Being sued by a customer is a stressful milestone for any South African business owner, but it does not have to be catastrophic. Whether the dispute arises from a defective product or a service disagreement, the way you respond in the first 10 days will largely determine the financial and reputational outcome for your company.

What are the typical customer claims against businesses in South Africa?

Most customer claims against South African businesses are based on either the Consumer Protection Act (CPA), a breach of contract, or delictual liability (negligence). Under the CPA, customers have a right to receive goods that are of good quality, in good working order, and free of defects, while services must be performed in a timely and professional manner.

Typical claims include:

- Refund or Repair Requests: Under Section 56 of the CPA, customers have an implied warranty of quality for six months, allowing them to choose a repair, replacement, or refund if the goods are defective.

- Personal Injury or Property Damage: Section 61 of the CPA introduces "strict liability," meaning a producer, importer, or retailer can be held liable for harm caused by unsafe or defective products without the customer needing to prove negligence.

- Breach of Contract: Claims where the business failed to meet specific terms outlined in a signed Service Level Agreement (SLA) or purchase order.

- Professional Negligence: Common in service-based industries where a professional (like an accountant or engineer) fails to meet the expected standard of care.

How long does a customer have to sue a business?

In most cases, the Prescription Act 68 of 1969 dictates that a debt or claim expires three years from the date the debt became due or the date the customer became aware of the issue.

What is the difference between a refund and a claim for damages?

A refund returns the purchase price to the customer, while a claim for damages seeks additional compensation for losses the customer suffered as a result of the product failure, such as medical bills or lost income.

What steps should you take after receiving a letter of demand or summons?

