- All legal entities registered in Greece must identify and register their Ultimate Beneficial Owners (UBOs) in the Central Register of Beneficial Owners (K.M.P.O.).

- A Beneficial Owner is defined as any natural person who ultimately owns or controls more than 25% of a company's shares or voting rights.

- Failure to comply results in a "block" on tax clearance certificates and administrative fines ranging from €10,000 to €100,000.

- Changes to ownership structure must be updated in the registry within 60 days of the modification.

- Foreign entities with Greek subsidiaries must provide a full audit trail of their ownership structure back to the final natural person.

Who qualifies as a Ultimate Beneficial Owner (UBO) under Greek Law 4557/2018?

Under Greek Law 4557/2018, an Ultimate Beneficial Owner is any natural person who ultimately owns or controls a legal entity through direct or indirect ownership. In most cases, this is defined as holding a percentage of shares or voting rights exceeding 25% of the total capital.

If no natural person meets the 25% threshold, or if there is doubt about whether the person with the controlling interest is the beneficial owner, the natural person(s) holding the position of senior management (e.g., CEO or Managing Director) must be registered as the UBO. The law distinguishes between two types of control:

- Direct Ownership: When a natural person holds more than 25% of the shares or ownership interest directly in the Greek company.

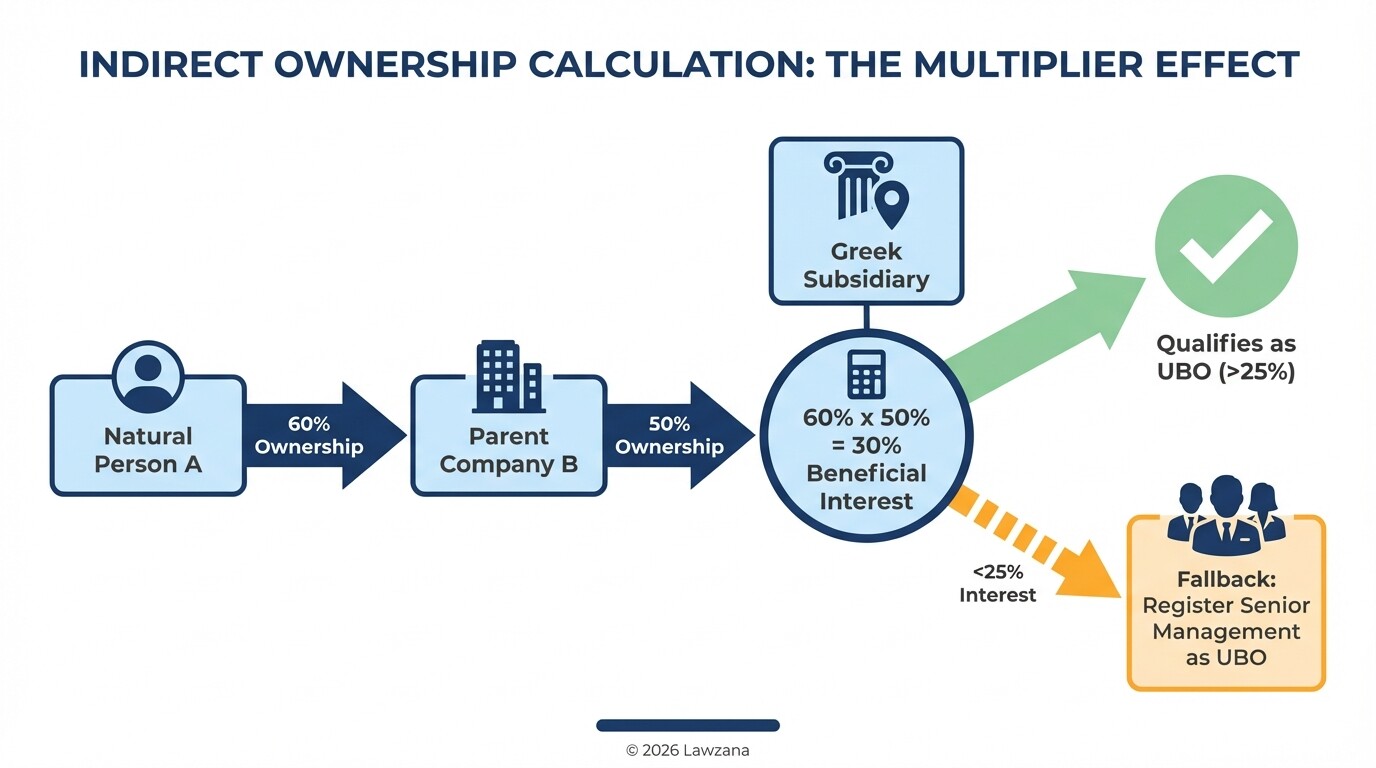

- Indirect Ownership: When a natural person holds more than 25% of the shares through one or more intermediate legal entities (e.g., holding companies).

