- Mandatory Annual Filings: Every Nigerian startup must file annual returns with the Corporate Affairs Commission (CAC) to maintain "active" status and avoid penalties.

- Simplified Structure: CAMA 2020 allows for single-shareholder companies and exempts small companies from the requirement to appoint auditors or hold Annual General Meetings (AGMs).

- PSC Transparency: Companies are legally required to disclose Persons with Significant Control (PSC) who hold 5% or more of shares or voting rights to the CAC.

- Digital First: All compliance actions, from registration to filing returns, are now conducted through the CAC's Companies Registration Portal (CRP).

- Severe Penalties: Failure to comply with CAMA 2020 can lead to the "striking off" of the company from the federal register and daily fines for directors.

Essential CAMA 2020 Compliance Checklist for Nigerian Startups

Nigerian startups must navigate specific regulatory milestones to remain in good standing with the Corporate Affairs Commission (CAC). This checklist provides a chronological and topical roadmap for compliance under the current legal framework.

- Post-Incorporation Filing: Within 14 days of any change in directors, addresses, or share capital, you must notify the CAC via the digital portal.

- Annual Returns: File your first annual return within 18 months of incorporation; thereafter, file annually no later than 42 days after your AGM (if applicable) or by June 30 for the upcoming 2026 cycle.

- PSC Register Maintenance: Maintain an internal register of Persons with Significant Control and update the CAC within 7 days of any change in ownership exceeding 5%.

- Statutory Books: Keep physical or digital copies of the Register of Members, Register of Directors, and Minutes of Meetings at the registered office address.

- Financial Record Keeping: Prepare financial statements that comply with the requirements of the Financial Reporting Council of Nigeria (FRCN).

- Company Secretary: Determine if your startup qualifies as a "small company" to decide if a formal Company Secretary is legally required or merely optional.

Annual Return Filing Requirements and Deadlines for 2026

Annual returns are not a tax payment but a mandatory informational filing that notifies the CAC that the company is still operational. For the 2026 filing cycle, companies must report their financial position and entity details based on the preceding fiscal year.

The deadline for filing annual returns is typically 42 days after the company's Annual General Meeting. However, for startups planning for 2026, the general rule is to file no later than June 30 to avoid the "inactive" status tag on the public registry. The filing fee for a small company is currently N3,000, while larger entities pay N5,000 to N10,000 depending on their status.

Failure to meet these deadlines results in a daily penalty for the company and every officer (director/secretary). As of the current schedule, these penalties can range from N100 to N1,000 per day of default, which accumulates quickly and can prevent the company from obtaining a "Letter of Good Standing" required for government contracts or bank loans.