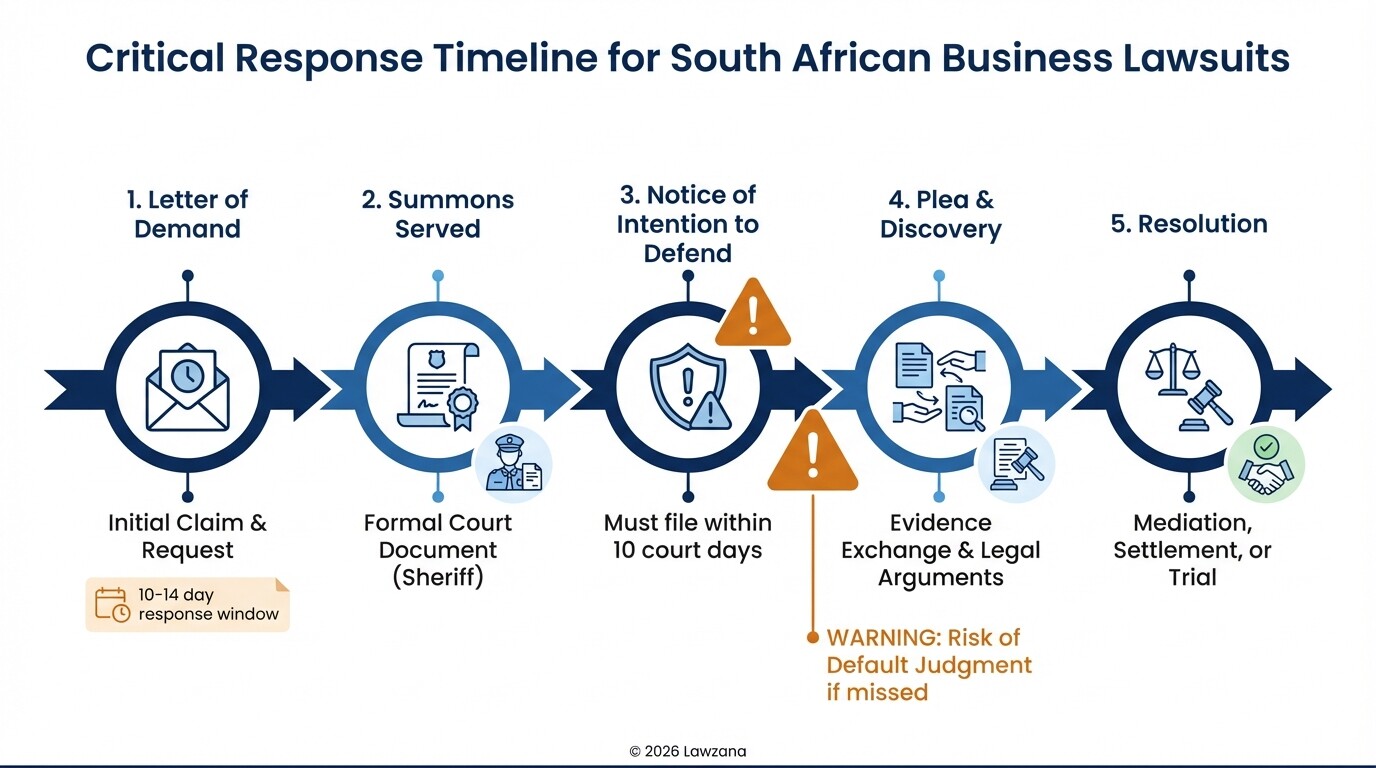

Upon receiving a formal Letter of Demand or a Summons, you must immediately document the date and method of delivery to calculate your deadline for a response. A Letter of Demand is a preliminary warning, while a Summons is a formal court document served by a Sheriff that initiates a lawsuit.

If you receive these documents, follow this process:

- Verify the Service: Ensure the document was served correctly. A summons must be served by a Sheriff of the Court, whereas a Letter of Demand is usually sent via registered mail or email.

- Review the Allegations: Carefully read the "Particulars of Claim" to understand exactly what the customer is claiming and what evidence they are citing.

- Notify Your Insurer: If you have professional indemnity or public liability insurance, notify your broker immediately, as late notification can result in a rejected claim.

- Appoint a Litigation Lawyer: For claims in the Magistrate's or High Court, a lawyer is essential to draft a "Notice of Intention to Defend" within 10 court days of receiving the summons.

What happens if I ignore a summons?

If you do not file a Notice of Intention to Defend within the 10-day window, the plaintiff can apply for a Default Judgment. This allows the court to rule in the customer's favor without you ever presenting your side, potentially leading to the Sheriff seizing your business assets.

Can I resolve the matter after receiving a Letter of Demand?

Yes, the Letter of Demand is designed to encourage settlement. You can respond with a "without prejudice" offer to settle, which allows you to negotiate a resolution without admitting liability in court later.

How do you assess the strength of a claim and available defenses?

Assessing a claim requires a critical look at both the facts and the South African legal statutes that apply to the specific industry. You must determine if the customer followed the correct procedures and whether your business is actually the party responsible for the alleged harm.

Key defenses often include:

- Contributory Negligence: Arguing that the customer's own actions or misuse of the product contributed to the damage or injury.

- Compliance with Standards: Proving that the product or service met the required safety standards set by the South African Bureau of Standards (SABS).

- The "As Is" Defense (Voetstoots): While largely abolished for most consumer transactions by the CPA, it may still apply in certain private sales or specific B2B contexts.

- Failure to Mitigate Loss: Arguing that the customer failed to take reasonable steps to minimize their damages after the problem occurred.

Does the CPA apply to every business?

The CPA does not apply if the customer is a juristic person (a company, trust, or partnership) with an annual turnover or asset value exceeding R2 million at the time of the transaction.

Can an indemnity clause protect my business?

While indemnity clauses (disclaimers) are legal, Section 48 of the CPA prevents businesses from using "unfair, unreasonable, or unjust" terms. A court may strike down a disclaimer if it is not clearly drawn to the consumer's attention or if it attempts to waive liability for gross negligence.

Should your business settle, use mediation, or go to court?

The decision to fight a claim in court versus settling depends on the financial amount at stake and the potential for a negative legal precedent. In South Africa, litigation is expensive and time-consuming, leading many businesses to favor Alternative Dispute Resolution (ADR).

