- Italian agency law is highly protective of the agent, and many statutory protections cannot be waived by contract, even if both parties agree.

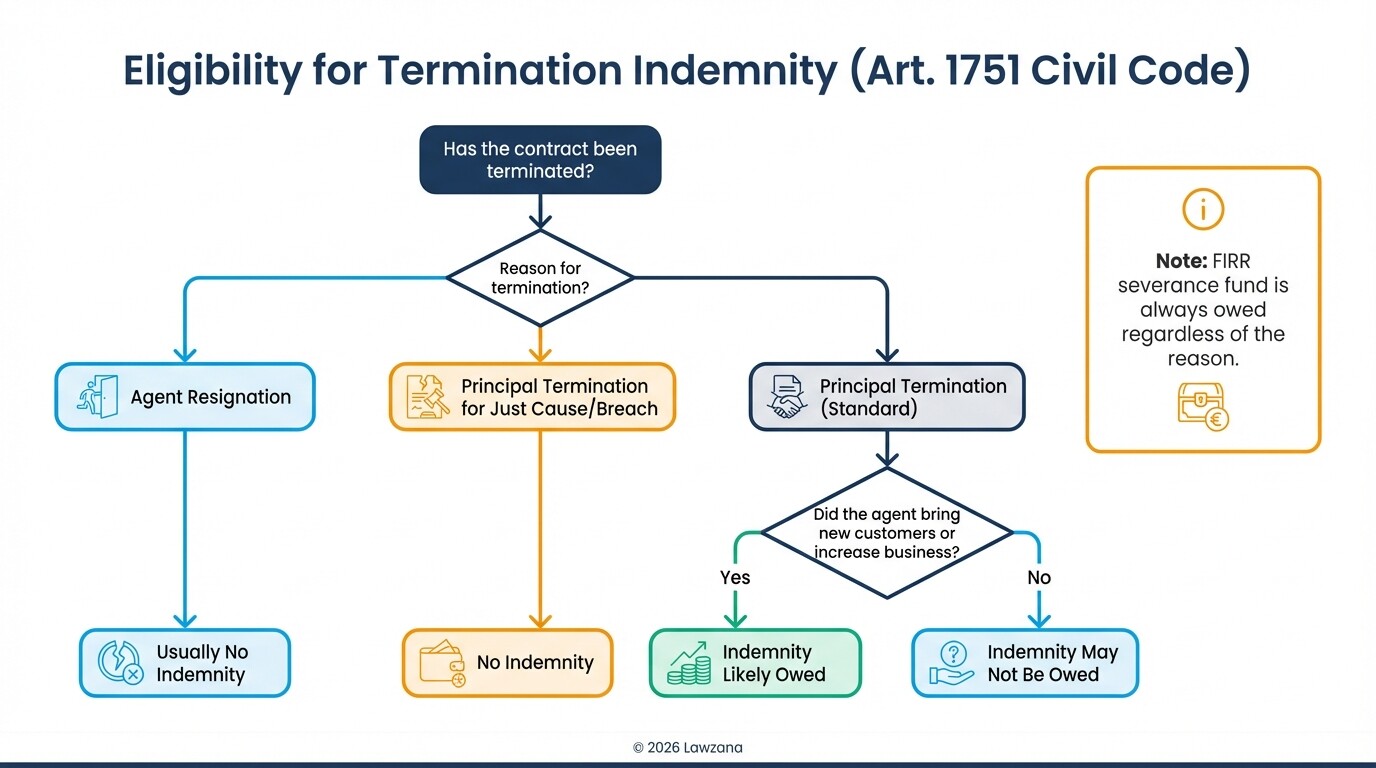

- Termination of an agency agreement almost always triggers a mandatory indemnity payment (Indennità di fine rapporto) unless the agent is at fault.

- All commercial agents operating in Italy must be registered with ENASARCO, a mandatory social security fund to which the principal must contribute.

