- South Africa practices "Freedom of Testation," allowing you to distribute your assets to anyone you choose, regardless of the "forced heirship" laws in your home country.

- A separate South African will is the most efficient way to manage local immovable property and prevents administrative delays at the Master of the High Court.

- Executor fees are legally capped at 3.5% (plus VAT) of the gross asset value, though these can often be negotiated for larger estates.

- Non-residents are subject to Capital Gains Tax (CGT) on South African real estate, with significant tax residency changes expected to impact offshore beneficiaries by 2026.

- Repatriating inheritance funds out of South Africa requires a Tax Compliance Status (TCS) pin from the South African Revenue Service (SARS).

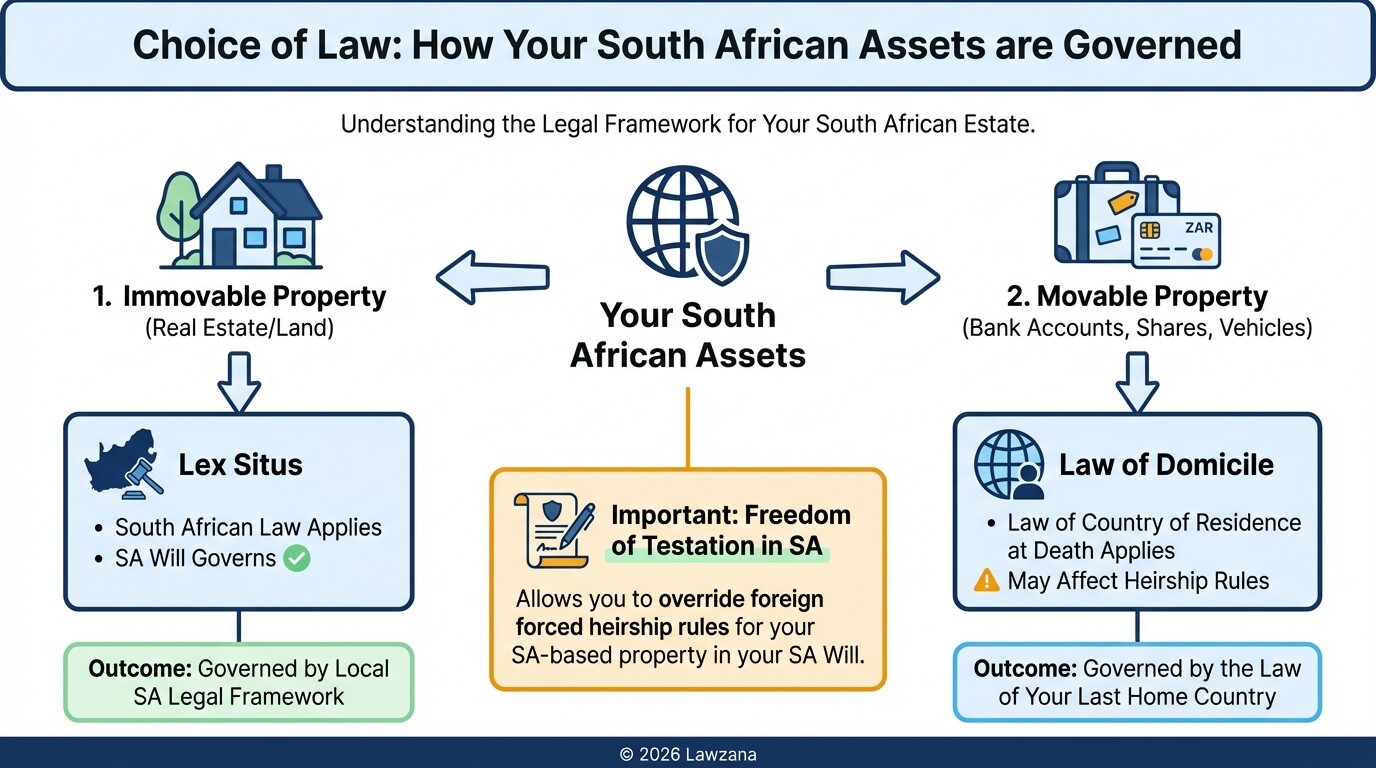

How Freedom of Testation Interacts With Foreign Heirship Rules

South Africa follows the principle of absolute freedom of testation, which means a testator can leave their estate to whomever they wish. Unlike many European or Islamic jurisdictions that mandate "forced heirship" for spouses or children, South African law respects the written will above all else, provided it does not contravene public policy.

For foreigners, this creates a "choice of law" scenario. While your home country might require you to leave 25% of your wealth to your children, South African courts will generally apply the law of the "lex situs" (the law of the place where the property is located) for immovable property. This means your South African vacation home or investment apartment will be distributed according to your South African will, potentially bypassing the mandatory rules of your home jurisdiction.

- Immovable Property: Governed by South African law (Lex Situs).

- Movable Property: Generally governed by the law of the country where the deceased was domiciled at the time of death.

- The Conflict: If a foreign court orders a specific distribution that contradicts a South African will regarding SA-based land, the South African executor must follow the SA will and local statutes.

