- Ireland offers a competitive 6.25% effective tax rate on profits derived from qualifying intellectual property through the Knowledge Development Box (KDB).

- Intra-group licensing agreements must strictly adhere to OECD transfer pricing guidelines to ensure tax compliance and avoid "double Irish" style scrutiny.

- While Ireland has delayed its referendum on the Unified Patent Court (UPC), multinational hubs must still prepare for the 2026 regulatory landscape to protect European-wide patent interests.

- Software patents in Ireland require a "technical contribution" to be enforceable, making trade secret protection a vital secondary strategy for tech firms.

- Successful IP transfers in cross-border M&A require rigorous chain-of-title audits and localized "assignment of IP" documentation to withstand Irish High Court scrutiny.

Multinational IP Management Checklist for Ireland

Establishing a technology hub in Ireland requires a systematic approach to asset protection and tax optimization. This checklist outlines the essential steps for legal and operational compliance when managing intellectual property (IP) within the Irish jurisdiction.

- Confirm Qualifying Assets for KDB: Verify that your IP consists of computer programs, specialized small-company research, or patented inventions as defined by the Knowledge Development Box (Certification of Inventions) Act 2017.

- Execute Intra-Group License Agreements: Draft formal licenses between the Irish hub and global affiliates that specify royalty rates, territory, and sub-licensing rights.

- Audit Chain of Title: Ensure all employment contracts and independent contractor agreements explicitly assign IP ownership to the Irish entity from the moment of creation.

- Register with the IPOI: File all trademarks, industrial designs, and patents with the Intellectual Property Office of Ireland to establish public record and priority.

- Establish Trade Secret Protocols: Implement physical and digital access controls, non-disclosure agreements (NDAs), and "clean room" development environments to comply with the European Union (Trade Secrets) Regulations 2018.

- Review Transfer Pricing Documentation: Maintain a contemporary "Local File" and "Master File" that justifies the economic substance of the Irish IP hub in line with Revenue Commissioner requirements.

- Prepare for UPC Integration: Monitor the legislative timeline for the Unified Patent Court referendum to determine whether to opt-in or opt-out of the new European patent litigation system.

