- Italian exporters must obtain an Economic Operator Registration and Identification (EORI) number from the Customs and Monopolies Agency (ADM) to trade outside the European Union.

- The United Nations Convention on Contracts for the International Sale of Goods (CISG) applies automatically to most Italian export contracts unless specifically excluded by a written clause.

- Proper "Made in Italy" labeling requires strict adherence to EU non-preferential rules of origin to avoid administrative fines and criminal penalties for "false indications."

- International distribution agreements should always specify the governing law and choose a neutral forum, such as the Milan Chamber of Arbitration, to resolve disputes.

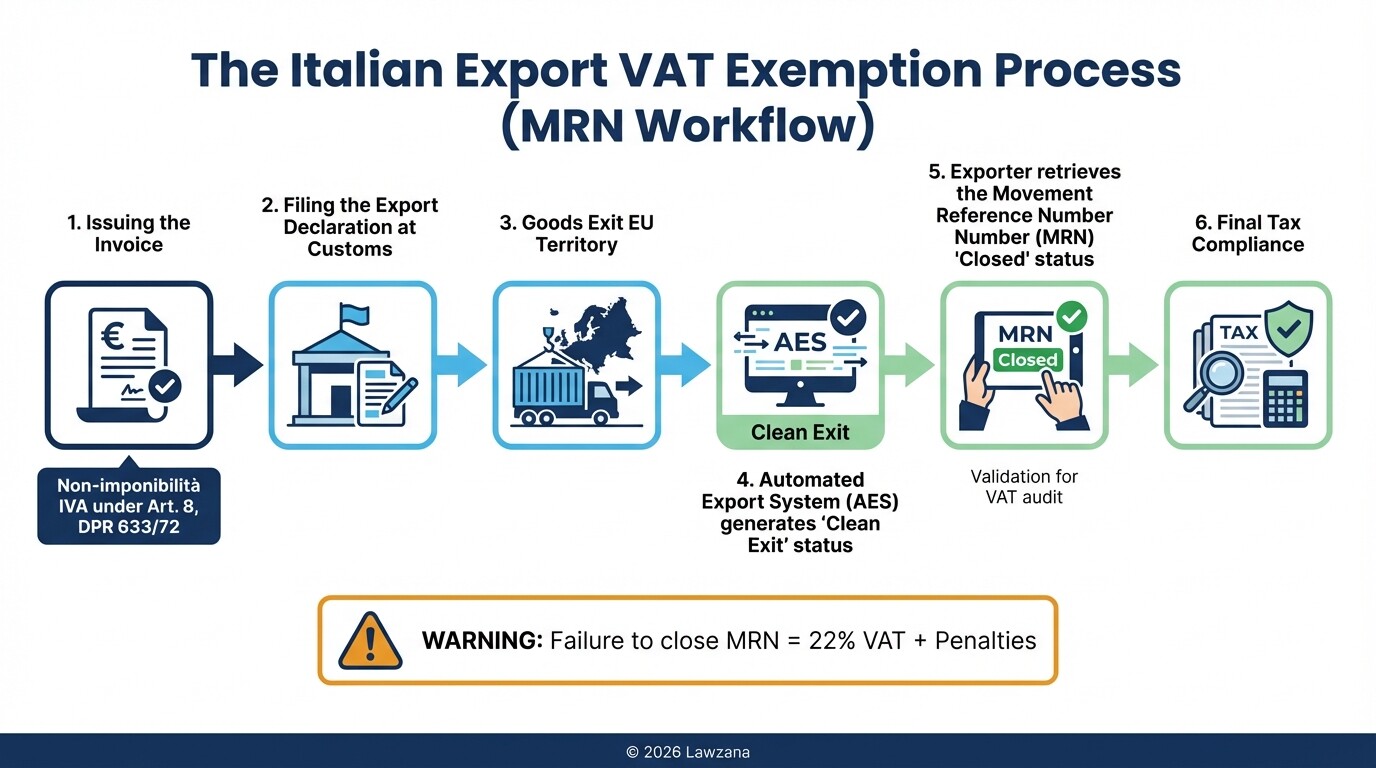

- VAT exemptions for exports (Non-imponibilità IVA) require strict documentary evidence, including the exit of goods from EU territory verified through the Movement Reference Number (MRN).

Compliance Checklist for Italian Exporters

Navigating cross-border trade requires a systematic approach to documentation and regulatory compliance. Italian manufacturers must ensure they have cleared every administrative hurdle before goods leave the warehouse to avoid costly delays at the border or legal disputes with foreign partners.

Use this checklist to verify your export readiness:

- EORI Registration: Verify that your company has an EORI number linked to its VAT ID (Partita IVA) via the Agenzia delle Dogane e dei Monopoli.

- HS Code Classification: Assign the correct Harmonized System (HS) code to your products to determine duty rates and import restrictions in the destination country.

