What are the most common contract mistakes that lead to lawsuits in Canada?

Ambiguity in performance obligations and reliance on verbal "handshake" deals are the leading causes of contract litigation between Canadian businesses. When a contract fails to define exactly what constitutes a "completed service" or "acceptable product," parties often develop conflicting expectations that only a judge or arbitrator can resolve.

Beyond simple ambiguity, many Canadian business owners fall into these common traps:

- Using generic templates: Many online templates are based on U.S. law and do not account for Canadian provincial statutes, such as the Canada Business Corporations Act or local consumer protection laws.

- Failure to update for "Change of Circumstances": Contracts that do not include a "Force Majeure" or "Variation" clause leave businesses vulnerable when external factors, like supply chain disruptions or government mandates, make performance impossible.

- Vague payment timelines: Simply stating "payment is due upon receipt" without specifying interest rates for late payments or penalties for non-payment often leads to accounts receivable disputes.

- Ignoring provincial differences: A contract drafted for a business in Alberta may not be fully enforceable in Quebec due to the Civil Code of Quebec, which differs from the common law systems used in other provinces.

How can you identify if your current contracts are at risk?

Review your existing agreements for any terms that rely on "reasonableness" or "industry standards" rather than specific dates, dollar amounts, and measurable outcomes. If two different people could interpret a clause in two different ways, that clause is a potential lawsuit.

Which essential clauses minimize risk in Canadian business agreements?

