- Canadian businesses are subject to strict liability under the Special Economic Measures Act (SEMA) and the Justice for Victims of Corrupt Foreign Officials Act (FAC), meaning intent is often irrelevant to a finding of a violation.

- All Canadian citizens and businesses, regardless of where they operate in the world, must comply with Canadian sanctions laws.

- Failure to comply can result in criminal prosecution, significant fines, and imprisonment for up to five years.

- Managing trade risk requires screening all parties against the Consolidated Canadian Autonomous Sanctions List and implementing a formal Internal Compliance Program (ICP).

- Real-time reporting of frozen assets and suspicious transactions to the RCMP or FINTRAC is a mandatory legal requirement for financial institutions and certain businesses.

How do Canadian businesses identify sanctioned individuals and entities?

Canadian businesses identify sanctioned parties by screening all customers, vendors, and partners against the Consolidated Canadian Autonomous Sanctions List. This list aggregates individuals and entities named under the Special Economic Measures Act (SEMA) and the Justice for Victims of Corrupt Foreign Officials Act (FAC).

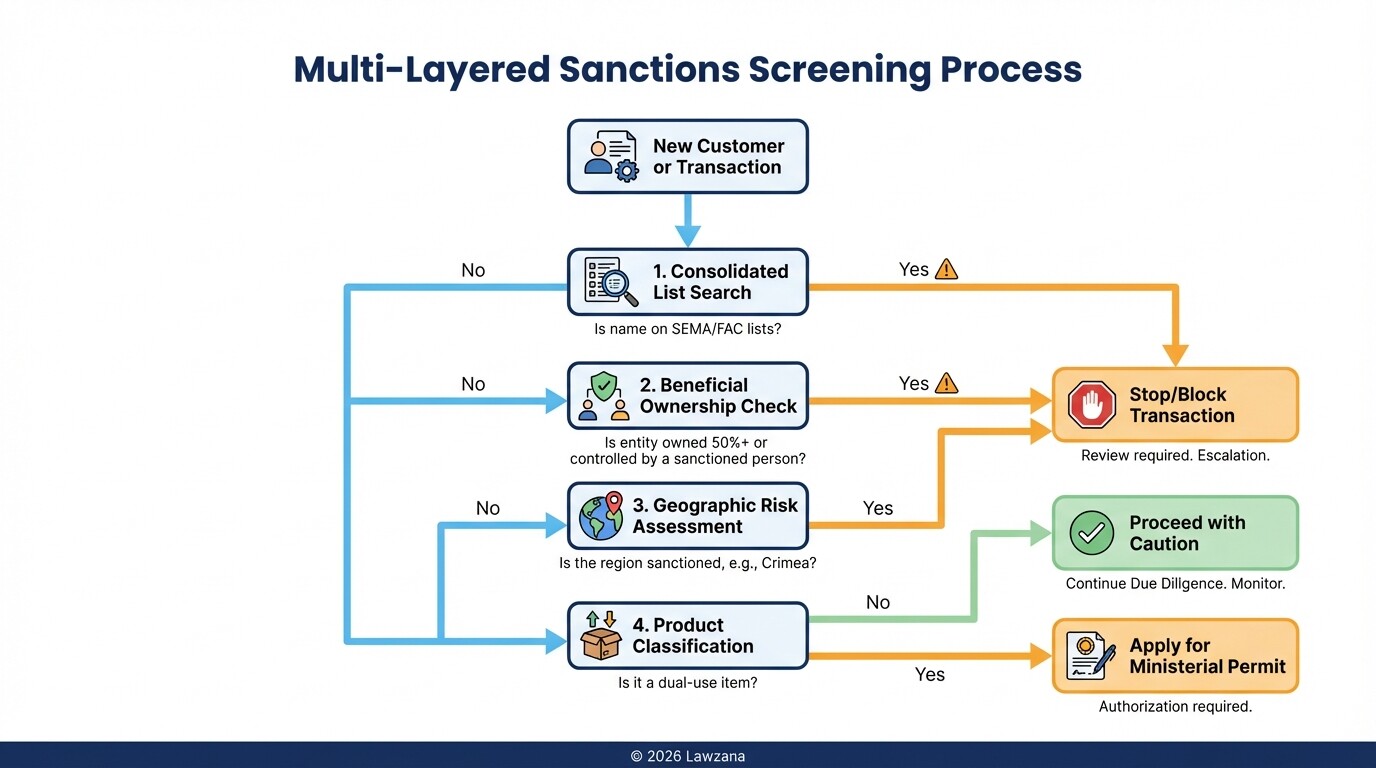

Effective identification requires more than a simple name search. Businesses must adopt a multi-layered screening process to ensure they do not inadvertently engage in prohibited activities.