In complex corporate structures, the "multiplier effect" is used to calculate indirect ownership. For example, if Person A owns 60% of Parent Company B, and Parent Company B owns 50% of Greek Subsidiary C, Person A is a UBO because their indirect interest is 30% (above the 25% threshold).

What are the registration deadlines for the Central Register of Beneficial Owners (K.M.P.O.)?

The Greek Central Register of Beneficial Owners (known locally as K.M.P.O.) requires that all new legal entities register their UBO information within 60 days of their establishment. Existing companies must ensure their data is kept current, with a mandatory 60-day window to report any changes to the ownership structure.

The registration process is handled electronically through the General Secretariat of Information Systems (GSIS) using the Taxisnet platform. The timeline for compliance is strictly enforced, and there is an annual "verification" period where companies must confirm that the data on record remains accurate.

| Action Item | Deadline |

|---|---|

| New Company Registration | Within 60 days of incorporation |

| Change in Ownership/Control | Within 60 days of the change |

| Annual Data Verification | Subject to annual ministerial decisions |

| Correction of Errors | Within 60 days of discovery |

How does the UBO registry apply to foreign-owned Greek subsidiaries?

Foreign entities operating through Greek subsidiaries are not exempt from UBO disclosure and must trace their ownership chain back to the ultimate natural person. The Greek registry requires specific documentation to prove the link between the Greek entity and its foreign parent company, often involving "chain of title" evidence.

For foreign-owned subsidiaries, the compliance process involves several administrative steps:

- Identify the Chain: Map out every legal entity between the Greek subsidiary and the final human owner.

- Documentary Evidence: Obtain certificates of incumbency or shareholder registers from foreign jurisdictions.

- Legalization: Any foreign documents must be officially translated into Greek and typically require an Apostille or consular legalization to be accepted by Greek authorities.

- Local Representation: The submission is usually performed by the legal representative of the Greek entity using their local tax credentials.

A common challenge for foreign entities is that the Greek system expects a "Natural Person" at the end of the chain. If the parent company is a publicly traded company on a regulated market, the disclosure requirements are slightly relaxed, but the entity must still prove its listed status.

What are the penalties for late or inaccurate UBO filings in Greece?

Greece imposes some of the strictest administrative penalties in the EU for non-compliance with UBO transparency rules. The primary consequence is the immediate suspension of the company's Tax Clearance Certificate, which prevents the business from selling property, participating in public tenders, or receiving state subsidies.

In addition to the suspension of tax services, the Independent Authority for Public Revenue (IAPR) can impose significant monetary fines:

- Immediate Fines: For failure to register or late registration, fines start at €10,000.

- Aggravated Fines: In cases of persistent non-compliance or deliberate misinformation, fines can reach €100,000.

- Operational Impact: Banks in Greece are legally required to verify UBO registry status during "Know Your Customer" (KYC) reviews; failure to comply can lead to the freezing of corporate bank accounts.

Who can access company ownership data in the Greek UBO Register?