- Proof of Origin: Secure the necessary Certificates of Origin or EUR.1 movement certificates to benefit from preferential tariffs under EU Free Trade Agreements.

- Incoterms® 2020 Selection: Explicitly state the chosen Incoterm (e.g., FCA, CIF, DDP) in the sales contract to define the exact point where risk and cost transfer to the buyer.

- VIES Validation: For intra-EU sales, verify the buyer's VAT number through the VAT Information Exchange System (VIES) to justify the zero-rated VAT invoice.

- Export License Check: Review the Dual-Use Regulation (EU 2021/821) if your products have potential military applications.

- Transport Documentation: Ensure the Bill of Lading, CMR, or Air Waybill matches the commercial invoice and packing list exactly.

Documentation Required for Rules of Origin Compliance

Rules of origin determine the "economic nationality" of a product, which is critical for calculating tariffs and claiming the "Made in Italy" label. In Italy, the Agenzia delle Dogane e dei Monopoli (ADM) enforces these rules to ensure that manufacturers do not misrepresent the origin of their goods.

To comply with origin requirements, Italian exporters generally need:

- Non-Preferential Certificate of Origin: Issued by the local Chamber of Commerce (Camera di Commercio), this proves the goods were produced in Italy for general trade purposes.

- EUR.1 Movement Certificate: A document used for trade with countries that have preferential agreements with the EU (like Switzerland or Turkey), allowing for reduced or zero customs duties.

- Long-Term Supplier Declaration: A statement from your Italian or EU suppliers confirming the origin of the components used in your final product.

- Registered Exporter System (REX) Statement: For certain trade agreements (like the EU-UK TCA or CETA), exporters must register in the REX database and provide a "statement on origin" directly on the commercial invoice.

Italy is particularly strict regarding the "Made in Italy" designation. Under Law 55/2010, at least two significant phases of production must occur in Italy to claim this origin. Failing to meet these standards can lead to goods being seized by customs authorities under the "Madonnina" law (Decree Law 135/2009).

Drafting International Distribution Agreements: Common Mistakes

An international distribution agreement governs the relationship between an Italian manufacturer and a foreign partner. Mistakes in these contracts often stem from using domestic templates that fail to account for the mandatory laws of the distributor's territory or the complexities of cross-border logistics.

Avoid these frequent pitfalls when drafting your agreements:

- Vague Exclusivity Clauses: Failing to clearly define the geographic territory or the specific product lines covered by the exclusivity can lead to "gray market" competition.

- Ignoring EU Competition Law: Distribution agreements involving Italian companies must comply with Article 101 of the TFEU (Treaty on the Functioning of the European Union), which prohibits certain vertical restraints like resale price maintenance (RPM).

- Inadequate Termination Provisions: Under Italian law and many foreign jurisdictions, distributors may be entitled to significant "goodwill indemnity" or "severance pay" upon termination, even if the contract is not renewed.

- Failure to Address Intellectual Property: Not explicitly stating that the distributor has no ownership rights over your trademarks can result in "trademark squatting" in the foreign market.

Sample Clause: Retention of Title (Riserva di Proprietà) "Ownership of the Goods shall remain with the Seller (Italian Manufacturer) until full payment of the price is received. The Buyer shall store the Goods separately and clearly mark them as the Seller's property until such time."

Comparing CISG vs. Local Italian Contract Law for Exports

The United Nations Convention on Contracts for the International Sale of Goods (CISG) is a uniform international law that Italy ratified in 1988. It automatically governs sales contracts between parties in different countries (if both are CISG signatories) unless the contract specifically opts out of it.

While the Italian Civil Code (Codice Civile) is familiar to local businesses, the CISG is often more favorable for international trade because it balances the interests of buyers and sellers more equitably.

| Feature | Italian Civil Code (Codice Civile) | CISG (UN Convention) |

|---|---|---|

| Formation of Contract | Requires a clear offer and acceptance; more formalistic. | More flexible; allows for "battle of the forms" resolutions. |

| Statute of Limitations | Generally 10 years for commercial claims. | Generally 2 years for notice of non-conformity. |

| Notice of Defects | Buyer must report defects within 8 days of discovery (Art. 1495). | Buyer must report within a "reasonable time" (up to 2 years). |

| Specific Performance | Frequently granted as a primary remedy. | Secondary to monetary damages in many cases. |

| Written Form | Written proof often required for specific terms. | No requirement for the contract to be in writing (unless specified). |

Exporters should consult with a lawyer to decide whether to exclude the CISG. Many Italian firms prefer the CISG because it limits the "hidden" traps found in the Italian Civil Code regarding the short 8-day deadline for defect notification.

Handling VAT and Customs Disputes in International Shipping

VAT and customs disputes in Italy are managed by the Agenzia delle Dogane e dei Monopoli (ADM) and can result in heavy administrative fines or the freezing of shipments. The most common issues arise from "triangulation" (sales involving three parties in different countries) and incorrect proof of export.