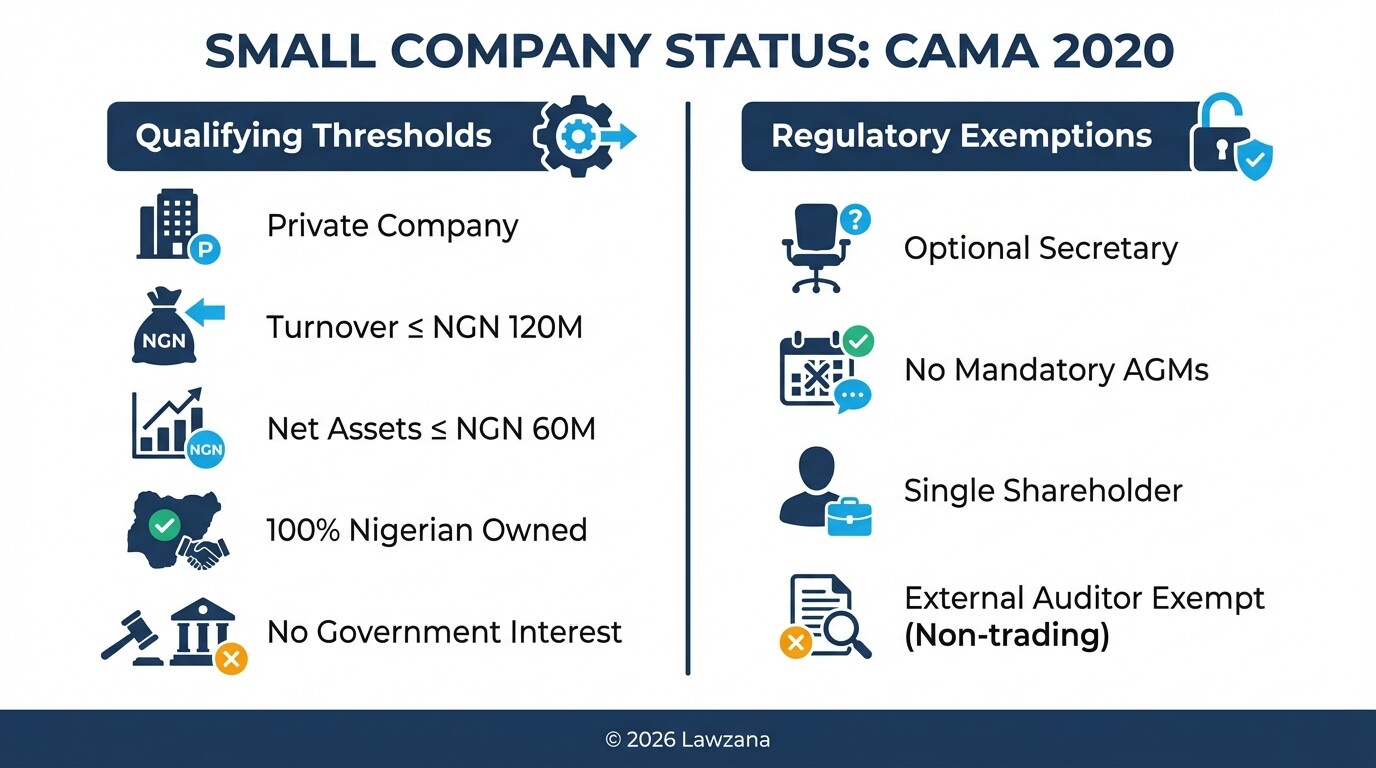

New Provisions for Small Companies and Single-Shareholder Entities

The Companies and Allied Matters Act (CAMA) 2020 introduced significant relief for early-stage entrepreneurs by creating a specific category for "small companies." These provisions reduce the administrative burden and costs of running a business in Nigeria.

To qualify as a small company under Section 394 of CAMA 2020, a startup must:

- Be a private company.

- Have a turnover of not more than N120 million.

- Have a net asset value of not more than N60 million.

- Have no foreign members (shareholders).

- Have no government or government corporation as a shareholder.

Small companies are now exempt from the mandatory appointment of a Company Secretary and the requirement to hold an Annual General Meeting (AGM). Furthermore, they are not required to appoint external auditors if they have not traded or if they meet the "small company" criteria for the financial year. Additionally, CAMA 2020 legalized the "Single Member Company," allowing one person to incorporate and own a private company, which was previously impossible under the 1990 Act.

Digital Compliance Procedures via the CAC Portal

The Corporate Affairs Commission has fully migrated its operations to the Companies Registration Portal (CRP). This digital shift means that almost all compliance tasks can be handled online without visiting a physical CAC office.

To maintain digital compliance, a startup must ensure its directors or an accredited agent (such as a lawyer or chartered accountant) have an active account on the Corporate Affairs Commission (CAC) portal. The process generally follows these steps:

- Login: Access the portal using valid credentials.

- Select Service: Choose the specific filing (e.g., Annual Returns, Change of Directors, or PSC Update).

- Document Upload: Upload PDF copies of signed resolutions, financial statements, and identification documents.

- Payment: Pay the filing fees through the integrated Remita platform.