Navigating the Knowledge Development Box (KDB) for Lower Tax on IP

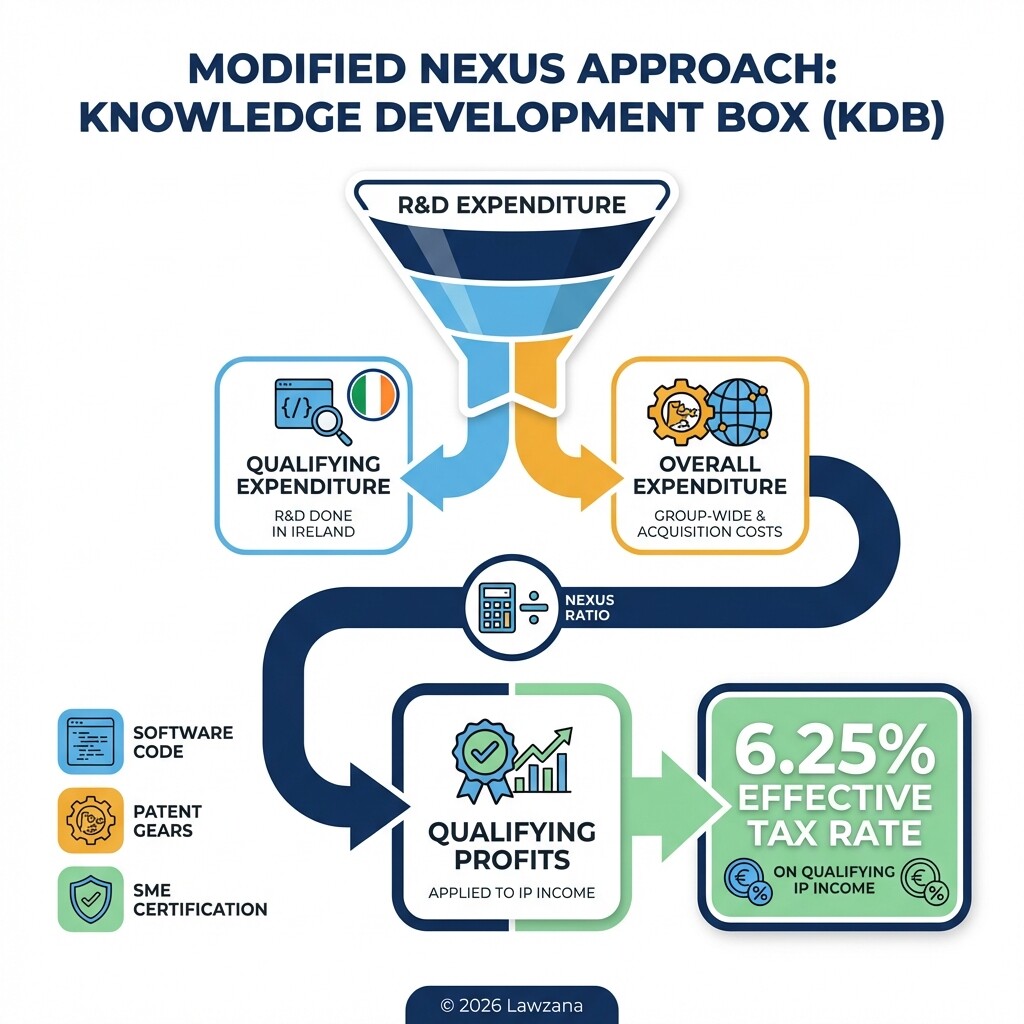

The Knowledge Development Box (KDB) is a corporation tax relief that applies a reduced 6.25% tax rate to profits generated from certain qualifying intellectual property assets. This incentive is designed to encourage companies to locate high-value R&D activities in Ireland by rewarding the creation of usable IP rather than just the holding of assets.

To qualify for the KDB, the Irish entity must have conducted the relevant R&D activities that led to the creation of the IP. Ireland uses a "Modified Nexus" approach, which means the tax relief is proportional to the amount of R&D expenditure incurred by the Irish company relative to the overall group expenditure on that asset.

Qualifying assets include:

- Computer Programs: Software protected by copyright.

- Patented Inventions: Inventions that are patented or have patent-like protection.

- SME IP: Specific IP assets for small to medium enterprises that are certified as novel, non-obvious, and useful.

Documentation is critical. The Revenue Commissioners require detailed tracking of "qualifying expenditure" versus "uplift expenditure" to calculate the final tax benefit accurately.

Drafting Intra-Group IP Licensing Agreements for Global Operations

Intra-group IP licensing agreements are the legal pillars that allow a multinational's Irish hub to distribute or monetize technology across global markets. These contracts must define the scope of use, the compensation structure (royalties), and the responsibilities for maintaining and defending the IP.

In Ireland, these agreements are scrutinized under "arm's length" principles. This means the terms of a license between two related companies must mirror what two independent companies would agree upon. If the royalty rate is too high or too low, the Revenue Commissioners may adjust the taxable profit of the Irish entity, leading to penalties and back taxes.

Key provisions in an Irish intra-group license should include:

- Grant of Rights: Clearly stating whether the license is exclusive, non-exclusive, or sole within specific geographic territories.

- Royalty Calculation: Defining whether payments are based on gross sales, net profit, or a fixed per-unit fee.

- IP Maintenance: Assigning the duty to pay renewal fees and prosecute infringers to a specific entity.

- Tax Indemnities: Addressing withholding tax obligations that may arise when royalties cross international borders.

