- A Representative Office (Ufficio di Rappresentanza) is restricted to promotional activities and has no separate legal personality or tax liability in Italy.

- A Branch (Sede Secondaria) acts as a permanent establishment, allowing the foreign parent company to conduct commercial transactions and generate revenue while maintaining full liability.

- Registration for both entities must be completed through the Italian Chamber of Commerce via the Economic and Administrative Index (REA).

- Branch offices are subject to Italian corporate income tax (IRES) and regional tax (IRAP), whereas representative offices generally are not.

- Foreign managers working in Italy must comply with local employment laws and may require specific work permits (Nulla Osta) depending on their citizenship.

What Are the Legal Personality Differences and Parent Company Liabilities?

An Italian representative office has no independent legal personality and is considered a mere cost center for the parent company, whereas a branch is an extension of the parent company that can conduct business but remains legally inseparable from it. In both cases, the foreign parent company retains 100% liability for all obligations, debts, and legal actions incurred by the Italian entity.

Because neither entity is a subsidiary (like an S.r.l.), there is no "corporate veil" to protect the parent company. Choosing between them depends on your intent to generate revenue:

- Representative Office: Limited to marketing, market research, or data collection. It cannot sign sales contracts or provide services to customers. If it begins performing commercial activities, it risks being reclassified by Italian tax authorities as a "hidden" permanent establishment.

- Branch: Can perform all commercial activities the parent company is authorized to do. It can enter into contracts, hire staff, and issue invoices. The parent company is responsible for the branch's financial commitments, including leases and employee salaries.

How Does Taxation Differ Between a Permanent Establishment and a Representative Office?

A branch is legally classified as a "Permanent Establishment" (PE) under Italian law and is subject to the same tax regime as domestic companies. A representative office is generally exempt from Italian corporate taxes because it does not generate income, provided its activities remain strictly auxiliary or preparatory.

Taxation of a Branch (Sede Secondaria)

A branch must maintain its own accounting records and file annual tax returns in Italy. It is subject to:

- IRES (Corporate Income Tax): Currently set at 24% on the net profit generated in Italy.

- IRAP (Regional Tax on Productive Activities): Generally around 3.9%, though it varies by region.

- VAT (IVA): The branch must obtain a VAT number and comply with Italian invoicing and filing requirements.

Taxation of a Representative Office (Ufficio di Rappresentanza)

A representative office does not pay IRES or IRAP because it has no taxable income. However, it must:

- Obtain a Tax Identification Number (Codice Fiscale).

- Comply with "Withholding Agent" duties if it hires local employees, meaning it must withhold and pay income taxes on behalf of its staff.

How Do You Register with the Economic and Administrative Index (REA)?

All foreign entities establishing a presence in Italy must register with the Economic and Administrative Index (REA) at the local Chamber of Commerce (Camera di Commercio). While a representative office only requires REA registration, a branch must also register with the Register of Companies (Registro delle Imprese), which involves a more rigorous legal process.

