- The Fighting Against Forced Labour and Child Labour in Supply Chains Act requires qualifying Canadian businesses and importers to submit an annual report by May 31 each year.

- Reporting entities must meet specific size thresholds, including at least $20 million CAD in assets, $40 million CAD in revenue, or an average of 250 employees.

- Failure to comply, including providing false or misleading information, can result in summary conviction and fines of up to $250,000 CAD.

- The report must be approved by the company's Board of Directors and include a signed attestation from a designated director or officer.

- Compliance is not just a legal formality but a transparency requirement that makes supply chain risks public via a searchable federal database.

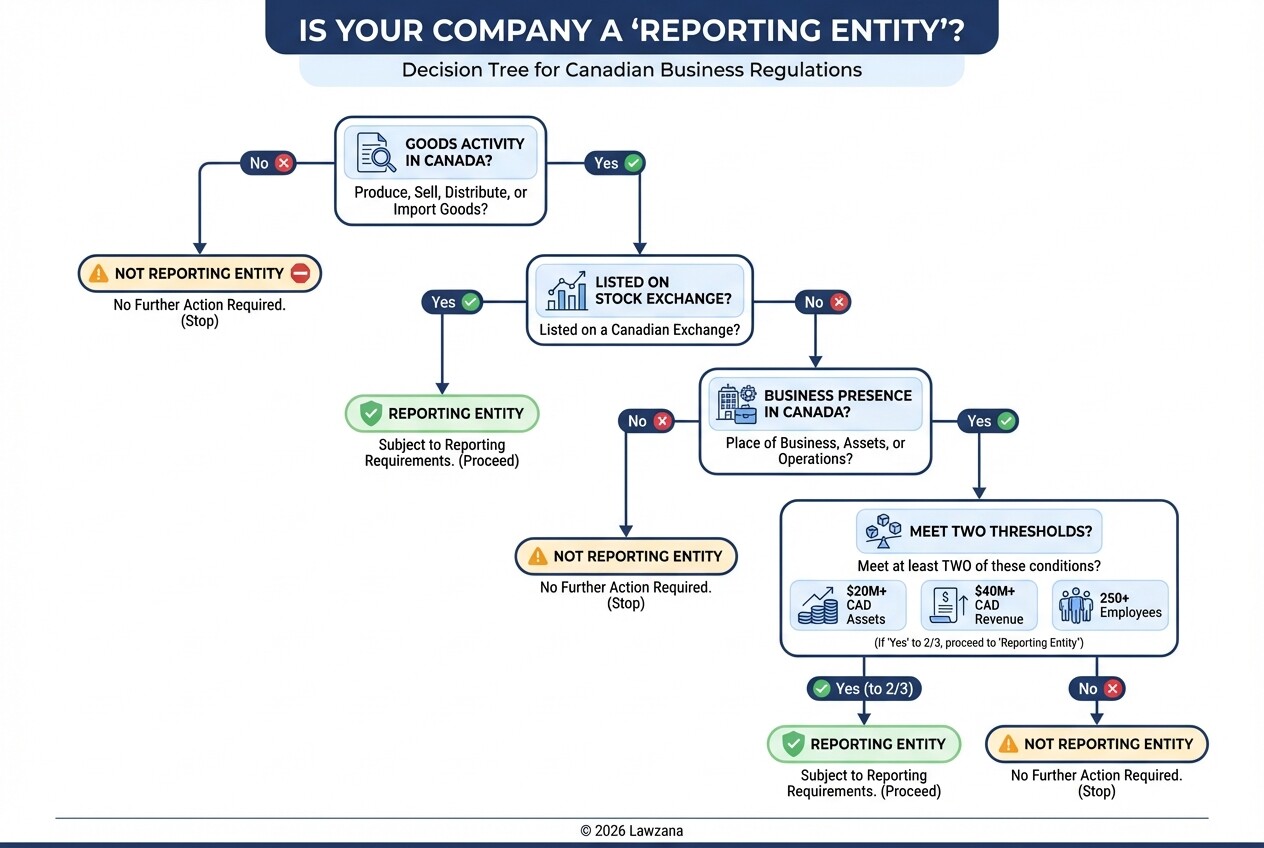

Which Businesses Are Considered a Reporting Entity Under the Act?