Consider these options:

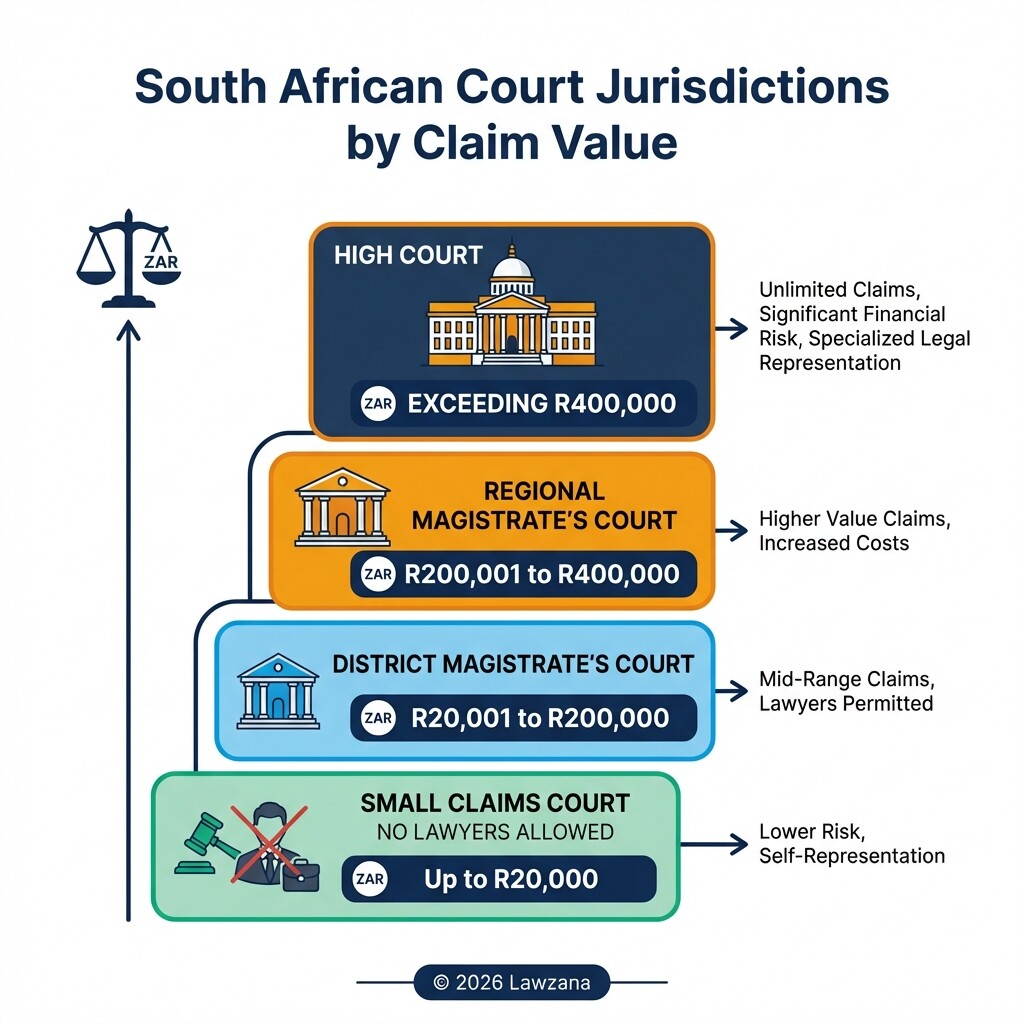

- Small Claims Court: If the claim is for R20,000 or less, the matter will likely go here. It is fast and lawyers are not allowed to represent you, though you should still consult one to prepare your defense.

- Mediation: Under Rule 41A of the High Court, parties are now required to consider mediation before proceeding with litigation. This is a private, confidential process that can save significant costs.

- National Consumer Commission (NCC): If a customer complains to the National Consumer Commission, they may facilitate an investigation or refer the matter to the National Consumer Tribunal (NCT), which can be cheaper than court.

- Litigation: If the claim involves complex legal issues or large sums (exceeding R400,000, usually handled in the High Court), formal litigation may be necessary to protect your interests.

| Dispute Method | Cost | Duration | Binding? |

|---|---|---|---|

| Small Claims Court | Very Low | 1-3 Months | Yes |

| Mediation | Moderate | 1-2 Days | If agreed upon |

| Magistrate's Court | High | 12-24 Months | Yes |

| High Court | Very High | 24+ Months | Yes |

Is mediation better than court for a business?