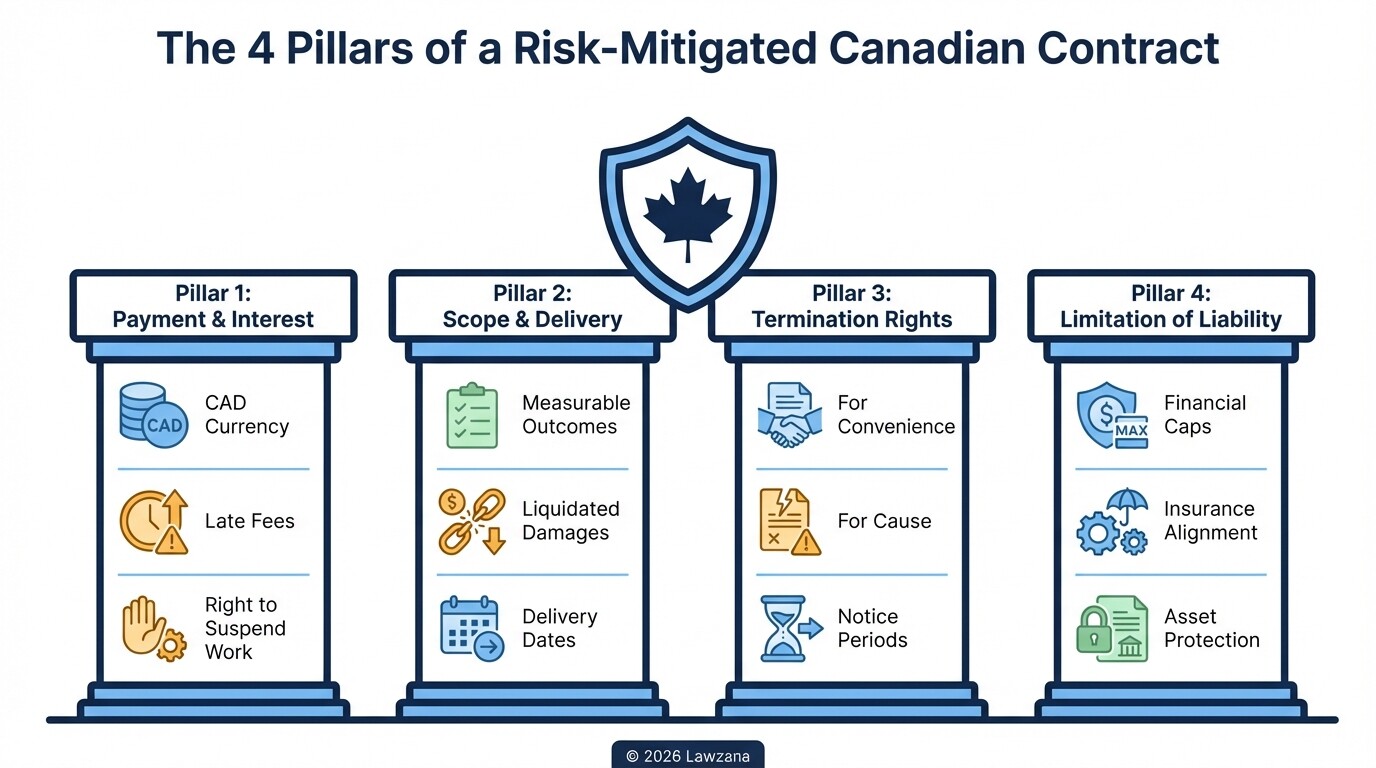

A risk-mitigated contract must include specific clauses for payment, delivery, termination, and liability limits to ensure both parties understand their boundaries. These clauses act as the "rules of engagement" and provide a clear roadmap for resolving disagreements without resorting to litigation.

To protect your business, ensure every contract contains these four pillars:

- Payment and Interest Terms: Clearly define the currency (CAD), the method of payment, and specific deadlines. Include a "Right to Suspend" clause, allowing you to stop work if payments are more than 30 days overdue.

- Detailed Scope of Work and Delivery: Use an appendix or schedule to list every deliverable. Specify what happens if a delivery is late, including "Liquidated Damages" if the delay causes a specific financial loss.

- Termination Rights: Include "Termination for Convenience" (allowing you to end the deal with 30-60 days' notice) and "Termination for Cause" (allowing immediate cancellation if the other party breaches the agreement).

- Limitation of Liability: This is perhaps the most important clause. It should cap your total financial exposure to a fixed amount, such as the total value of the contract or the limit of your professional liability insurance.

What happens if a contract is missing a termination clause?

In Canada, if no termination clause exists, "reasonable notice" is usually required to end an ongoing business relationship. What is considered "reasonable" is often determined by a court, which can lead to expensive legal battles over how much notice should have been given.

How can businesses use dispute resolution clauses to avoid court?