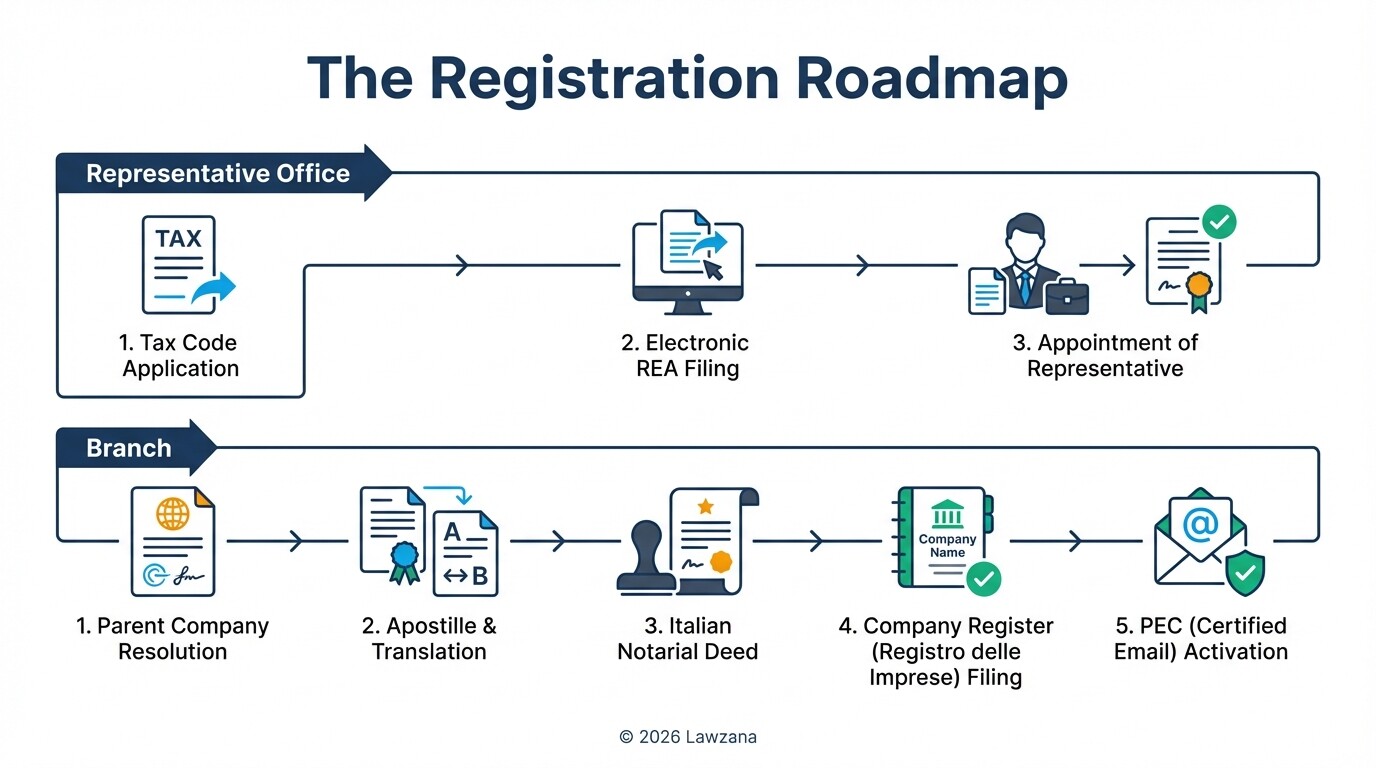

Steps for Registering a Representative Office

- Tax Code Acquisition: Apply for a fiscal code from the Agenzia delle Entrate.

- REA Submission: File the "Comunica" (Single Communication) electronically with the Chamber of Commerce in the province where the office is located.

- Appointment of a Representative: Designate a person in charge of the office (does not have to be an Italian resident).

Steps for Registering a Branch

- Board Resolution: The parent company must pass a formal resolution to open the branch and appoint a legal representative.

- Notarial Act: An Italian notary must certify the parent company's bylaws and the resolution (translated into Italian and apostilled).

- Company Register: The notary files the documents with the Registro delle Imprese.

- Certified Email (PEC): The branch must obtain a certified email address for all official communications.

What Are the Employment Law Implications for Foreign Managers?

Foreign managers working in Italy are subject to Italian labor laws, regardless of whether they work for a branch or a representative office. Italy's labor market is highly regulated, primarily governed by the Civil Code and National Collective Labor Agreements (CCNL), which mandate specific minimum wages, holidays, and termination procedures.

For foreign managers, the following rules apply:

- Social Security: Contributions must be paid to INPS (Social Security) and INAIL (Accident Insurance) unless a totalization agreement exists between Italy and the manager's home country.

- Work Permits: Non-EU managers usually require an intra-corporate transfer (ICT) permit or a "Blue Card" if they meet high-skill requirements.