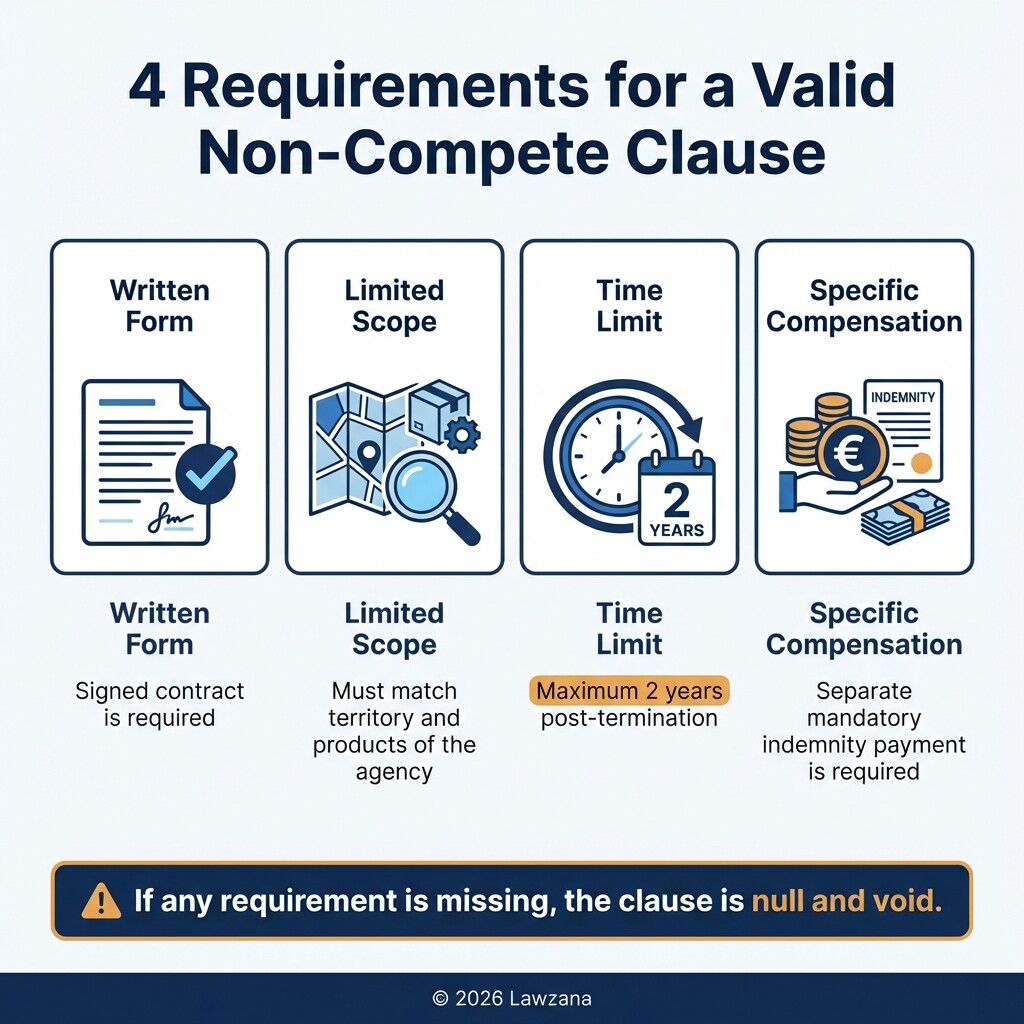

- Non-compete agreements are only valid if they are in writing, limited to two years, and involve a specific additional payment to the agent.

- Foreign principals often struggle with "overriding mandatory provisions" of Italian law that apply even if the contract specifies a different country's governing law.

Checklist for Drafting Italian Commercial Agency Agreements

An Italian agency agreement (Contratto di Agenzia) is a formal contract where a principal assigns an agent the permanent task of promoting the conclusion of contracts within a specific territory. Because the Italian Civil Code and Collective Economic Agreements (AECs) provide strict frameworks, foreign firms must ensure their contracts cover specific local requirements.

The following checklist and sample language provide the foundational elements required for a compliant agreement in Italy.

Essential Drafting Checklist:

- Definition of Territory: Clearly define the geographic boundaries (e.g., Lombardy region or all of Italy).

- Product Scope: Specify exactly which product lines the agent is authorized to sell.

- Exclusivity: State whether the agent has exclusive rights to the territory; under Article 1743 of the Civil Code, exclusivity is presumed unless stated otherwise.

- Commission Structure: Detail the percentage, when it is earned (usually upon execution of the order), and the payment schedule.

- ENASARCO Compliance: Explicitly mention the obligation for both parties to contribute to the ENASARCO fund.

- Reporting Obligations: Define how often the agent must provide market intelligence and sales reports.