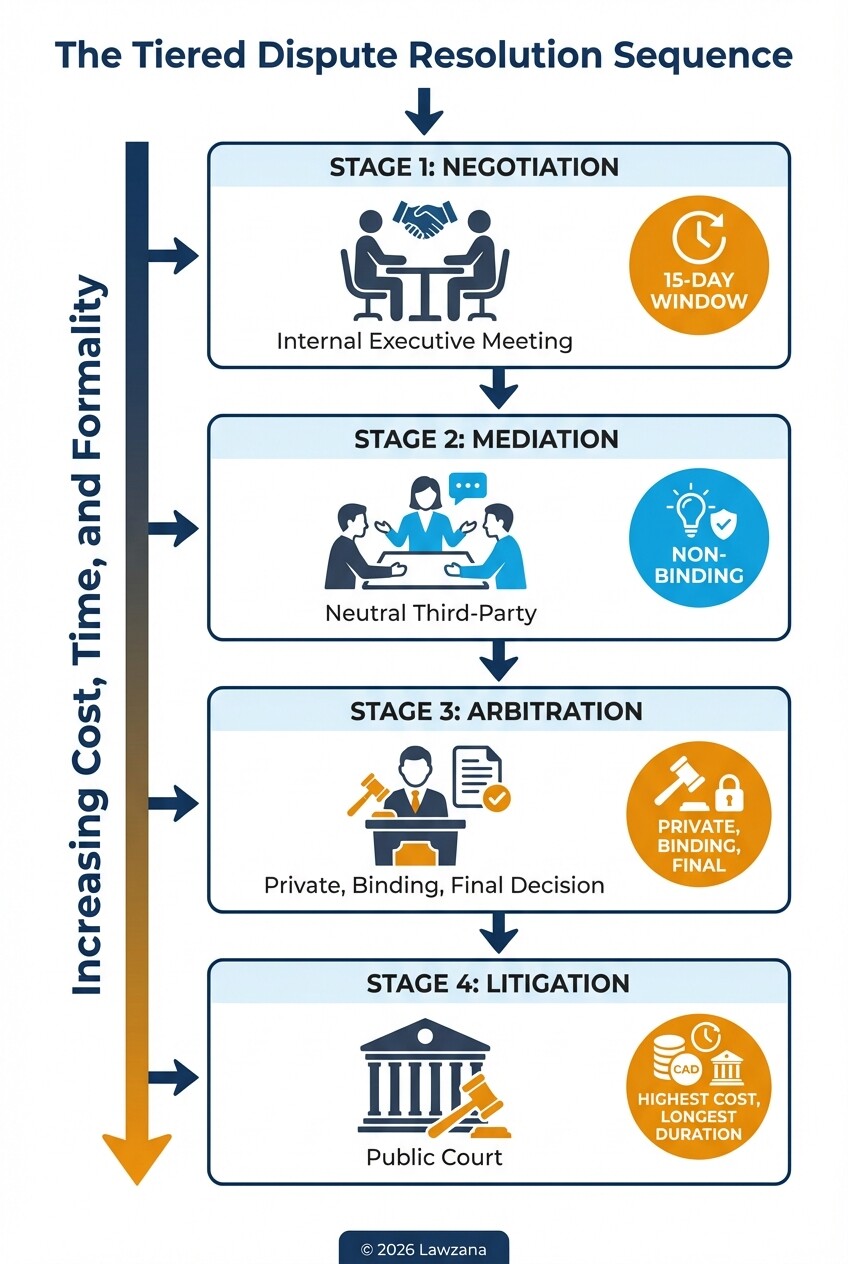

Dispute resolution clauses should mandate a "tiered" approach that requires parties to attempt negotiation and mediation before filing a statement of claim in court. By including these provisions, you force the other party to sit at the bargaining table, which often results in a settlement at a fraction of the cost of a trial.

Effective dispute resolution in Canada typically follows this sequence:

- Negotiation: The contract requires senior executives from both companies to meet in person or via video link to attempt a good-faith resolution within 15 days of a dispute arising.

- Mediation: If negotiation fails, the parties must hire a neutral third-party mediator. Mediation is non-binding but successful in over 70% of commercial cases in Canada.

- Arbitration: For more complex deals, you may choose binding arbitration. This is private, unlike the public Courts of Ontario or other provincial courts, and the decision is final.

- Governing Law and Forum: Always specify which province's laws apply and where the legal proceedings must take place. This prevents a "forum shopping" tactic where one party tries to sue you in a distant or unfavorable jurisdiction.

Is arbitration always cheaper than going to court?

Not necessarily. While arbitration is faster and private, you must pay for the arbitrator's time and the venue, whereas the government pays the judge's salary in court. However, the speed of arbitration usually results in lower overall legal fees for your own lawyers.

When should you have a lawyer review or negotiate a contract?

You should involve a Canadian lawyer whenever a contract involves high-value assets, long-term commitments, or the transfer of intellectual property (IP). A professional review ensures that the "boilerplate" language-the fine print at the end of the document-doesnt inadvertently strip you of your legal rights or insurance coverage.

Consider legal counsel essential in the following scenarios:

- The contract value exceeds $50,000: The cost of a 2-hour legal review (typically $600 to $1,200 CAD) is negligible compared to the cost of a $50,000 lawsuit.

- Indemnification requests: If the other party asks you to "indemnify and hold them harmless," you are essentially acting as their insurer. A lawyer can narrow this language so you only cover losses caused by your own negligence.

- Exclusivity or Non-Competes: These clauses can stifle your business growth for years. A lawyer can ensure these restrictions are narrow in geographic scope and duration to remain enforceable under Canadian law.