- Check the Specific Regulation: Sanctions are often country-specific (e.g., Russia, Iran, or Haiti). Each regulation lists specific prohibitions, which may include a total ban on services or specific restrictions on certain goods.

- Identify Beneficial Ownership: Canadian law prohibits dealing with entities "owned or controlled" by a sanctioned person. This requires looking through corporate layers to identify individuals who own 50% or more of an entity or exercise significant influence.

- Automated Screening Tools: For companies with high transaction volumes, manual searches are insufficient. Specialized software can provide "fuzzy matching" to catch variations in spelling or aliases used by sanctioned actors.

- Geographic Red Flags: Even if a person is not on a list, doing business in specific regions (like Crimea or parts of Eastern Ukraine) may be prohibited under broad territorial sanctions.

What are the components of a robust Internal Compliance Program (ICP)?

A robust Internal Compliance Program (ICP) is a set of formal policies and procedures designed to ensure a company adheres to Canada's export controls and sanctions laws. While not explicitly mandated by law, having an ICP serves as a critical "due diligence" defense if a violation occurs, potentially mitigating legal penalties.

A standard ICP for a Canadian firm should include the following five pillars:

- Management Commitment: A written statement from senior leadership emphasizing that the company will not bypass trade laws for profit.

- Risk Assessment: A periodic review of the company's products, geographic reach, and customer base to identify where sanctions exposure is highest.

- Written Policies and Procedures: Clear, step-by-step instructions for employees on how to screen parties, handle "hits" on a sanctions list, and apply for export permits from Global Affairs Canada.

- Training and Awareness: Regular training sessions for employees in sales, procurement, and finance to help them recognize "red flags" in international trade.

- Monitoring and Auditing: Annual internal or external audits to verify that the compliance program is actually being followed and to update it as Canadian laws change.

What are the reporting obligations for suspicious financial transactions in Canada?

Reporting obligations in Canada require businesses to immediately notify the Royal Canadian Mounted Police (RCMP) or the Canadian Security Intelligence Service (CSIS) if they possess or control property belonging to a sanctioned person. Under SEMA and the United Nations Act, every person in Canada and every Canadian outside Canada has a continuous duty to report.

Financial institutions, including banks, credit unions, and insurance companies, face even stricter requirements under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA).

| Obligation | Description | Recipient |

|---|---|---|

| Property Reporting | Reporting any assets, funds, or property held for a sanctioned person. | RCMP / CSIS |

| Monthly Filing | Financial institutions must report monthly on whether they hold any frozen assets. | Respective Regulator (e.g., OSFI) |

| Suspicious Transactions | Reporting transactions where there are reasonable grounds to suspect money laundering or sanctions evasion. | FINTRAC |

| Duty to Disclose | Any knowledge of a transaction or proposed transaction related to sanctioned property. | Global Affairs Canada |

How is due diligence conducted for cross-border mergers and acquisitions?

Due diligence for cross-border M&A involves a deep dive into the target company's historical trade data, customer lists, and international partnerships to ensure they have not violated Canadian or international sanctions. In Canada, a buyer can inherit the "successor liability" of the target company, meaning you could be held responsible for the target's past compliance failures once the deal closes.

To manage this risk, the acquiring firm must follow a structured investigative process:

- Review of Jurisdiction: Map out every country where the target company operates, has subsidiaries, or ships goods.

- End-User Verification: Audit the target's customer base to ensure no products were diverted to sanctioned regimes or "end-users of concern."

- Contractual Protections: Include specific "Representations and Warranties" in the purchase agreement stating the target is in full compliance with SEMA and the Export and Import Permits Act (EIPA).

- Permit Audit: Verify that all previous exports of "dual-use" items (goods with both civilian and military applications) were backed by valid permits from Global Affairs Canada.