International Estate Planning Checklist for South Africa

Properly structuring an estate with cross-border elements requires specific documentation to ensure the Master of the High Court recognizes your wishes. Use this checklist to audit your current estate plan if you hold assets in South Africa.

- Draft a "Concurrent" South African Will: Ensure this document specifically states it only governs assets located within the Republic of South Africa.

- Include a "Revocation Clause" Exception: Ensure your South African will does not accidentally revoke your foreign will (and vice versa).

- Nominate a Local Agent: If your executor is a non-resident, the Master of the High Court may require them to appoint a local "agent" or attorney to administer the estate.

- Identify "Situs" Assets: List all immovable property, shares in local companies, and bank accounts held with South African institutions.

- Verify Marital Regime: If you were married in a foreign country without an Ante-Nuptial Contract (ANC), South Africa may view your marriage as being "in community of property," which entitles your spouse to 50% of your SA assets regardless of your will.

- Secure "Letters of Executorship": Prepare your heirs for the fact that foreign "Probate" or "Letters of Representation" are not automatically valid; they must be "sealed" or re-issued by the South African Master.

Why a Foreign Will Might Be Invalid for South African Property

While South Africa recognizes the validity of foreign wills under Section 3bis of the Wills Act 7 of 1953, using one for local property often leads to months or years of delays. The Master of the High Court requires an "authenticated" or "apostilled" copy of the foreign will, along with formal translations if it is not in English.

The most common reason for invalidity or "failed" administration is the lack of specific South African formalities. If a foreign will is signed without two witnesses present at the same time, or if the witnesses are also beneficiaries, it may be contested or rejected. Furthermore, a foreign executor who is not resident in South Africa may be required to provide "security" (a bond of security from an insurance company) to the Master, which is costly and difficult for non-residents to obtain.

Cost Estimates for Winding Up a Deceased Estate

Winding up an estate in South Africa involves several statutory costs and professional fees. For foreigners, these costs are often higher due to the need for international couriers, document authentication, and specialized tax clearances.

| Expense Type | Estimated Cost (ZAR) | Notes |

|---|---|---|

| Executor Fees | Max 3.5% of gross assets | Statutory cap; plus 15% VAT. |

| Master's Fees | Up to R7,000 | Capped at a maximum amount based on estate value. |

| Conveyancing Fees | Sliding scale (e.g., R30k+ for R2m property) | Required for transferring real estate to heirs. |

| Valuation Fees | R2,500 - R10,000+ | Needed for "Fair Market Value" for SARS. |

| Advertising Costs | R1,500 - R2,500 | Required notices in the Government Gazette and local press. |

| Postage & Petties | R1,000 - R5,000 | Higher for international beneficiaries. |

2026 Updates: Capital Gains Tax (CGT) for Non-Resident Inheritances

As we move toward 2026, the South African Revenue Service (SARS) has significantly tightened the "Exit Tax" and CGT requirements for non-residents. While inheritance itself is not taxed as "income," the estate is liable for CGT on the "deemed sale" of assets at the time of death.

Non-residents are particularly vulnerable because they do not benefit from the same primary residence exclusions that residents enjoy. By 2026, the integration of the "Three Year Rule" for tax residency means that even if you have lived abroad for years, your South African property remains firmly within the CGT net at a high effective rate (up to 18% for individuals). Heirs should be prepared for the estate to pay this tax before any funds are distributed or property is transferred.