- Mandatory Reporting: All employers must file a Unilav form with the Ministry of Labor whenever a new employee starts.

How Do Italian Corporate Governance and Reporting Requirements Compare?

The governance and reporting burden for a branch is significantly higher than that of a representative office because it must mirror the transparency of an Italian company. While a representative office simply reports its costs to the parent company, a branch must file its financial statements publicly in Italy.

Reporting Checklist for Branches

- Annual Financial Statements: The branch must file its annual accounts and the parent company's consolidated financial statements (translated into Italian) with the Register of Companies.

- VAT Ledger: Mandatory digital recording of all sales and purchase invoices.

- Corporate Books: Maintenance of a minute book for decisions made by the branch manager.

Reporting for Representative Offices

- No Financial Filings: There is no requirement to file annual accounts with the Chamber of Commerce.

- Expense Records: Must maintain records of expenses and payroll if local staff are employed.

Common Misconceptions About Italian Business Structures

Misconception 1: "A Representative Office is the easiest way to start selling in Italy."

This is false. A representative office is strictly prohibited from engaging in commercial sales. If you use it to sign contracts, the Italian Revenue Agency can audit the parent company, claim that a "de facto branch" exists, and levy heavy penalties and back taxes for all Italian revenue.

Misconception 2: "A Branch has limited liability because it is separate from the main office."

This is a dangerous misunderstanding. Unlike a subsidiary (S.r.l.), a branch is the same legal entity as the parent company. If the Italian branch is sued or defaults on a debt, the parent company's assets in its home country can be seized to satisfy the Italian obligation.

Summary Comparison: Representative Office vs. Branch

| Feature | Representative Office | Branch (Sede Secondaria) |

|---|---|---|

| Legal Personality | None | None (Extension of Parent) |

| Commercial Activity | Prohibited (Marketing only) | Permitted |

| Tax Liability | Generally None | IRES, IRAP, and VAT |

| Registration | REA only | Company Register & REA |

| Audit/Filing | None | Annual Financial Statements |

| Complexity | Low | Medium to High |

FAQs

Can a representative office hire employees in Italy?

Yes, a representative office can hire staff. It must obtain an Italian Tax Code and register with the social security (INPS) and insurance (INAIL) authorities. The parent company acts as the employer and is responsible for withholding income tax from the employees' paychecks.

How long does it take to set up a branch in Italy?

Setting up a branch typically takes 3 to 6 weeks. The timeline depends heavily on how quickly the parent company can provide apostilled and translated corporate documents and the availability of an Italian notary.

Does a branch need a local director who is an Italian resident?

No, the legal representative of an Italian branch does not need to be an Italian resident or citizen. However, they must obtain an Italian Tax Code (Codice Fiscale) and, if they are from a non-EU country, they may need a specific visa if they intend to reside in Italy to manage operations.

When to Hire a Lawyer

Navigating the Italian "Bureaucracy Jungle" requires precision to avoid costly tax audits. You should consult a lawyer if:

- You are unsure if your planned activities constitute "preparatory" work or "commercial" operations.

- You need to draft a power of attorney for a local representative.

- You are transferring non-EU managers and require assistance with "Nulla Osta" work permit applications.

- You need to coordinate with an Italian notary to translate and legalize foreign corporate bylaws.

Next Steps

- Define Your Goal: Determine if you need to generate revenue immediately (Branch) or simply test the market (Representative Office).

- Prepare Corporate Documents: Gather the parent company's Articles of Association and a Board Resolution, ensuring they are apostilled for use in Italy.

- Apply for Tax Codes: Obtain a Codice Fiscale for both the parent company and the designated Italian representative.

- Appoint a Notary: If opening a branch, engage an Italian notary to review your documents and manage the filing with the Register of Companies.

- Set Up Digital Infrastructure: Acquire a Certified Email (PEC) and a Digital Signature, which are mandatory for doing business in Italy.