A business is considered a reporting entity if it is listed on a Canadian stock exchange or meets specific size thresholds and operates by producing, selling, or importing goods into Canada. Under the Act, private companies are captured if they have a place of business in Canada, do business in Canada, or have assets in Canada, and meet at least two of the following conditions in one of their last two financial years: $20 million CAD in assets, $40 million CAD in revenue, or 250 employees.

To determine if your business must comply, evaluate your operations against these three categories:

- Entity Status: Your organization is a corporation, trust, partnership, or unincorporated organization that is either listed on a Canadian stock exchange or has a physical presence in Canada.

- Activity Threshold: Your business produces, sells, or distributes goods in Canada or elsewhere; imports goods into Canada; or controls an entity engaged in these activities.

- Financial Threshold: For those not listed on a stock exchange, you must meet at least two of the following:

- At least $20 million CAD in assets.

- At least $40 million CAD in revenue.

- An average of at least 250 employees.

If your business meets these criteria, you are legally obligated to file a report. Government institutions also have separate reporting requirements under the same legislation.

What Are the Mandatory Requirements for the Annual Report to Public Safety Canada?

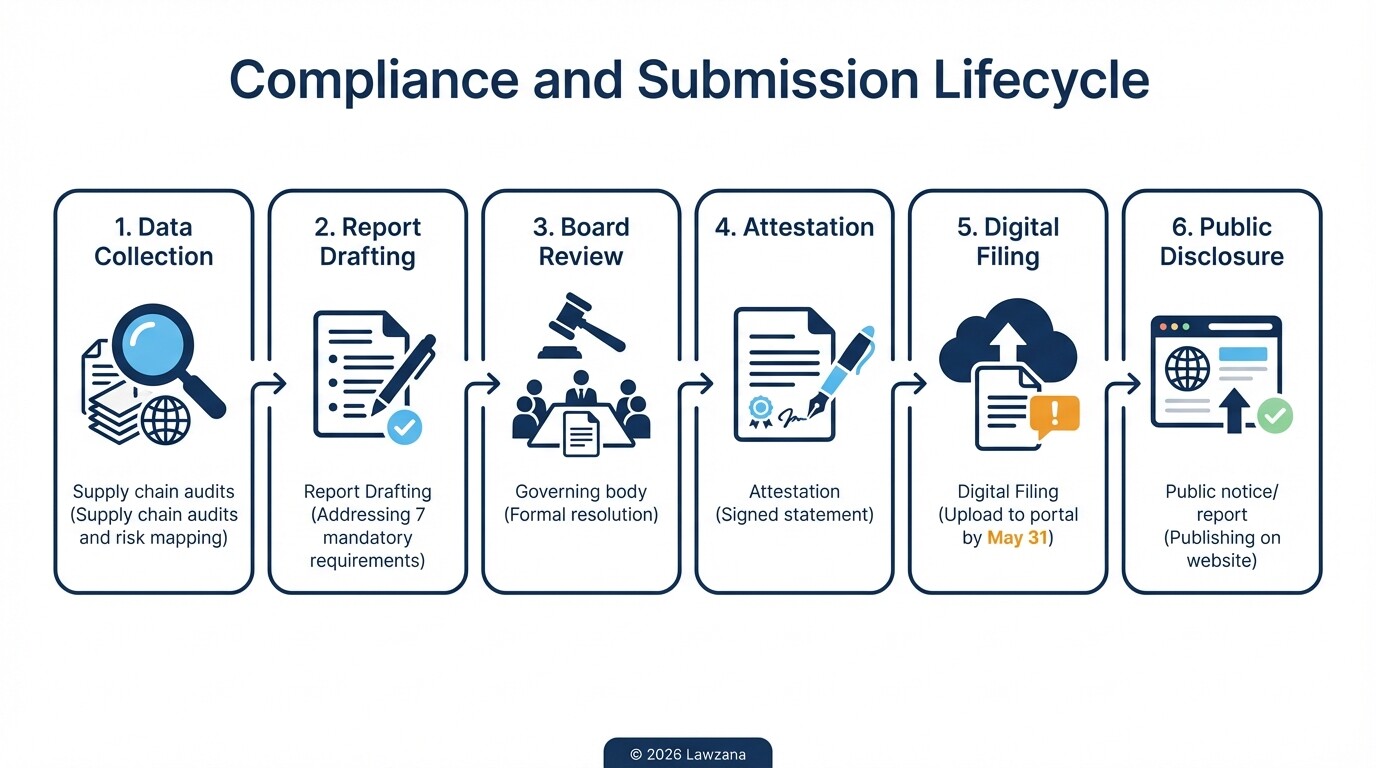

The annual report must detail the specific steps your organization took during its previous financial year to prevent and reduce the risk that forced labor or child labor is used at any point in your production or imports. This report is submitted through an online questionnaire and a PDF upload to the Public Safety Canada portal.

The Act specifies that every report must address these seven mandatory areas:

- Structure and Activities: A description of your business structure, activities, and supply chains.

- Policies and Due Diligence: The specific policies and due diligence processes you have in place regarding forced labor and child labor.

- Risk Assessment: The parts of your business and supply chains that carry a risk of forced or child labor and the steps taken to manage those risks.

- Remediation Measures: Any measures taken to remediate forced labor or child labor, including steps taken to remediate the loss of income to the most vulnerable families that results from any measure taken to eliminate the use of forced or child labor.

- Training: The training provided to employees on forced labor and child labor.