- Termination Notice: Ensure notice periods align with Article 1750 of the Civil Code (ranging from one to six months depending on the duration of the relationship).

Sample Clause: Scope of Authority and Exclusivity

"The Principal hereby appoints the Agent, who accepts, as its commercial agent for the promotion of [Product Name/Category] in the territory of [Region/Country]. Unless otherwise agreed in writing, this appointment is granted on an exclusive basis; the Principal shall not appoint other agents in the Territory for the same branch of business, and the Agent shall not represent competing products."

Mandatory Indemnity Payments Upon Termination (Indennità di fine rapporto)

Upon the termination of an agency agreement, Italian law typically requires the principal to pay the agent a termination indemnity to compensate for the goodwill created. This payment is mandatory under Article 1751 of the Italian Civil Code and various Collective Economic Agreements (AECs), which are often incorporated into contracts by default or industry practice.

The indemnity is generally due if the agent has brought in new customers or significantly increased business with existing customers, and the principal continues to derive substantial benefits from this business. There are three main components or "tiers" often considered in the calculation:

- The Merit Indemnity: Based on the agent's performance and the value brought to the principal.

- The Supplemented Indemnity: Often dictated by AECs, which provide more specific calculation formulas than the Civil Code.

- The Maximum Limit: By law, the indemnity cannot exceed a figure equivalent to the agent's average annual commission over the last five years (or the duration of the contract if shorter).

Principal firms should be aware that this indemnity is not due if the principal terminates the contract for "just cause" (serious breach by the agent) or if the agent terminates the contract themselves without a reason attributable to the principal.

ENASARCO Registration and Mandatory Contributions

ENASARCO (Ente Nazionale di Assistenza per gli Agenti e Rappresentanti di Commercio) is the mandatory social security and pension fund specifically for commercial agents in Italy. Every foreign principal hiring an agent in Italy must register with ENASARCO and make quarterly contributions, regardless of where the principal is headquartered.

The contribution system works as follows:

- Shared Cost: Both the principal and the agent contribute a percentage of the commissions earned (currently approximately 17%, split 50/50 between the two).

- Contribution Ceilings: There are annual minimums (minimali) and maximums (massimali) that change yearly based on whether the agent is "monomandatario" (working for one principal) or "plurimandatario" (working for multiple).

- Filing Requirements: The principal is responsible for calculating, withholding the agent's share, and paying the total amount to the ENASARCO portal every quarter.

- FIRR (Fondo Indennità Risoluzione Rapporto): The principal must also pay a separate percentage into a severance fund held by ENASARCO, which is paid out to the agent when the contract ends.

Failure to comply with ENASARCO regulations can lead to significant penalties and interest, and the agent may have a legal claim for unpaid benefits even years after the relationship has ended.

Enforceability of Non-Compete Clauses in Italy

A post-termination non-compete agreement prevents an agent from working with competitors after the agency contract ends, but it is strictly regulated under Article 1751-bis of the Italian Civil Code. To be enforceable, these clauses must meet specific criteria regarding duration, scope, and compensation.

For a non-compete clause to hold up in an Italian court, it must satisfy these four conditions:

- Written Form: The agreement must be in writing.

- Scope Limitation: It can only apply to the same territory, customers, and product types covered by the agency agreement.

- Time Limit: The restriction cannot exceed two years following the termination of the contract.

- Mandatory Compensation: The principal must pay the agent a "non-compete indemnity." This is a separate payment from commissions and termination indemnities, typically paid in installments or as a lump sum upon termination.

If the contract includes a non-compete clause but fails to provide for specific compensation, the clause is considered null and void, meaning the agent is free to work for a competitor immediately.

Governing Law Choices and Limitations in Italian Courts

While international contracts often allow parties to choose the governing law (such as Delaware or English law), Italian courts frequently override these choices in favor of local protective statutes. Under EU Regulation 593/2008 (Rome I), mandatory provisions of the country where the agent performs their work-Italy-must be respected.

Foreign principals should be aware of the following jurisdictional realities:

- Protective Provisions: Rules regarding termination indemnity (Art. 1751) and notice periods are considered "public policy" or "overriding mandatory provisions." An Italian court will likely apply Italian law to these specific issues even if the contract says otherwise.

