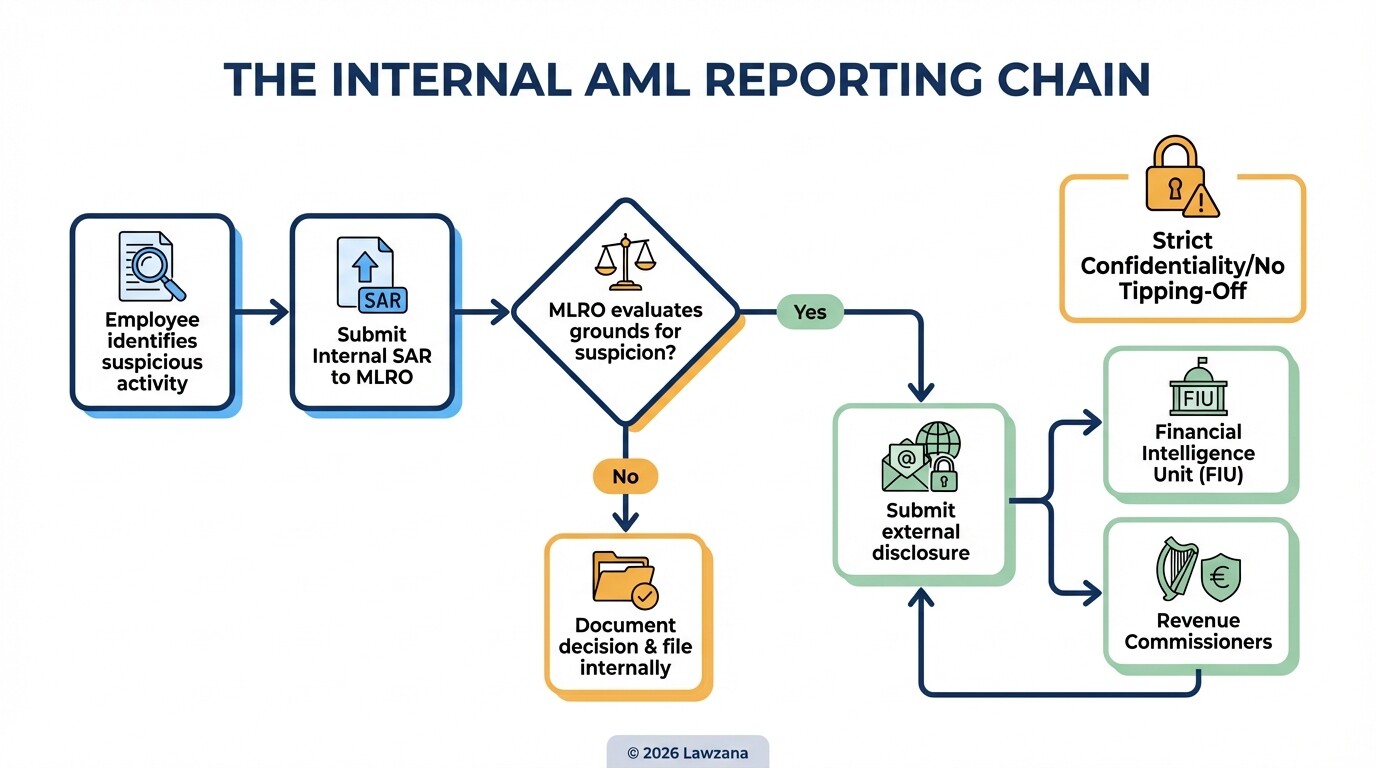

The Money Laundering Reporting Officer (MLRO) is the central pillar of an Irish holding company's AML defense. This individual is responsible for receiving internal "suspicious activity reports" (SARs) from employees and deciding whether a formal disclosure must be made to An Garda Síochána and the Revenue Commissioners.

The MLRO must have a high level of seniority and unfettered access to all company records. Their role is not merely administrative; they are personally responsible for ensuring the firm's compliance. In an international holding context, the MLRO must monitor the flow of dividends and capital injections across the group to spot "layering"-the process of moving funds through multiple accounts to obscure their origin. Documentation of the MLRO's decision-making process is vital, as regulators will review these records during any inspection.