- Approval: Wait for the CAC registrar to review the documents and issue a digital certificate or an acknowledgment letter.

Legal Implications of Failing to Update Person with Significant Control (PSC) Registers

Transparency in corporate ownership is a core pillar of CAMA 2020, specifically designed to combat money laundering and terrorism financing. A Person with Significant Control (PSC) is any individual who holds at least 5% of shares, 5% of voting rights, or the right to appoint/remove a majority of directors.

If a startup fails to identify its PSCs or fails to notify the CAC of their details, the consequences are severe. Under Section 119 of the Act, both the company and the individual PSC can be held liable. The CAC has the power to:

- Mark the company's status as "Inactive" or "Flagged."

- Impose heavy fines on the company and its officers for every day the default continues.

- Restrict the company from making any other changes to its corporate structure until the PSC register is updated.

Transparency is now a prerequisite for opening corporate bank accounts in Nigeria, as most Tier-1 banks verify the PSC status on the CAC's Open Central Register before processing high-volume transactions or credit facilities.

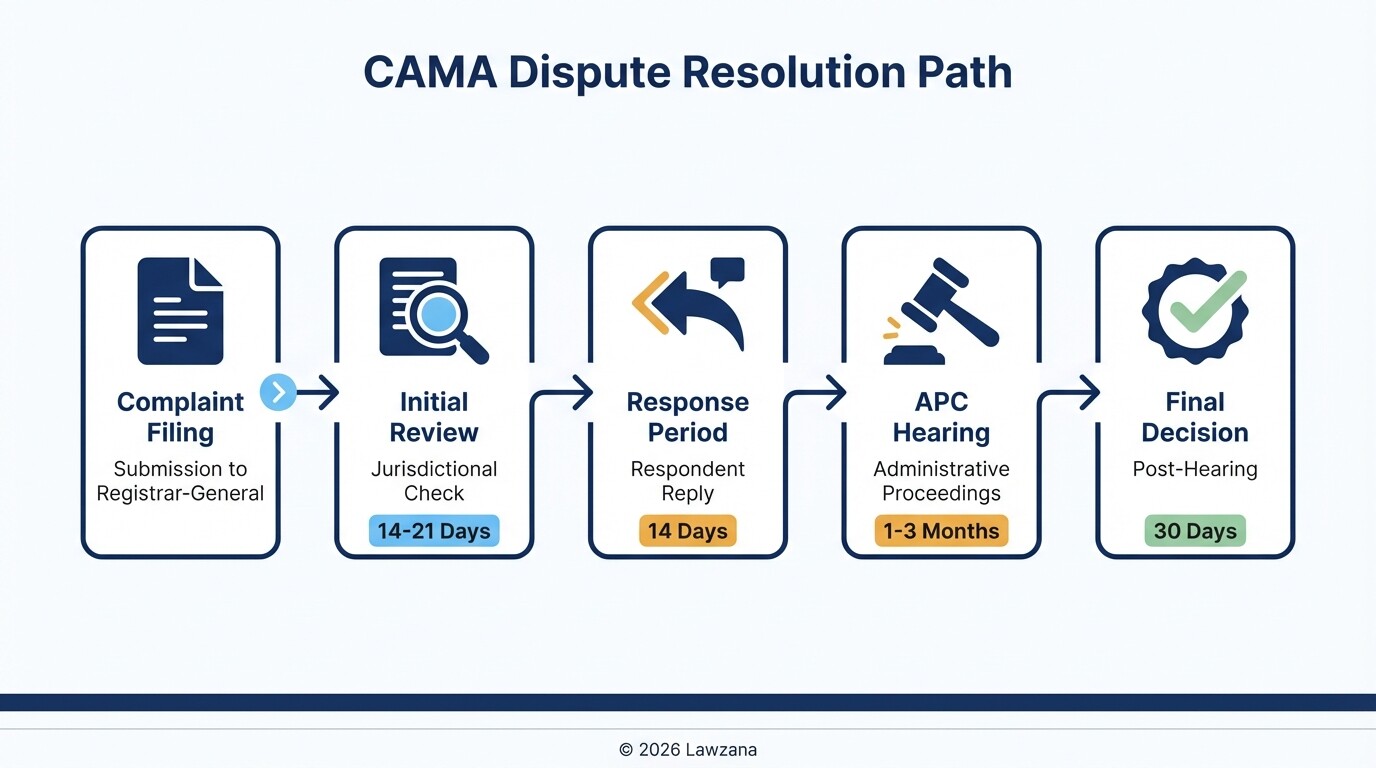

Timeline for Resolving Corporate Disputes Through the CAC

When internal disputes arise between shareholders or directors, CAMA 2020 provides administrative mechanisms to resolve issues without immediately resorting to the Federal High Court. The CAC has established the Administrative Proceedings Committee (APC) to handle such matters.

The timeline for resolving disputes via the CAC typically follows this trajectory:

- Filing a Complaint: An aggrieved party submits a formal petition to the Registrar-General of the CAC.

- Initial Review (14-21 Days): The CAC reviews the petition to determine if it falls within its administrative jurisdiction.

- Response Period (14 Days): The respondent is given a window to file a reply to the allegations.

- Hearing (1-3 Months): If the matter is not settled on paper, a hearing is scheduled before the APC.

- Decision (30 Days post-hearing): The Committee issues a decision which can include fines, orders to rectify the register, or recommendations for further legal action.

While this process is faster than traditional litigation, which can take 2-5 years in Nigeria, the APC's decisions can still be appealed at the Federal High Court.

Common Misconceptions About Nigerian Business Compliance

Filing with the CAC is the same as paying taxes

