In Nigeria, consumers often face challenges ranging from defective electronics to unfair banking charges. While suing a multi-billion naira corporation individually may seem daunting, Nigerian law provides a pathway for collective justice through representative actions, commonly known as class actions.

When are group or representative actions possible in Nigeria?

A group action is possible in Nigeria whenever several people have the same interest in a legal proceeding. This typically occurs when a single act or omission by a company-such as a mass data breach, a widespread telecommunications glitch, or the distribution of contaminated food-affects a large number of consumers in the same way.

Under the High Court Rules of various states (like Lagos and Abuja) and the Federal High Court, one or more persons may sue on behalf of a larger group. This mechanism is designed to save time and prevent the court from hearing hundreds of identical cases. For a representative action to be valid, the "class" must be clearly defined, and the lead plaintiffs must show that they suffered the same type of harm as the people they represent.

Common scenarios for group claims in Nigeria include:

- Banking and Finance: Excessive or unauthorized stamp duty charges or hidden maintenance fees applied to thousands of accounts.

- Product Liability: Defective batches of drugs or consumer goods that cause illness or injury across a region.

- Telecommunications: Systematic overcharging for data or drop-call rates that violate service level agreements.

- Real Estate: Mass delays in the delivery of housing units in large-scale developmental projects.

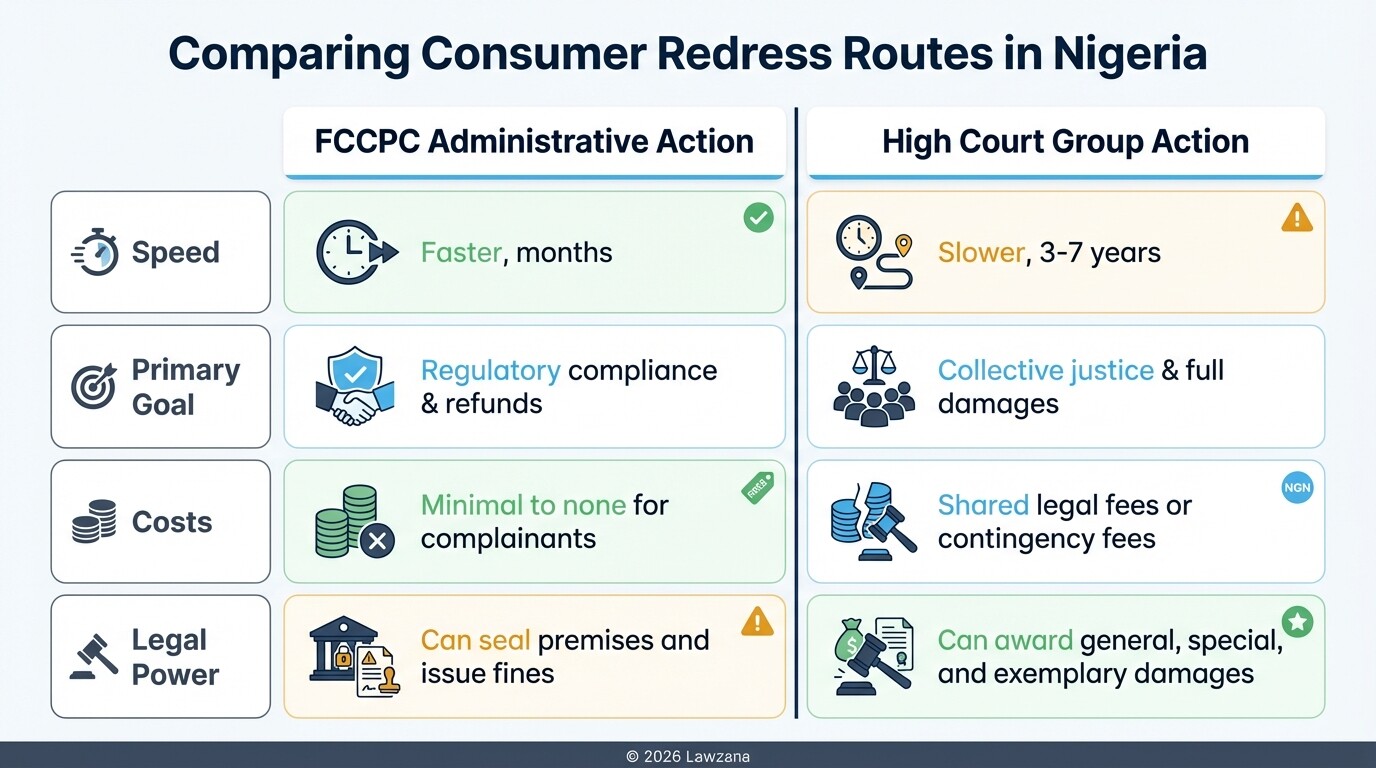

How long does a representative action typically take in Nigeria? While timelines vary by jurisdiction, complex group actions in Nigerian courts can take between three to seven years to reach a final judgment, though settlements often occur sooner.

How do you qualify to join an existing consumer lawsuit?