- Forum Selection: You can include a clause selecting a foreign court or arbitration, but if the agent is considered a "weak party" (similar to an employee in some legal interpretations), an Italian court might still claim jurisdiction.

- The "Borgazzi" Principle: Italian case law has established that if a foreign law provides substantially less protection than Article 1751 of the Italian Civil Code, the Italian provision will prevail to protect the agent.

| Feature | Standard Contract (US/UK Style) | Italian Commercial Agency |

|---|---|---|

| Termination | Usually "at will" or fixed notice | Mandatory notice + Indemnity |

| Social Security | Handled by Agent | Shared ENASARCO contributions |

| Non-Compete | Often included without extra pay | Requires specific extra payment |

| Exclusivity | Must be explicitly granted | Presumed unless excluded |

Common Pitfalls for Foreign Principals

Foreign companies entering the Italian market often make the mistake of using a "standard" international sales representative agreement that does not account for the specificities of the Italian Civil Code. This oversight can lead to unexpected liabilities that surface only when the relationship sours.

- Ignoring the AECs: Many principals do not realize that Collective Economic Agreements (AECs) may apply to their contract even if they are not members of a trade association, simply because the contract refers to "Italian Law."

- Misclassifying the Relationship: Attempting to label an agent as a "distributor" to avoid ENASARCO and indemnity payments is a high-risk strategy. If the person acts as an agent (promoting sales rather than buying and reselling), Italian courts will "re-qualify" the contract and award the agent back-dated benefits.

- Poor Documentation of "Just Cause": Terminating an agent for poor performance without extensive documentation of warnings and specific breaches rarely meets the high bar of "just cause" (giusta causa) in Italy, resulting in the principal having to pay full indemnity and notice period damages.

Common Misconceptions

"We can avoid ENASARCO if our company has no physical office in Italy."

This is false. If the agent is performing their activity in Italy, the mandatory social security requirements apply to the principal, regardless of where the principal's legal seat is located. Foreign companies must obtain an Italian tax code to fulfill these obligations.

"If the agent resigns, I don't owe them anything."

While the termination indemnity (Article 1751) is generally not due if the agent resigns, you are still required to pay the FIRR (severance fund) that was accrued at ENASARCO during the life of the contract. Additionally, if the agent resigns due to the principal's breach, the indemnity is still owed.

"I can set a 15-day notice period for termination."

Italian law sets mandatory minimum notice periods based on the duration of the contract. For example, in the first year, the minimum is one month. These periods cannot be shortened by agreement; any clause attempting to do so will be automatically replaced by the statutory minimum.

FAQ

What is the difference between an agent and a distributor in Italy?

An agent promotes the sale of goods on behalf of the principal for a commission, while a distributor buys the goods from the principal and resells them at a profit. Distributors generally do not benefit from the same mandatory indemnity and ENASARCO protections as agents.

Is a written contract mandatory for an agency relationship in Italy?

While an agency relationship can exist in practice without a written document, Article 1742 of the Civil Code gives both parties the right to demand a written contract. Furthermore, specific clauses like non-compete agreements are only valid if written.

How much does it cost to terminate an agent in Italy?

The cost includes the notice period (or payment in lieu of notice), the accumulated FIRR severance, and the termination indemnity. Total costs often range from 3% to 12% of the total commissions paid during the entire life of the relationship.

When to Hire a Lawyer

Navigating Italian agency law requires professional legal counsel in the following scenarios:

- Before Signing: To ensure the contract does not inadvertently trigger the most expensive tiers of the Collective Economic Agreements (AECs).

- During Registration: To handle the complexities of obtaining a tax code and registering with the ENASARCO system as a foreign entity.

- Upon Termination: To draft a settlement agreement (verbale di conciliazione) that prevents the agent from suing for additional indemnity or misclassification later.

- Dispute Resolution: If an agent claims "employee status" (parasubordinate labor), which can lead to massive tax and social security liabilities.

Next Steps

- Audit your current agreements: Review any existing representative contracts in Italy to see if they mention ENASARCO or Article 1751.

- Obtain an Italian Tax Code: If you are hiring your first agent, your company will need a Codice Fiscale to process social security payments.

- Calculate Potential Indemnity: Before terminating an agent, perform a "worst-case" calculation of the indemnity and notice payments to budget for the exit.

- Consult an Expert: Reach out to an Italian commercial lawyer to draft a localized version of your standard agency agreement.