Complying with the 2026 EU Patent Court (UPC) Regulations

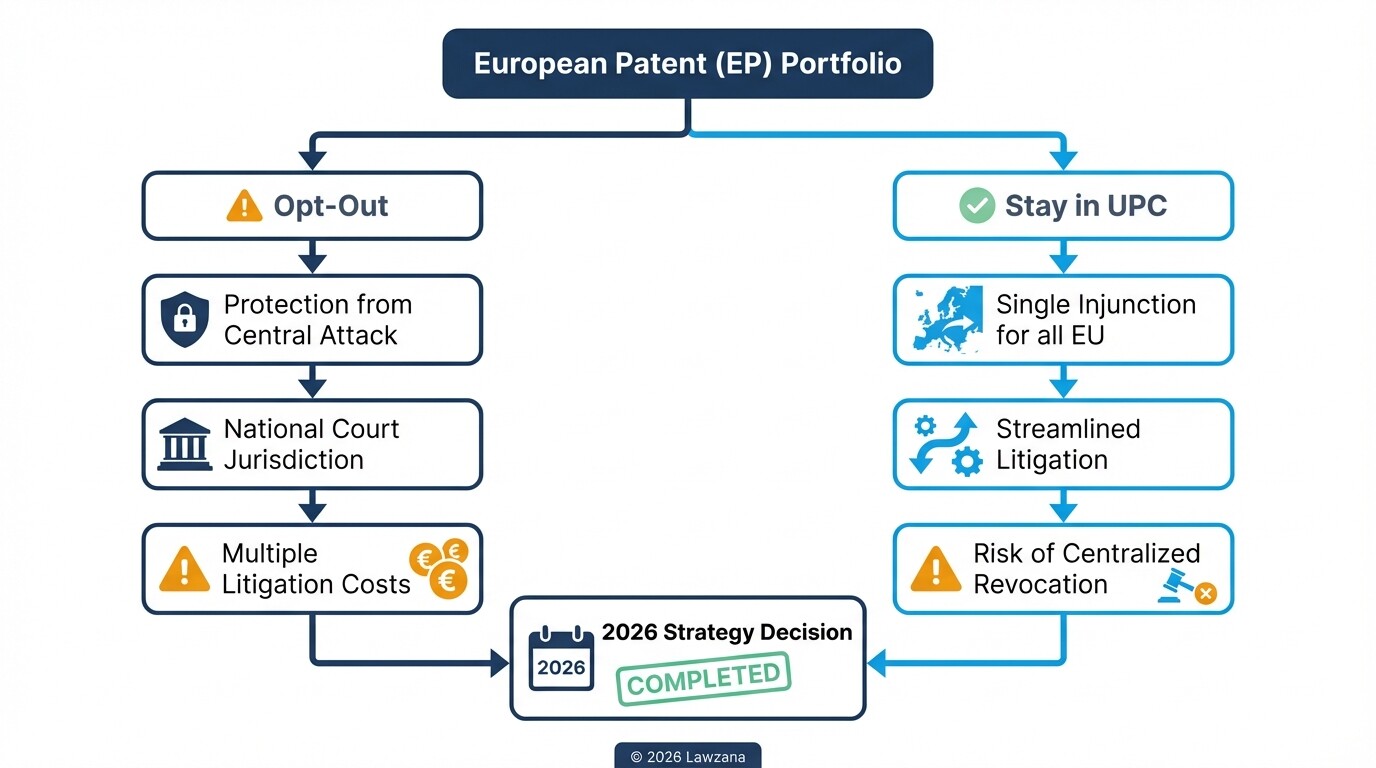

The Unified Patent Court (UPC) and the Unitary Patent system represent a major shift in European patent law, aiming to provide a single court for patent litigation across participating EU member states. While Ireland's participation is subject to a public referendum (currently delayed), multinational hubs in Ireland must plan for a 2026 landscape where their European patents (EPs) may fall under UPC jurisdiction by default.

For tech firms, the primary decision is whether to "opt-out" of the UPC's jurisdiction for existing European patents. Staying in the UPC system allows for a single injunction that covers multiple countries but also carries the risk of a single "central attack" that could invalidate a patent across the entire bloc.

Multinationals operating from Ireland should:

- Review Portfolio Jurisdiction: Identify which patents are currently registered as "European Patents" and assess the risk of centralized litigation.

- Monitor the Referendum: Stay updated on the Irish government's timeline for the UPC referendum, as a "Yes" vote will eventually lead to a local division of the UPC in Dublin.

- Update Filing Strategies: Consider filing Unitary Patents (UPs) for new inventions if broad, cost-effective European protection is the priority.

Enforcement of Software Patents and Trade Secrets in Irish Courts

Enforcing software patents in Ireland requires proving that the software provides a "technical solution to a technical problem," as pure business methods or mathematical formulas are not patentable. When patenting is not viable, firms rely on the Irish implementation of the EU Trade Secrets Directive to protect their proprietary source code and algorithms.