To qualify for a group claim in Nigeria, you must demonstrate that your legal grievance is identical to that of the named plaintiffs. You do not always need to sign a contract at the start; however, you must fall within the "class description" defined in the court processes, such as "all customers who purchased Product X between January and June 2023."

Nigeria primarily operates on an "opt-in" or "defined class" basis. This means that while a judgment can technically cover all affected parties, you usually need to identify yourself to the lead lawyers or the court to benefit from a specific financial payout. If a lawyer has already filed a representative suit, you can apply to be joined as a party or simply monitor the case if your interests are already being adequately represented by the lead plaintiff.

To verify your eligibility, you should check for the following:

- Shared Fact Pattern: Did the same event or product cause your loss?

- Common Legal Issue: Is the company being sued for a specific breach of the FCCPA or a contract?

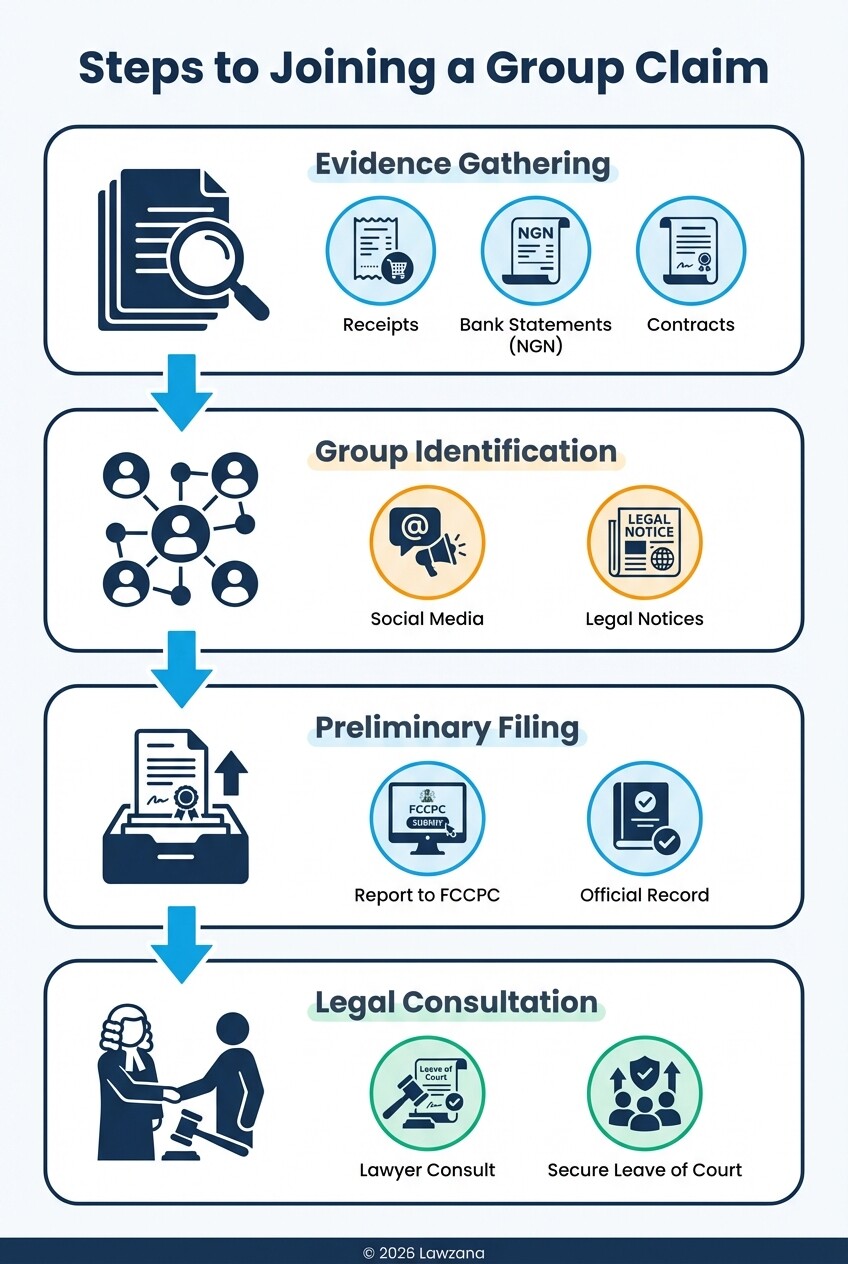

- Evidence of Transaction: Do you have receipts, bank statements, or digital logs proving you were a customer during the relevant period?

What happens if I don't know a lawsuit has been filed? Courts often require lead plaintiffs to publish a "Notice of Action" in national newspapers (like The Guardian or ThisDay) to inform potential class members of their right to join or opt-out.

What is the role of the FCCPC and other regulators in consumer claims?

The Federal Competition and Consumer Protection Commission (FCCPC) serves as the primary government body responsible for protecting consumer rights and can initiate collective redress without the traditional delays of court. Under the FCCPA 2018, the Commission has the power to investigate complaints, seal premises, and order companies to compensate affected groups of consumers directly.