- Assessing Effectiveness: How the entity assesses its effectiveness in ensuring that forced labor and child labor are not being used in its business and supply chains.

- Approval and Attestation: Confirmation that the report was approved by the appropriate governing body.

How Does the Board of Directors Approval and Attestation Process Work?

The Act requires a formal approval process to ensure that the highest levels of corporate leadership are accountable for the accuracy of the report. Before the report is submitted to Public Safety Canada, it must be approved by the entity's governing body-typically the Board of Directors-and contain a signed attestation statement.

The attestation serves as a legal confirmation that the information provided is true, accurate, and complete. The process generally follows these steps:

- Drafting and Review: Legal and compliance teams prepare the report based on supply chain audits and internal data.

- Board Resolution: The Board of Directors reviews the findings and passes a resolution to approve the report.

- Signature: One or more directors or officers must sign the attestation on behalf of the Board.

- Public Disclosure: Once approved and submitted, the report must be made prominently available on the company's website.

For groups of companies, a joint report is permitted if the information applies to multiple entities within the same corporate structure. In such cases, the report must be approved by the governing body of each entity or the governing body that controls the group.

What Are the Consequences of False Statements or Failure to Report?

Non-compliance with the Act carries significant legal and financial risks, including criminal charges for the entity and its directors. If a business fails to submit a report, fails to make it public, or obstructs an investigation, it can be prosecuted under a summary conviction.

The specific penalties and enforcement mechanisms include:

- Financial Fines: Every person or entity that fails to comply with the reporting requirements is guilty of an offense and liable to a fine of up to $250,000 CAD.

- Individual Liability: Directors, officers, or agents who directed, authorized, assented to, or participated in the offense can be held personally liable for the fine, regardless of whether the entity itself has been prosecuted.

- Compliance Orders: The Minister of Public Safety has the power to order an entity to take any measures necessary to ensure compliance, such as amending a deficient report.

- Reputational Damage: Because all reports are published in a searchable online database, public interest groups, investors, and consumers can easily identify companies that fail to meet transparency standards.