The Irish High Court features a specialized Commercial List, which is designed to handle complex IP disputes efficiently. This court is known for its ability to grant "Anton Piller" orders (search orders) and "Mareva" injunctions (freezing orders) to prevent the destruction of evidence or the flight of assets during an IP theft case.

| Protection Method | Primary Legal Basis | Strength |

|---|---|---|

| Software Patent | Patents Act 1992 | Strong public monopoly for 20 years; requires "technical effect." |

| Trade Secret | EU Trade Secrets Regs 2018 | Indefinite protection; requires "reasonable steps" to maintain secrecy. |

| Copyright | Copyright & Related Rights Act 2000 | Automatic protection for code; does not protect the underlying idea. |

To succeed in a trade secret enforcement action, a company must demonstrate that the information was secret, had commercial value because it was secret, and was subject to reasonable steps to keep it confidential.

Strategies for IP Transfer During Cross-Border M&A

IP transfer during cross-border M&A involves the legal transition of ownership or usage rights from a target company to an Irish holding or operating entity. In Ireland, the "Chain of Title" is the most scrutinized element; any break in the history of ownership can devalue the entire acquisition.

During the due diligence phase, Irish counsel will look for "Automatic Vesting" clauses in employment contracts. Under Irish law, IP created by an employee in the course of their employment generally belongs to the employer, but this does not always apply to independent contractors or founders.

Key strategies for a smooth transfer include:

- Confirmatory Assignments: If original assignment documents are missing or vague, execute new confirmatory assignments during the M&A process to "cure" the title.

- Warranties and Indemnities: Secure specific warranties that the IP does not infringe on third-party rights and that no former employees have "moral rights" claims.

- Stamp Duty Review: Most IP transfers in Ireland are exempt from stamp duty (a transfer tax), but specific filings are still required to claim the exemption and update the IPOI register.

Common Misconceptions About Irish IP Law

Misconception 1: "The Double Irish" tax structure is still viable.

This tax strategy, which involved shifting profits between Irish and offshore entities, has been fully phased out. Modern IP management in Ireland must focus on "substance," meaning the company must have real employees and operations in Ireland to justify its tax position.

Misconception 2: Copyright automatically protects the "function" of software.

In Ireland, copyright protects the literal expression of the code (the text), but it does not prevent a competitor from writing their own code to perform the exact same function. For functional protection, a patent or a robust trade secret strategy is necessary.

FAQs

How long does it take to register a trademark in Ireland?

The process generally takes between 6 to 9 months if there are no oppositions. Once filed, the application is examined for "absolute grounds" (distinctiveness) before being published for a 3-month opposition period.

Can I patent an "app" in Ireland?

You cannot patent the idea of an app or a simple business process. However, if the app solves a technical problem-such as optimizing battery usage, improving data encryption, or managing server latency-it may qualify as a "computer-implemented invention."

What happens to IP if a company is dissolved in Ireland?

If a company is dissolved without transferring its IP, those assets typically become "bona vacantia" and revert to the Irish State. It is vital to assign IP out of a company before formal liquidation or strike-off.

When to Hire a Lawyer

Managing IP for a multinational hub involves high-stakes intersections of tax law, employment law, and international treaties. You should consult an Irish corporate and commercial lawyer if you are:

- Structuring a new R&D center and need to qualify for the Knowledge Development Box.

- Negotiating a high-value acquisition of an Irish technology firm.

- Faced with a patent infringement claim or a breach of trade secrets by a former employee.

- Drafting complex cross-border licensing agreements that must comply with both Irish and EU regulations.

Next Steps

- Audit Your Portfolio: Identify which IP assets are currently held by your Irish entity and whether the "Chain of Title" is documented.

- Review R&D Spent: Coordinate with your tax advisors to see if your current R&D activities meet the "Modified Nexus" requirements for KDB tax relief.

- Update Contracts: Ensure all Irish-based employee and contractor agreements contain robust IP assignment and confidentiality clauses.

- Consult Counsel: Schedule a strategy session with a legal expert specializing in Irish IP and corporate law to ensure your global licensing model is future-proofed against upcoming EU regulatory changes.