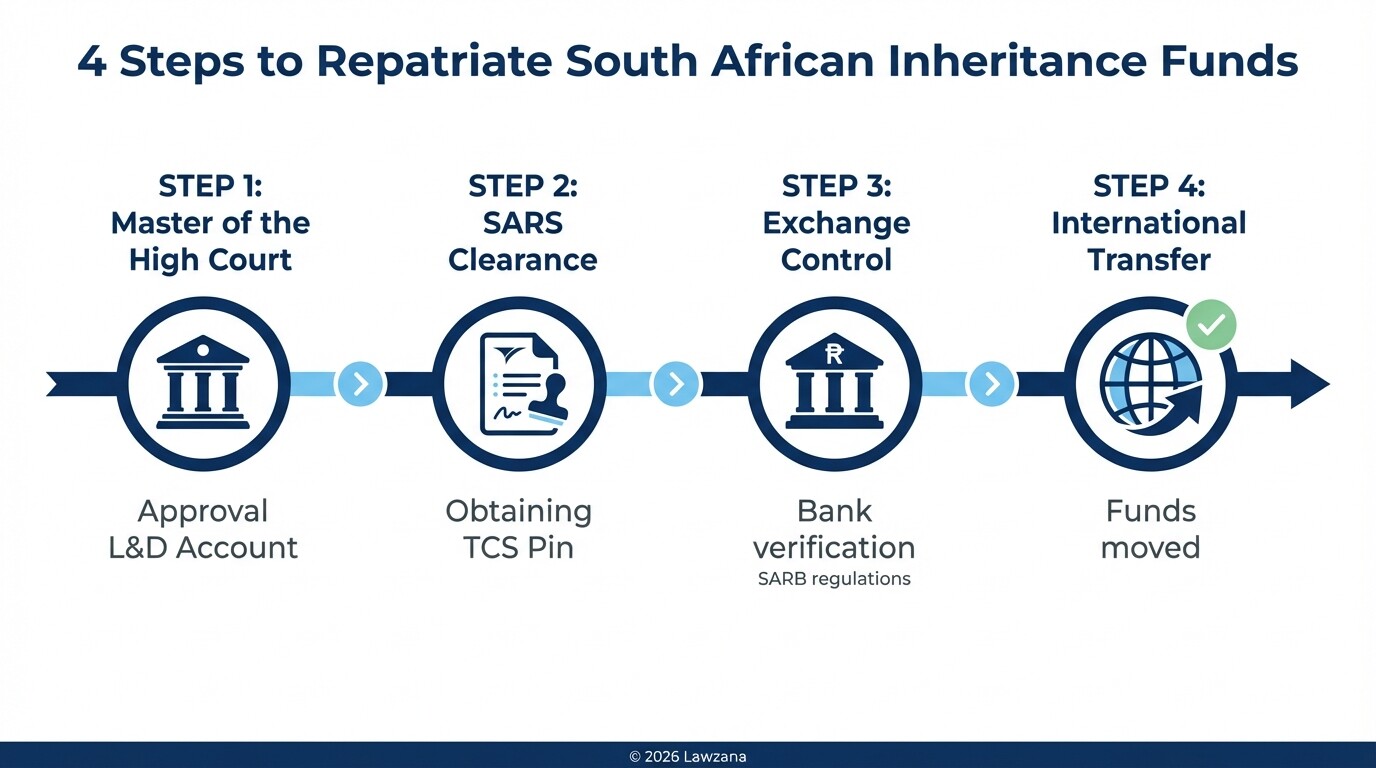

Regulatory Process for Repatriating Inheritance Funds

Inheriting money in South Africa is one thing; getting it into a foreign bank account is another. The South African Reserve Bank (SARB) and SARS control the flow of capital out of the country through strict Exchange Control Regulations.

To repatriate funds, the executor must first obtain a "Liquidation and Distribution Account" approved by the Master of the High Court. Once the "clearance certificate" is issued, the non-resident beneficiary must apply for a Tax Compliance Status (TCS) pin from SARS under the "International Transfer" category. This requires proving that the estate has paid all local taxes and that the funds are legitimate inheritance. Without this digital approval, South African banks are legally prohibited from transferring the currency abroad.

Common Misconceptions About South African Inheritance

"My foreign will covers everything globally, so I don't need a South African one." This is the most dangerous myth. While legally possible, the administrative hurdle of "proving" a foreign will to the South African Master of the High Court can take 12 to 24 months. A local "concurrent" will allows the local estate to be processed independently and much faster.

"There is no 'Inheritance Tax' in South Africa." Technically true for the beneficiary, but false for the estate. South Africa levies "Estate Duty" at a rate of 20% on the portion of the estate above R3.5 million. While there are rebates for spouses, non-resident heirs often find the estate value significantly diminished by this tax before they receive their share.

"I can just sell the inherited house and wire the money to my home country." You cannot. The transfer of the property to the heir (or the sale by the executor) must be recorded in the Deeds Office, and the resulting cash is "blocked" until SARS issues a Tax Compliance Status pin for the repatriation of those specific funds.

FAQs

Can a non-resident be an executor of a South African estate?

Yes, but it is impractical. The Master of the High Court usually requires a non-resident executor to appoint a South African-based attorney or trust company as their "agent" to handle the local paperwork and provide the necessary security.

Does South Africa have a "Death Tax"?

South Africa calls it "Estate Duty." It is charged at 20% on estates valued up to R30 million, and 25% on anything above that. There is a standard abatement (deduction) of R3.5 million per person.

How long does it take to wind up an estate for a foreigner?

A simple estate with a local will typically takes 12 to 18 months. If there is only a foreign will, or if there are disputes regarding "forced heirship" from the home country, the process can extend to 3 years or more.

When to Hire a Lawyer

Navigating South African inheritance law is complex for foreigners due to the intersection of the Wills Act and Exchange Control Regulations. You should consult a South African litigation or estate attorney if:

- You own "immovable property" (real estate) in South Africa but do not have a local will.

- You are an heir to a South African estate and the executor is demanding "security" or is unresponsive.

- You need to repatriate a large inheritance and are facing hurdles with SARS or the Reserve Bank.

- Your home country has "forced heirship" rules that conflict with the deceased's South African will.

Next Steps

- Audit your assets: Create a list of all South African bank accounts, shares, and properties.

- Draft a Concurrent Will: Contact a South African legal professional to draft a "South Africa Only" will to sit alongside your international estate plan.

- Appoint a Local Professional: Ensure your will nominates an executor or agent who understands the Master of the High Court's specific requirements for non-residents.

- Notify your Heirs: Inform your beneficiaries about the "Tax Compliance Status" process so they are prepared for the regulatory requirements of moving funds abroad.