How Can Businesses Integrate Due Diligence Into Existing Procurement Policies?

Compliance should not be treated as a once-a-year filing but as an ongoing part of your procurement and risk management strategy. Integrating these requirements into your existing systems ensures that you are gathering the data needed for the report throughout the year while actively reducing your legal exposure.

To integrate due diligence effectively, follow this checklist:

| Integration Step | Action Item |

|---|---|

| Supplier Code of Conduct | Update contracts to include specific prohibitions against forced and child labor. |

| Questionnaires | Add labor standard questions to your standard Request for Proposal (RFP) and onboarding processes. |

| Audit Rights | Ensure your contracts grant you the right to perform third-party audits of supplier facilities. |

| Employee Training | Implement mandatory training for procurement officers to identify red flags in international logistics. |

| Monitoring Tools | Use AI or risk-mapping software to track geographical or industry-specific labor risks in your Tier 1 and Tier 2 suppliers. |

By embedding these steps into your standard operating procedures, your organization moves beyond "check-the-box" compliance and toward a proactive stance that protects your brand and fulfills Canadian legal requirements.

Common Misconceptions About the Modern Slavery Act

Misconception: My company doesn't have "slavery" in its supply chain, so I don't need to report. The Act is about transparency and the risk of forced labor. Even if you are confident your direct suppliers are compliant, you are still legally required to file a report if you meet the size thresholds. The law mandates that you disclose your processes for identifying and managing these risks, regardless of whether an incident has been confirmed.

Misconception: Only mining and garment industries are targeted. While high-risk sectors are under more scrutiny, the Act applies to all industries. Tech companies, food importers, and wholesalers are equally responsible for reporting if they meet the financial and employee thresholds. The law focuses on the act of importing and distributing, not the specific nature of the goods.

Misconception: The report is just a formality with no real teeth. Unlike some international disclosure laws, the Canadian Act includes personal liability for directors and officers. A false statement on an attestation is a criminal offense under the Act. Public Safety Canada has the authority to conduct inspections and seize documents to verify the contents of your report.

FAQ

When is the reporting deadline each year?

The report must be submitted to the Minister of Public Safety and made public on your website no later than May 31 of each year, covering the activities of the previous financial year.

Can a foreign parent company file on behalf of its Canadian subsidiary?

Yes, a joint report can be filed for a parent and its subsidiaries. However, the report must clearly identify all entities covered and must be approved by the governing body of each reporting entity or the entity that controls the group.

What is the definition of "child labor" under Canadian law?

Under the Act, child labor refers to labor or services provided by persons under the age of 18 that are provided under circumstances that are contrary to the laws applicable in Canada or that interfere with a child's education or are likely to be harmful to their health or development. Full definitions are available on the Justice Laws Website.

Where must the report be published besides the government portal?

In addition to the Public Safety Canada portal, the report must be posted in a prominent place on the entity's website. If the entity is incorporated under the Canada Business Corporations Act, the report must also be sent to each shareholder along with annual financial statements.

When to Hire a Lawyer

Navigating the Modern Slavery Act requires a blend of corporate governance knowledge and international trade expertise. You should consult a lawyer if:

- You are unsure if your asset or revenue calculations trigger reporting requirements for a complex corporate structure.

- You need to draft or review the Board of Directors' attestation to ensure it meets legal standards.

- You are responding to a notice of non-compliance or an investigation from Public Safety Canada.

- You need to update international supplier contracts to include enforceable labor compliance clauses.

Next Steps

- Determine Status: Have your accounting team confirm if you meet the $20M/$40M/250-employee threshold.

- Map Your Supply Chain: Identify where your goods originate and which suppliers present the highest risk.

- Draft the Report: Use the Public Safety Canada questionnaire as a template to gather necessary data.

- Obtain Board Approval: Schedule a board meeting well before the May 31 deadline to review and sign the attestation.

- Publish and File: Submit the report via the official portal and upload it to your company's public website.