- Probate is a Formal Process: In Ontario, probate is legally known as applying for a "Certificate of Appointment of Estate Trustee," which confirms the authority of the person managing the estate.

- Estate Administration Tax (EAT): This tax is calculated based on the total value of the estate assets, with the first $50,000 being exempt from taxation.

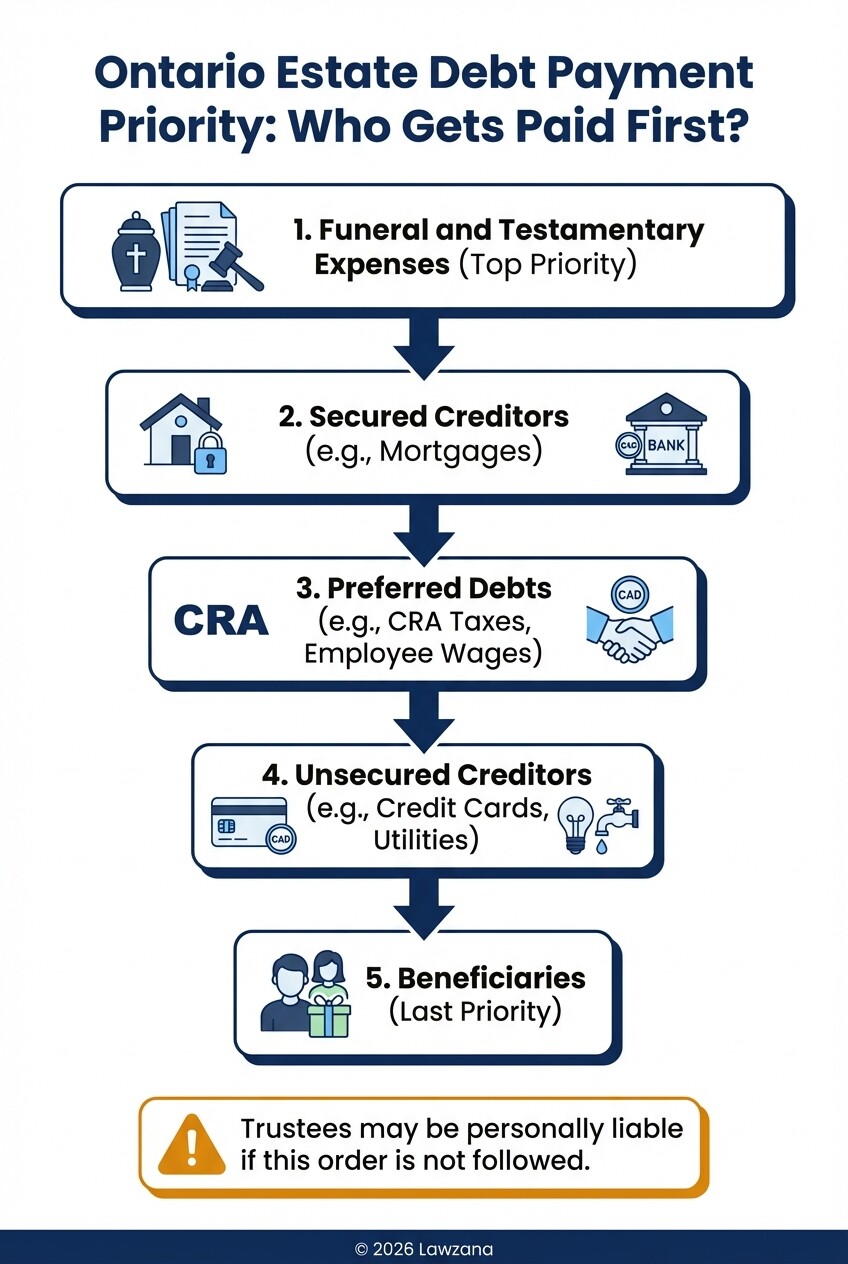

- Executor Liability: Estate trustees are personally liable for any errors in debt repayment or asset distribution, making precise record-keeping and legal compliance essential.

- Timeline Expectations: The probate process in Ontario typically takes several months for the court to grant the certificate, and a minimum of one year for full estate administration.

- Small Estates: Estates valued at $50,000 or less may qualify for a simplified Small Estate Certificate process.