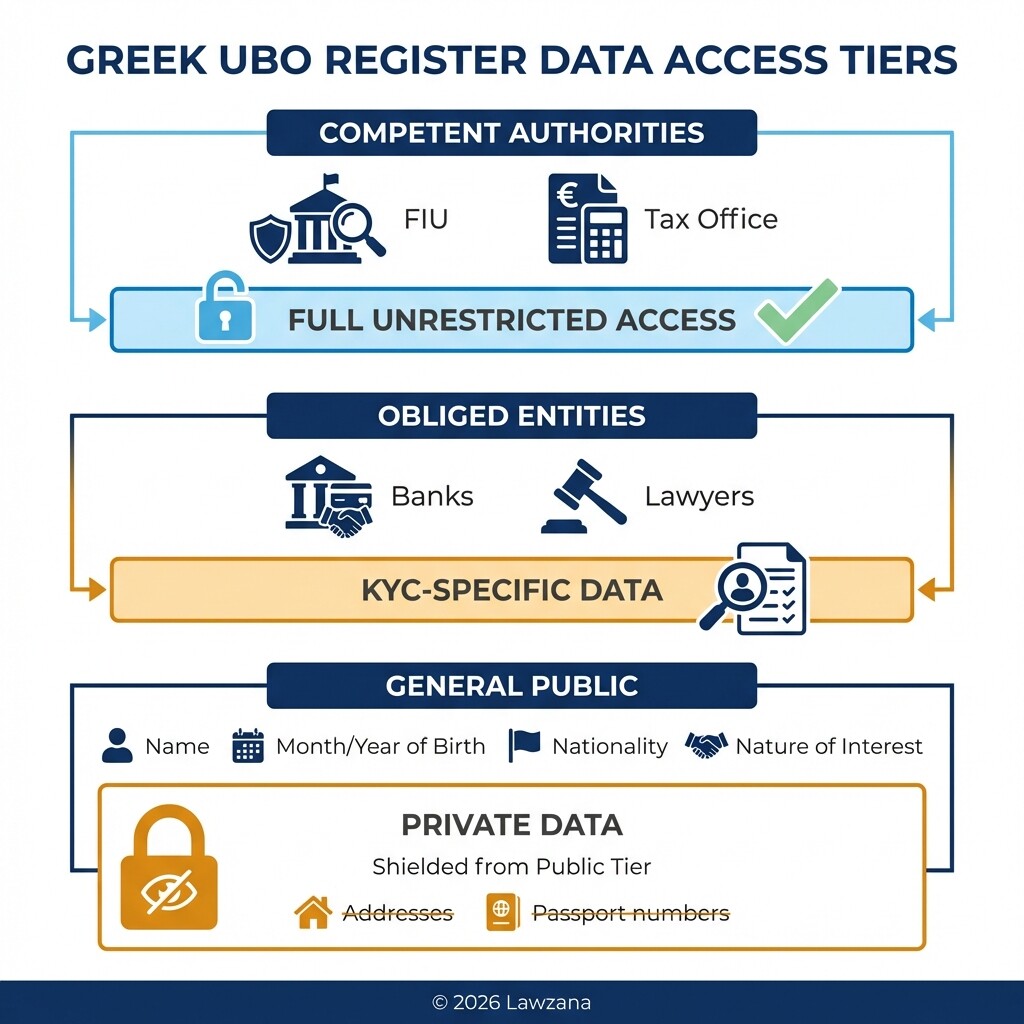

Access to the Greek UBO Register is divided into three tiers based on the level of authority and the sensitivity of the data. While the register aims for transparency, it balances this with privacy protections for the individuals involved.

The access tiers are structured as follows:

- Competent Authorities: The Hellenic Financial Intelligence Unit (FIU), the Bank of Greece, and tax authorities have full, unrestricted access to all data to investigate money laundering and tax evasion.

- Obliged Entities: Banks, law firms, and accountants have access to specific data points required for their mandatory due diligence (KYC) processes when taking on new clients.

- The General Public: Since 2021, the general public has limited access to the register. This includes the name, month and year of birth, nationality, and the nature/extent of the beneficial interest held by the UBO.

Personal data such as home addresses or passport numbers are generally shielded from public view unless the person requesting the data can prove a "legitimate interest" in a legal proceeding.

Common Misconceptions About Greek UBO Compliance

"We don't need to file because our parent company is in the USA"

This is a frequent mistake. Regardless of where the parent company is located-be it the US, UK, or Cayman Islands-if there is a registered legal entity (subsidiary or branch) in Greece, the UBO filing is mandatory. The Greek government does not grant exemptions based on the jurisdiction of the parent company.

"If no one owns more than 25%, we just leave it blank"

The registry can never be left blank. If no natural person meets the 25% ownership threshold through shares or voting rights, Greek law mandates that the senior management officials of the company (such as the Board of Directors or the Administrator) must be registered as the beneficial owners.

"Only the majority shareholder needs to be listed"

The law requires the disclosure of all natural persons who meet the criteria. If four individuals each own exactly 25% plus one share, all four must be registered. It is not sufficient to simply list the "primary" owner.

FAQ

Does the UBO registry apply to non-profit organizations in Greece?

Yes. Non-profits, foundations, and associations are required to register their beneficial owners. In these cases, the UBOs are usually the members of the board of directors or the individuals who control the distribution of the organization's funds.

How much does it cost to register a UBO in Greece?

There is no direct government fee for the electronic submission of UBO data via the GSIS portal. However, companies usually incur costs for legal advice, document translation, Apostille services for foreign documents, and professional accounting fees for the filing.

Can a UBO request to be hidden from the public register?

In exceptional circumstances, a UBO can apply for an exemption from public disclosure if such disclosure would expose them to a disproportionate risk of fraud, kidnapping, blackmail, or if the UBO is a minor. These exemptions are rare and require substantial evidence.

What documents do I need for a foreign shareholder?

For a foreign legal entity holding shares in a Greek company, you typically need a Certificate of Good Standing, a Certificate of Shareholders (or Incumbency), and a copy of the Articles of Association, all of which must be translated into Greek and Apostilled.

When to Hire a Lawyer

Compliance with the Greek Register of Beneficial Owners is more than just a clerical task; it is a significant regulatory requirement with heavy financial stakes. You should consult a Greek legal expert if:

- Your corporate structure involves multiple layers of foreign holding companies or discretionary trusts.

- You are unsure how to calculate "indirect control" under the multiplier effect.

- You have received a notice of non-compliance or a fine from the Greek tax authorities.

- You are undergoing a complex M&A transaction where ownership will change hands rapidly.

Next Steps

- Audit your structure: Identify every natural person who owns or controls more than 25% of your Greek entity.

- Collect documentation: Gather Apostilled and translated documents for all foreign entities in the ownership chain.

- Verify Taxisnet credentials: Ensure your Greek legal representative or accountant has active access to the GSIS portal.

- Submit the filing: Upload the UBO data within the 60-day window to avoid the suspension of your tax clearance.

- Set a reminder: Schedule an annual review to ensure your registered data remains consistent with your current shareholder ledger.