To manage these disputes effectively, exporters must ensure:

- Verification of Exit: For VAT-exempt exports, the Italian seller must obtain the "Clean Exit" message from the Electronic Export System (AES). This is confirmed by the Movement Reference Number (MRN). If the MRN does not show as "closed," the Italian tax authorities will treat the sale as a domestic sale and charge 22% VAT plus penalties.

- Customs Valuation: Disputes often arise when the ADM believes the declared value of the goods is too low. Ensure your commercial invoice includes all costs, including commissions and royalties, to avoid accusations of under-valuation.

- Binding Tariff Information (BTI): If you are unsure of an HS code, apply for a BTI from the ADM. This provides a legally binding ruling on the classification of your goods valid across the entire EU.

If a dispute arises, you have 30 days to file an administrative appeal (Ricorso) against a customs assessment. It is often faster to resolve these via a "settlement with adhesion" (Accertamento con adesione) to reduce penalties.

The Role of ADR in Resolving Cross-Border Commercial Conflicts

Alternative Dispute Resolution (ADR), specifically arbitration and mediation, is the preferred method for resolving international trade conflicts involving Italian companies. Litigation in Italian courts can be notoriously slow, with commercial cases often taking 3 to 5 years to reach a final judgment.

For Italian exporters, ADR offers several advantages:

- Enforceability: Under the New York Convention, an arbitration award is enforceable in over 160 countries, whereas an Italian court judgment might not be recognized outside the EU.

- Expertise: Parties can choose arbitrators who have specific expertise in international trade law or the specific industry (e.g., fashion, machinery).

- Confidentiality: Unlike court proceedings, which are public, ADR allows companies to settle disputes privately, protecting their reputation.

The Milan Chamber of Arbitration (Camera di Commercio di Milano) is the leading institution in Italy for these cases. For smaller disputes, mediation (Mediazione) is often a mandatory first step under Italian law (Decree 28/2010) before a case can proceed to court.

Common Misconceptions in Italian Trade Law

Myth 1: "Made in Italy" is just a marketing label and has no legal requirements. In reality, the use of "Made in Italy" is strictly regulated by EU and Italian law. Using the label on goods that did not undergo substantial transformation in Italy is a criminal offense under Article 517 of the Italian Penal Code.

Myth 2: If the contract is silent on the law, Italian law always applies. This is incorrect. Under the Rome I Regulation (EU 593/2008), if no law is chosen, the law of the country where the seller has their habitual residence usually applies. However, this can be overridden by the CISG or other international treaties, leading to unexpected legal outcomes.

Myth 3: An Italian court judgment is easy to enforce worldwide. While judgments are easily enforced within the European Union, enforcing an Italian civil court ruling in countries like the USA, China, or the UAE is extremely difficult without a specific bilateral treaty. Arbitration is almost always a better choice for non-EU trade.

FAQ

What is an EORI number and why do I need it?

The Economic Operator Registration and Identification (EORI) number is a unique ID used by customs authorities throughout the European Union. Any Italian business engaging in imports or exports with non-EU countries must have an EORI number to clear customs and file declarations.

How do I prove my goods are "Made in Italy" for customs?

You must demonstrate that the "last substantial transformation" of the product occurred in Italy. This is usually documented through a Certificate of Origin issued by your local Chamber of Commerce and supported by production records and supplier declarations.

Can I sell goods to another EU country without charging VAT?

Yes, this is known as an intra-community supply. To do this without charging VAT, you must verify that the buyer has a valid VAT number in the VIES database and you must maintain proof that the goods physically left Italy (e.g., a signed CMR or transport document).

What is the difference between Incoterms EXW and FCA?

EXW (Ex Works) places maximum risk on the buyer, who must handle all export clearances. FCA (Free Carrier) is generally preferred for Italian exporters as it requires the seller to clear the goods for export, providing better control over the MRN documentation needed for VAT compliance.

When to Hire a Lawyer

International trade law is a high-stakes environment where a single documentation error can lead to the seizure of goods or heavy tax penalties. You should consult a legal expert specializing in Italian trade law if:

- You are entering a new non-EU market with complex customs regulations (e.g., China, Brazil, or the USA).

- You are drafting or renewing a long-term distribution or agency agreement.

- You have received a "Notice of Assessment" (Avviso di Accertamento) from the Agenzia delle Dogane.

- Your intellectual property is being infringed upon by a foreign distributor or competitor.

- You need to determine if your products fall under Dual-Use or export control restrictions.

Next Steps

- Audit Your Documentation: Review your current commercial invoices and ensure they include the correct HS codes, EORI numbers, and Incoterms.

- Verify VIES Status: Check the VAT numbers of all your EU-based clients to ensure your intra-community sales are compliant with tax laws.

- Review Contracts: Identify any older contracts that do not specify the governing law or dispute resolution method and consider drafting an addendum.

- Consult a Specialist: Reach out to an international trade lawyer to review your "Rules of Origin" compliance to safeguard your "Made in Italy" status.