Essential Ontario Estate Administration Checklist

The following checklist outlines the critical steps an estate trustee must take from the moment of death through to the final distribution of assets.

| Phase | Task | Completion Status |

|---|---|---|

| Immediate Steps | Locate the original Will and funeral instructions. | [ ] |

| Arrange funeral and burial/cremation services. | [ ] | |

| Secure the deceased's property (lock doors, check insurance). | [ ] | |

| Asset Discovery | Create a comprehensive list of all bank accounts, investments, and real estate. | [ ] |

| Obtain formal valuations or appraisals for property and high-value items. | [ ] | |

| Identify assets that pass outside the estate (e.g., joint accounts, RRSPs with beneficiaries). | [ ] | |

| Probate Application | Determine if probate is required by third parties (banks, Land Registry). | [ ] |

| Calculate the Estate Administration Tax (EAT) deposit. | [ ] | |

| File Form 74A (with Will) or 74C (without Will) with the Superior Court of Justice. | [ ] | |

| Tax & Debt | Notify creditors and the Canada Revenue Agency (CRA). | [ ] |

| File the Estate Information Return (EIR) within 180 days of receiving the certificate. | [ ] | |

| Obtain a Tax Clearance Certificate from the CRA. | [ ] | |

| Distribution | Prepare a "Passing of Accounts" for beneficiary approval. | [ ] |

| Pay out specific bequests (set sums or items) before the residue. | [ ] | |

| Distribute the remaining estate to beneficiaries and obtain releases. | [ ] |

Applying for a Certificate of Appointment of Estate Trustee

Applying for a Certificate of Appointment of Estate Trustee is the formal court process used to "probate" a Will in Ontario. This certificate proves to financial institutions, the Land Registry Office, and other entities that the person named has the legal authority to deal with the deceased's assets.

In Ontario, the application is filed in the Superior Court of Justice in the county or district where the deceased lived. If there is a valid Will, the applicant applies for a "Certificate of Appointment of Estate Trustee with a Will." If the deceased died "intestate" (without a Will), a family member usually applies for a "Certificate of Appointment of Estate Trustee without a Will."

The process involves submitting several forms, the original Will, and the payment of the Estate Administration Tax. Since 2021, Ontario has offered a simplified process for "Small Estates" where the total value is $50,000 or less, reducing the administrative burden on the trustee. You can find the necessary forms and instructions on the Government of Ontario website.

Calculating and Paying Estate Administration Tax

Estate Administration Tax (EAT) is a provincial tax charged on the total value of the deceased's estate assets at the time of death. The tax must be paid as a deposit to the Minister of Finance when the probate application is filed with the court.

The current tax rates in Ontario are designed to provide relief for smaller estates. As of January 1, 2020, there is no EAT payable on the first $50,000 of the estate value. For every $1,000 (or part thereof) of value exceeding $50,000, the tax rate is $15.

| Estate Value | EAT Calculation | Total Tax Owed |

|---|---|---|

| $50,000 or less | $0 | $0 |

| $100,000 | ($100,000 - $50,000) x 0.015 | $750 |

| $500,000 | ($500,000 - $50,000) x 0.015 | $6,750 |

| $1,000,000 | ($1,000,000 - $50,000) x 0.015 | $14,250 |

The trustee must also file an "Estate Information Return" with the Ontario Ministry of Finance within 180 calendar days of receiving the Certificate of Appointment. This return provides a detailed breakdown of the assets and their values to ensure the correct amount of tax was paid.

Identifying, Valuing, and Securing Estate Assets

Identifying and securing assets is the trustee's first physical responsibility to ensure the estate is not diminished by theft, damage, or neglect. This involves taking immediate control of real estate, redirecting mail, and notifying financial institutions to freeze individual accounts.

Valuation must be based on the "Fair Market Value" of the assets on the actual date of death. For real estate, a professional appraisal or a detailed Broker Price Opinion is usually required. For bank accounts and investments, the value is the balance (including accrued interest) on the date of death.

Assets that do not form part of the "probate estate" include:

- Real estate held in "Joint Tenancy" (which passes to the survivor).

- Life insurance policies with a named beneficiary.

- Registered accounts (RRSPs, RRIFs, TFSAs) with a designated beneficiary.