Penalties for Corporate Governance Failures Under Irish AML Law

Ireland's regulatory bodies, including the Central Bank of Ireland and the Corporate Enforcement Authority (CEA), have the power to impose significant sanctions for AML failures. The legal framework treats administrative negligence with the same gravity as intentional non-compliance.

| Infraction | Potential Fine (Corporate) | Potential Penalty (Individual/Director) |

|---|---|---|

| Failure to maintain RBO data | Up to €500,000 | Fines and potential strike-off |

| Failure to report suspicious activity | Up to €10 million or 10% of turnover | Up to 5 years imprisonment |

| Inadequate Customer Due Diligence | Up to €10 million | Professional disqualification |

| Failure to appoint an MLRO | Administrative sanctions | Regulatory reprimand |

Beyond financial costs, a holding company faces severe "reputational contagion." A single AML fine in Ireland can lead to the freezing of banking facilities across the entire international group and the loss of "fit and proper" status for directors in other jurisdictions.

Impact of the EU's AMLA on Irish Firms

The establishment of the EU Anti-Money Laundering Authority (AMLA), headquartered in Frankfurt, represents the most significant shift in Irish compliance history. Starting in 2025 and 2026, AMLA will have direct supervisory powers over certain "selected obliged entities" that operate in multiple member states or present a high risk.

For Irish holding companies, the impact of AMLA includes:

- Harmonized Rulebook: AMLA will enforce a single rulebook, removing the ability of firms to "jurisdiction shop" for more lenient AML interpretations within the EU.

- Direct Supervision: If a holding company is deemed high-risk due to its international exposure, it may be supervised directly by AMLA rather than just the Irish authorities.

- Unified Reporting: AMLA will facilitate better communication between Financial Intelligence Units, making it much easier for regulators to track assets across the EU.

Common Misconceptions About Irish AML Compliance

Misconception: "Dormant holding companies do not need to comply with AML laws." Even if a holding company has no active trading operations, it is still a legal entity required to file beneficial ownership details with the RBO. If it holds assets or shares in other companies, it must still perform risk assessments and maintain records of its ownership structure.

Misconception: "AML compliance is only for banks and financial institutions." While banks are high-profile "designated persons," many Irish holding companies fall under this definition if they provide certain trust or company services, or if they are part of a group involved in regulated financial activities. Furthermore, all Irish companies are subject to the RBO requirements, regardless of their sector.

Misconception: "We only need to verify ownership once during incorporation." Beneficial ownership is a dynamic requirement. Any transfer of shares, change in voting rights, or alteration of a trust agreement requires an immediate update to internal records and the RBO. Regulators often penalize firms for "stale" data that was accurate at incorporation but failed to reflect subsequent restructuring.

What is a "Beneficial Owner" under Irish law?

A beneficial owner is any natural person who ultimately owns or controls a legal entity. This is typically defined as holding more than 25% of the shares or voting rights. If no such person can be identified, senior managing officials (such as directors) must be recorded as the beneficial owners.

Do I need a PPS number to register an Irish holding company?

To register beneficial ownership with the RBO, directors and beneficial owners usually need an Irish Personal Public Service (PPS) number. If an international director does not have one, they must submit a Form V3, which involves a verified declaration of identity to obtain an RBO-specific identification number.

How often should an AML risk assessment be updated?

An AML risk assessment should be a "living document." It must be updated at least annually or whenever there is a significant change in the company's business model, such as entering a new market, acquiring a subsidiary in a high-risk jurisdiction, or a change in EU AML directives.

What is the difference between CDD and EDD?

Customer Due Diligence (CDD) is the standard process of identifying and verifying a client or partner. Enhanced Due Diligence (EDD) is a more rigorous process required for higher-risk scenarios, such as transactions involving Politically Exposed Persons (PEPs) or jurisdictions with weak anti-money laundering controls.

When to Hire a Lawyer

Navigating Irish AML laws requires legal expertise when your holding company involves complex trust structures, multi-layered international ownership, or subsidiaries in high-risk jurisdictions. You should consult a lawyer if you are undergoing a regulatory audit, need to draft a bespoke AML policy manual, or are unsure of your MLRO's legal obligations. Legal counsel is also essential if you discover a past failure to report or an error in your RBO filings, as voluntary disclosure can often mitigate potential penalties.

Next Steps

- Review Ownership: Audit your current share table and identify all individuals with more than 25% control to ensure RBO accuracy.

- Assign Responsibility: Formally appoint an MLRO and ensure they receive specialized training on the Criminal Justice Acts.

- Update Policies: Revise your internal AML and CTF policy manuals to include 2026 EU AMLA standards and PPS verification steps.

- Conduct Training: Schedule a compliance briefing for your board of directors to ensure they understand their personal liability under Irish law.

- Consult Official Resources: Visit the Central Register of Beneficial Ownership and the Department of Justice for the latest statutory instruments and guidance notes.