- Sanctions Clauses: Ensure that the deal includes an indemnity clause to protect the buyer from fines or legal costs arising from the target's pre-acquisition conduct.

What are the legal consequences of facilitating sanctioned trade?

The legal consequences of facilitating sanctioned trade in Canada are severe and can include criminal records for executives, massive corporate fines, and the permanent loss of export privileges. Canada treats sanctions violations as "strict liability" or "public welfare" offenses, which makes it easier for the Crown to secure a conviction.

- Financial Penalties: Fines are not capped at a specific dollar amount for many offenses; they are at the discretion of the court and can exceed the total value of the prohibited trade.

- Imprisonment: Individuals, including company directors and officers who authorized or acquiesced in the violation, can face up to five years in prison per offense.

- Administrative Monetary Penalties (AMPs): The Canada Border Services Agency (CBSA) can issue immediate fines for paperwork errors or failure to report, even if no sanctions were actually violated.

- Asset Seizure: Under recent amendments to SEMA, the Canadian government has the power to seize and forfeit assets belonging to sanctioned individuals to compensate victims or assist in foreign reconstruction.

- Reputational Damage: Being named in a sanctions enforcement action can lead to "de-banking," where financial institutions refuse to provide services to your business due to the high risk.

Common Misconceptions About Canadian Sanctions

"If it is legal in the US, it is legal in Canada."

While Canada and the US are close allies, their sanctions lists are not identical. Canada may sanction individuals that the US does not, and vice versa. Furthermore, Canada has "blocking" legislation (the Foreign Extraterritorial Measures Act) that can actually prohibit Canadian companies from complying with certain US sanctions, particularly those regarding Cuba.

"We only sell consumer goods, so sanctions don't apply to us."

Sanctions target people and entities, not just products. Even if you are selling basic office supplies or food, if the recipient is a "Designated Person" under SEMA, the transaction is illegal. There are very few "humanitarian" exemptions, and most require a specific permit from the Minister of Foreign Affairs.

"I am not responsible for what my distributor does."

Canadian law prohibits "facilitating" a violation. If you sell products to a third-party distributor in a neutral country knowing (or being willfully blind to the fact) that they will re-export those goods to a sanctioned region, you can be held criminally liable in Canada.

Frequently Asked Questions

Can I get a permit to deal with a sanctioned entity?

Yes, you can apply for a "Ministerial Permit" or "Certificate" from Global Affairs Canada. However, these are rarely granted and are typically reserved for humanitarian aid, diplomatic activities, or the evacuation of Canadian citizens. The application process can take several months.

Does Canada recognize the US "SDN" list?

No, Canada does not automatically incorporate the US Specially Designated Nationals (SDN) list into Canadian law. However, most Canadian banks will refuse to process any transaction involving an SDN-listed person because of their own exposure to the US financial system.

What is a "Dual-Use" item?

Dual-use items are goods, software, or technology that can be used for both commercial and military purposes. Examples include high-end sensors, certain chemicals, or encryption software. These items often require an export permit even if the destination country is not under a general sanction.

How often is the Canadian sanctions list updated?

The list is updated frequently, often with no advance notice. In response to global conflicts, the Canadian government may add hundreds of names in a single week. Real-time monitoring is essential for compliance.

When to Hire a Lawyer

You should consult a Canadian trade lawyer if you are expanding into high-risk markets (such as Eastern Europe, the Middle East, or Southeast Asia) or if you discover a potential past violation. Legal counsel is also necessary when drafting "Sanctions and Anti-Corruption" clauses for international contracts or when responding to an inquiry from the CBSA or the RCMP. If you are involved in a merger or acquisition with a company that has significant international operations, a legal trade audit is a mandatory step in your due diligence.

Next Steps

- Audit Your Current Partners: Immediately screen your current client and vendor lists against the Consolidated Canadian Autonomous Sanctions List.

- Draft a Compliance Policy: If you do not have a written Internal Compliance Program, appoint a compliance officer and begin drafting one today.

- Review Export Classifications: Determine if your products fall under the Export Control List (ECL) by reviewing the technical specifications of your goods.

- Stay Informed: Subscribe to official government notices from Global Affairs Canada to receive updates on new sanctions regulations as they are announced.