Many founders believe that filing annual returns with the CAC satisfies their tax obligations. This is incorrect. CAC filings are for corporate status maintenance, while taxes (CIT, VAT, etc.) must be filed separately with the Federal Inland Revenue Service (FIRS) and State Internal Revenue Services (SIRS).

Small companies don't need to keep any records

While small companies are exempt from holding AGMs, they are still legally required to maintain minutes of "decisions taken" and keep accurate financial records. Failure to produce these during a regulatory audit or during a due diligence process for investment can lead to legal liability.

FAQ

Do I need a lawyer to file my annual returns?

While the CAC portal allows company directors to file their own returns, it is highly recommended to use an accredited professional. This ensures the financial data and resolutions are formatted correctly, preventing the CAC from rejecting the filing.

What happens if I missed the filing deadline for 2025?

If you missed a deadline, you must pay the "Late Filing Fee" in addition to the standard filing fee. The penalty accumulates for each year or day of default, and you will not be able to perform any other portal transactions until the debt is cleared.

Can a foreigner be a single shareholder in a Nigerian company?

Yes, but with caveats. While CAMA 2020 allows for single-shareholder companies, a foreigner must still comply with the Nigerian Investment Promotion Commission (NIPC) requirements, including a minimum share capital of N100 million for companies with foreign participation.

When to Hire a Lawyer

Navigating CAMA 2020 is straightforward for basic operations, but you should consult a legal professional if:

- You are structuring a complex "Person with Significant Control" (PSC) arrangement involving holding companies.

- You are transitioning from a small company to a medium or large entity.

- You are facing a "striking off" notice from the CAC.

- You are involved in a dispute between shareholders regarding the control of the company.

- You are preparing for an investment round and need a comprehensive compliance audit.

Next Steps

- Verify Status: Check your company's status on the CAC Public Search portal to ensure you are listed as "Active."

- Update PSCs: If you haven't yet disclosed shareholders holding more than 5%, do so immediately via the CRP portal.

- Review 2026 Deadlines: Mark June 30 on your calendar as the internal deadline for gathering financial statements and preparing for the next filing cycle.

- Organize Records: Transition your physical minute books and registers into a secure digital format to ensure they are accessible for future filings.