In many cases, the FCCPC acts as a faster alternative to a lawsuit. If the Commission finds a company has violated consumer rights, it can impose heavy fines and mandate a "Consent Order," which outlines how the company must refund or compensate all affected customers. Other sector-specific regulators, such as the Nigerian Communications Commission (NCC) or the Central Bank of Nigeria (CBN), also handle group complaints regarding service failures in their respective industries.

Key functions of the FCCPC include:

- Mediation: Facilitating settlements between aggrieved groups and corporations.

- Administrative Redress: Issuing orders for refunds or replacements that are legally binding.

- Public Interest Litigation: The FCCPC can sue companies on behalf of the Nigerian public to seek compensation for mass wrongs.

Can I sue a company if the FCCPC is already investigating them? Yes, but it is often strategic to wait for the FCCPC's findings, as their report can be used as powerful evidence in your court case.

What compensation can you recover through group actions in Nigeria?

Compensation in Nigerian consumer actions is generally designed to restore the victims to the position they were in before the harm occurred. This usually translates to "Special Damages," which are quantifiable losses like the exact price of a faulty car or the total sum of illegal bank deductions, and "General Damages" for emotional distress or inconvenience.

In a successful group claim, the court may award a lump sum to be distributed among all class members based on their individual losses. It is also common for Nigerian courts to grant "Injunctions," which are orders forcing a company to stop a specific bad practice immediately. In rare cases involving gross negligence or extreme corporate misconduct, "Exemplary Damages" may be awarded to punish the company and deter others.

Potential recovery items include:

- Full Refunds: Returning the purchase price of defective products.

- Repair or Replacement: Forcing the manufacturer to fix the issue at no cost to the group.

- Interest: Compensation for the time your money was unlawfully held by a service provider.

- Legal Costs: The court may order the losing company to pay the legal fees incurred by the group.

Is there a limit on how much a consumer can receive in Nigeria? There is no statutory "cap" on damages under the FCCPA; the amount is determined by the actual evidence of loss presented to the court or regulator.

Why is consulting a Nigerian class action lawyer essential?

Navigating the Nigerian judicial system for a group claim is procedurally intense and requires strict adherence to the "Rules of Court." A lawyer specialized in consumer litigation is necessary to obtain "Leave of Court" to sue in a representative capacity-a step where many self-represented groups fail. Without this formal permission, a judge may strike out the entire case, regardless of how valid the complaints are.

Furthermore, a lawyer manages the complex task of "Class Certification." This involves proving to the judge that the group is too large to sue individually but shares enough in common to be handled as one unit. Attorneys also handle the high-stakes negotiations with corporate legal teams, ensuring that any settlement offer is fair to all members of the group, not just the lead plaintiffs.

Professional legal counsel provides:

- Strategic Advice: Deciding whether to file in the State High Court, Federal High Court, or through the FCCPC.

- Evidence Management: Organizing testimony and documents from hundreds of consumers into a single, cohesive case.

- Cost Sharing: Helping the group structure an agreement to share legal fees, making justice affordable for everyone.

Common Misconceptions About Group Claims in Nigeria

Myth 1: "I have to pay a fortune to join a class action." Reality: In many consumer group actions, lawyers work on a "contingency fee" basis or an "uplift" arrangement, where they only get paid if the case is won. Even if fees are required upfront, they are divided among all participants, making it much cheaper than a private lawsuit.

Myth 2: "If the lead plaintiff loses, I can still sue individually later." Reality: Generally, if a representative action is decided on its merits, the judgment is binding on all members of the class. If the case is lost, you may be barred from filing the same claim again under the doctrine of res judicata.

FAQs

How do I find out if there is an ongoing class action against a Nigerian company?

You can monitor the "Legal Notices" section of major daily newspapers or check the Federal High Court of Nigeria cause lists. Many consumer advocacy groups also post updates on social media regarding pending representative suits.

Can non-Nigerian citizens join a group claim in Nigeria?

Yes, as long as the transaction or the harm occurred within Nigerian territory. If you bought a defective product in Lagos or used a Nigerian banking app while abroad, you are protected by the FCCPA.

How long do I have to join a lawsuit after being harmed?

In Nigeria, the Statute of Limitations for most contract and tort claims is six years. However, for claims against government agencies, the window is often much shorter (usually three months). It is best to take action as soon as the harm is discovered.

When to Hire a Lawyer

You should consult a Nigerian litigation attorney if:

- You and several colleagues or neighbors have been harmed by the same company.

- You have received a notice that a representative action has been filed and need to understand your rights.

- A company has ignored your individual complaint, and you want to organize other victims for a collective claim.

- You need to challenge a "settlement" that you believe does not adequately cover your losses.

Next Steps

- Gather Evidence: Collect all receipts, contracts, emails, and photos related to the consumer issue.

- Identify Others: Use social media or community forums to find other people who have faced the same problem with the same company.

- File a Preliminary Complaint: Report the issue to the FCCPC to create an official record of the grievance.

- Consult Counsel: Speak with a lawyer experienced in High Court representative actions to evaluate if your group meets the requirements for a class suit.