- Assets held in a valid inter vivos trust.

Priority of Debts: What to Pay Before Beneficiaries

Under Ontario law, an estate trustee is required to pay the estate's liabilities in a specific order of priority before any money is distributed to beneficiaries. If a trustee distributes funds to beneficiaries while debts remain unpaid, the trustee can be held personally liable for those debts.

The general order of priority for payment is:

- Funeral and Testamentary Expenses: Reasonable costs for the funeral, burial/cremation, and the legal costs associated with probating the estate.

- Secured Creditors: Debts secured by collateral, such as a mortgage on a property.

- Preferred Debts: This primarily includes any taxes owed to the Canada Revenue Agency (CRA) and certain wages owed to employees of the deceased.

- Unsecured Creditors: General debts like credit card balances, utility bills, and personal loans.

- Beneficiaries: Legacies (specific cash gifts) are paid first, followed by the "residue" of the estate.

It is highly recommended that trustees obtain a Clearance Certificate from the CRA before the final distribution to ensure all taxes have been assessed and paid.

The Passing of Accounts and Liability of the Trustee

The "Passing of Accounts" is the process by which an estate trustee presents a detailed report of all transactions to the beneficiaries or the court for approval. This serves as a formal protection for the trustee, confirming they have managed the funds appropriately.

An "Informal Passing of Accounts" occurs when the trustee provides a ledger of all income, expenses, and distributions to the beneficiaries, who then sign a "Release." This release protects the trustee from future claims by those beneficiaries regarding the period covered by the accounting.

A "Formal Passing of Accounts" involves a court hearing and is typically necessary if there are minor or mentally incapable beneficiaries, or if a beneficiary disputes the trustee's actions or the proposed executor's compensation. In Ontario, trustees are generally entitled to a fee of approximately 5% of the estate's value (2.5% of receipts and 2.5% of disbursements), though this can be challenged if the administration was straightforward or mishandled.

Common Misconceptions About Ontario Probate

Myth 1: "Probate is always required for every estate."

Probate is not always necessary. If the deceased owned all assets jointly with a spouse (like a home and bank accounts) or had designated beneficiaries on all policies, there may be no "estate" assets that require a court certificate to transfer.

Myth 2: "The executor gets to decide who gets what."

The executor (estate trustee) has no personal discretion over the distribution of assets. They are legally bound by the terms of the Will. If there is no Will, they must follow the strict distribution rules set out in Ontario's Succession Law Reform Act.

Myth 3: "Probate takes years to complete."

While the total administration of an estate often takes 12 to 18 months, obtaining the Certificate of Appointment usually takes between 4 and 12 weeks, depending on the specific court's backlog.

FAQ

How much does probate cost in Ontario?

The main cost is the Estate Administration Tax, which is 1.5% of the estate's value over $50,000. Other costs include court filing fees, legal fees, and appraisal costs for real estate or jewelry.

Can I settle an estate without a lawyer?

While not legally required, it is often risky. Estate trustees are personally liable for mistakes. If the estate involves real estate, corporate shares, or disgruntled beneficiaries, professional legal guidance is essential.

What happens if someone dies without a Will in Ontario?

The Succession Law Reform Act dictates the distribution. Typically, the spouse receives the first $350,000 (the "preferential share"), and the remainder is split between the spouse and children.

How long do I have to file the Estate Information Return?

You must file the return with the Ontario Ministry of Finance within 180 calendar days of the date your Certificate of Appointment of Estate Trustee was issued.

When to Hire a Lawyer

Estate administration in Ontario involves significant legal and financial risks. You should consult an estate lawyer if:

- The estate includes complex assets like a business, foreign property, or private shares.

- There is no Will, or the Will is poorly drafted or outdated.

- Beneficiaries are disagreeing or threatening litigation.

- The estate is "insolvent" (debts exceed assets).

- You are unsure of the tax implications or the priority of creditor claims.

Next Steps

- Locate the Will: Ensure you have the original document, not a copy.

- Consult a Professional: Meet with a lawyer or accountant to estimate the estate's value and potential tax liability.

- Notify Institutions: Inform the deceased's bank and service providers to prevent identity theft or unnecessary charges.

- Gather Documents: Collect the last three years of tax returns and a list of all known assets and debts.