Mediation is generally better for businesses because it is confidential, preventing a public record of the dispute that could damage your brand's reputation.

How much are the legal costs if I lose?

If you lose in a South African court, you are typically ordered to pay the other party's legal costs on a "party and party" scale, which usually covers about 50-70% of their actual legal expenses.

How can a South African business reduce future legal risk?

Proactive risk management is the most effective way to avoid the South African courts. This involves aligning your internal processes with the Consumer Protection Act and ensuring your contracts are legally sound.

Implement these risk-reduction strategies:

- CPA-Compliant Contracts: Have a lawyer review your Terms and Conditions to ensure they do not contain prohibited clauses under Section 48 of the CPA.

- Clear Communication: Ensure all staff are trained on what they can and cannot promise customers. Misleading representations are a major source of CPA claims.

- Documented Quality Control: Keep meticulous records of product testing, service delivery logs, and customer complaints to use as evidence if a dispute arises.

- Mandatory ADR Clauses: Include a clause in your contracts that requires the parties to attempt mediation or arbitration before filing a lawsuit.

Should I use a generic "No Refunds" sign?

No. Under the CPA, "No Refund" policies are generally illegal if the product is defective. Using such signs can actually lead to fines from the National Consumer Commission.

What insurance is mandatory for South African businesses?

While not all insurance is legally mandatory, Public Liability insurance and Professional Indemnity insurance are highly recommended to cover the costs of legal defense and potential settlements.

Common Misconceptions About Being Sued in South Africa

Myth 1: "If I have a signed disclaimer, I am 100% protected." In South Africa, the CPA overrides many disclaimers. If a court finds a disclaimer was not clearly brought to the consumer's attention (e.g., in bold or on the front page), it may be ruled invalid. Furthermore, you cannot contract out of "gross negligence."

Myth 2: "I can just close my PTY Ltd and start a new company to avoid the lawsuit." While a company is a separate legal entity, South African courts can "pierce the corporate veil" if they find the directors are using the company to commit fraud or avoid legal obligations. Directors can be held personally liable in such cases.

Myth 3: "The customer has to prove I was negligent to win a CPA claim." For product liability under Section 61, the customer does not have to prove you were negligent. They only need to prove the product was defective and that the defect caused them harm. This is known as "strict liability."

FAQ

What is the maximum amount a customer can sue for in the Small Claims Court?

As of current regulations, the limit for the Small Claims Court is R20,000. For claims between R20,001 and R200,000, the District Magistrate's Court is the appropriate forum, while the Regional Magistrate's Court handles claims up to R400,000.

Can a customer sue me if they didn't have a written contract?

Yes. In South Africa, verbal contracts are legally binding, although they are harder to prove. Furthermore, the Consumer Protection Act applies to the "transaction" and the "supply of goods," regardless of whether a formal written contract was signed.

Does the National Consumer Commission (NCC) provide lawyers?

The National Consumer Commission does not provide lawyers for either party. They act as a regulatory body that investigates complaints and may refer matters to the National Consumer Tribunal for a ruling.

When to Hire a Lawyer

You should consult a South African litigation lawyer if:

- You have been served with a Summons from a Magistrate's or High Court.

- The claim involves a complex interpretation of the Consumer Protection Act.

- The financial value of the claim is high enough to threaten your business's cash flow.

- The customer is claiming for personal injury or long-term health complications.

- You want to draft or update your Terms and Conditions to prevent future litigation.

Next Steps

- Secure your evidence: Gather all invoices, emails, and product logs related to the customer in question.

- Review your insurance policy: Check if your "Legal Expenses" or "Professional Indemnity" cover applies.

- Draft a formal response: If you have received a Letter of Demand, reply within the deadline, preferably via your legal counsel, to state your position.

- Audit your contracts: Ensure your current client agreements are compliant with the latest South African consumer laws to prevent a repeat of the situation.