- Complex Regulatory Environments: If your business operates in healthcare, finance, or construction, specific provincial regulations must be integrated into your contracts to avoid fines and liability.

Can a lawyer help after I have already signed the contract?

Yes, but your options are more limited. A lawyer can help interpret existing clauses to find "exit ramps" or leverage points for a renegotiation, but it is always more cost-effective to fix a contract before the ink is dry.

What should you do if another party threatens to sue over a contract?

If a party threatens litigation, your immediate priority is to cease informal communication and begin a formal "litigation hold" on all related documents. In Canada, failing to preserve evidence (including emails, Slack messages, and text messages) can lead to "spoliation" sanctions, where a court assumes the destroyed evidence would have hurt your case.

Follow these steps if a lawsuit is threatened:

- Review the Notice Provision: Most Canadian contracts require a specific method for "Notice of Dispute." Ensure any response you send follows these requirements exactly.

- Audit Your Performance: Gather all evidence that you fulfilled your obligations, such as delivery receipts, signed acceptance forms, and timestamps of completed work.

- Check Your Insurance Policy: Many "Errors and Omissions" (E&O) or "Commercial General Liability" (CGL) policies require you to notify your insurer as soon as a threat is made, or they may deny coverage later.

- Consult Counsel Before Replying: Do not send an angry email or admit fault. Even a seemingly polite apology can be used in court as an admission of liability.

Should you ignore a "Demand Letter" from a lawyer?

Never ignore a formal demand letter. Ignoring it often signals to the other party that you are not taking the matter seriously, which may encourage them to file a formal Statement of Claim in court to get your attention.

Common Misconceptions About Canadian Contracts

Myth: If a contract is unfair, a Canadian judge will automatically throw it out. Reality: Canadian courts generally respect "freedom of contract." Unless the terms are truly unconscionable (grossly unfair due to a massive power imbalance) or illegal, judges will enforce the deal you signed, even if it was a bad bargain for you.

Myth: You can't be sued if you didn't sign a physical piece of paper. Reality: Digital signatures, email confirmations, and even "conduct" (starting the work) can create a legally binding contract in Canada. If you act like there is a contract, the law often treats it as if there is one.

Myth: "Standard" U.S. contracts work perfectly in Canada. Reality: U.S. contracts often include terms like "at-will employment" or specific state-based interest rate caps that are invalid in Canada. Using them can make your entire agreement unenforceable.

FAQs

How much does it cost to sue for breach of contract in Canada? For claims under $35,000 (depending on the province), you can use Small Claims Court, where costs are relatively low. For larger claims in Superior Court, legal fees can quickly exceed $20,000 to $50,000 per party just to reach the discovery phase.

What is the statute of limitations for contract disputes in Canada? In most provinces, including Ontario and British Columbia, the basic limitation period is two years from the day the claim was "discovered." This means you generally have two years from the date you knew a breach occurred to start a lawsuit.

Can I include a clause that says the loser pays the winner's legal fees? Yes. In fact, Canadian courts often award "costs" to the successful party anyway, but including a "Cost Shifting" clause in your contract provides extra certainty and can discourage frivolous lawsuits.

When to Hire a Lawyer

You should consult a business lawyer if you are entering into a partnership agreement, licensing your intellectual property, or signing a commercial lease. Professional legal advice is also vital if you receive a "Notice of Default" or a "Statement of Claim," as there are strict provincial deadlines (often only 20 days) to file a formal statement of defense.

Next Steps

- Inventory your templates: Audit the contracts you currently send to clients and vendors.

- Identify "Red Flag" terms: Look for vague language or missing "Limitation of Liability" clauses.

- Establish a signing protocol: Ensure only authorized personnel sign contracts and that every signed version is saved in a central, secure digital location.

- Schedule a consultation: Have a qualified Canadian lawyer review your most frequent agreement to create a "gold standard" version you can use moving forward.