For many business owners in India, the mounting pressure of unpaid loans can feel like an inevitable slide toward the National Company Law Tribunal (NCLT). However, business debt restructuring offers a critical window to renegotiate terms with creditors, adjust repayment schedules, and protect your assets before a formal insolvency filing under the Insolvency and Bankruptcy Code (IBC) becomes necessary.

What are the warning signs that an Indian business should start planning a debt restructure?

A business should begin debt restructuring the moment it identifies a structural mismatch between its cash flow and its debt service obligations. Indicators include frequent utilization of the maximum limit of working capital, devolvement of Letters of Credit, and the inability to pay interest for two consecutive months.

In India, the transition from a "Standard" asset to a "Non-Performing Asset" (NPA) happens quickly, and proactive restructuring is the only way to prevent a credit freeze. Watch for these specific red flags:

- DSCR Below 1.25: A Debt Service Coverage Ratio (DSCR) falling below 1.25 suggests the business is barely generating enough profit to cover its interest and principal payments.

- Statutory Default: Delaying payments for GST, Provident Fund (PF), or Tax Deducted at Source (TDS) is a sign that operational cash is being diverted to keep bank loans afloat.

- Section 138 Notices: Receiving legal notices for "cheque bouncing" under the Negotiable Instruments Act indicates that the liquidity crisis has reached a critical stage.

- Creditor Pressure: Persistent calls from smaller suppliers or NBFCs (Non-Banking Financial Companies) often precede a formal filing for insolvency by a disgruntled creditor.

What are the consequences of ignoring these signs? Ignoring these signs usually leads to the account being classified as an NPA, which triggers the bank's right to take over physical assets under the SARFAESI Act or file for Corporate Insolvency Resolution Process (CIRP) at the NCLT.

How can you negotiate debt restructuring with Indian banks and NBFCs?

Negotiating with Indian financial institutions requires invoking the Reserve Bank of India (RBI) Prudential Framework for Resolution of Stressed Assets. This framework allows lenders to implement a resolution plan that can include extending the loan tenor, reducing interest rates, or converting a portion of the debt into equity.

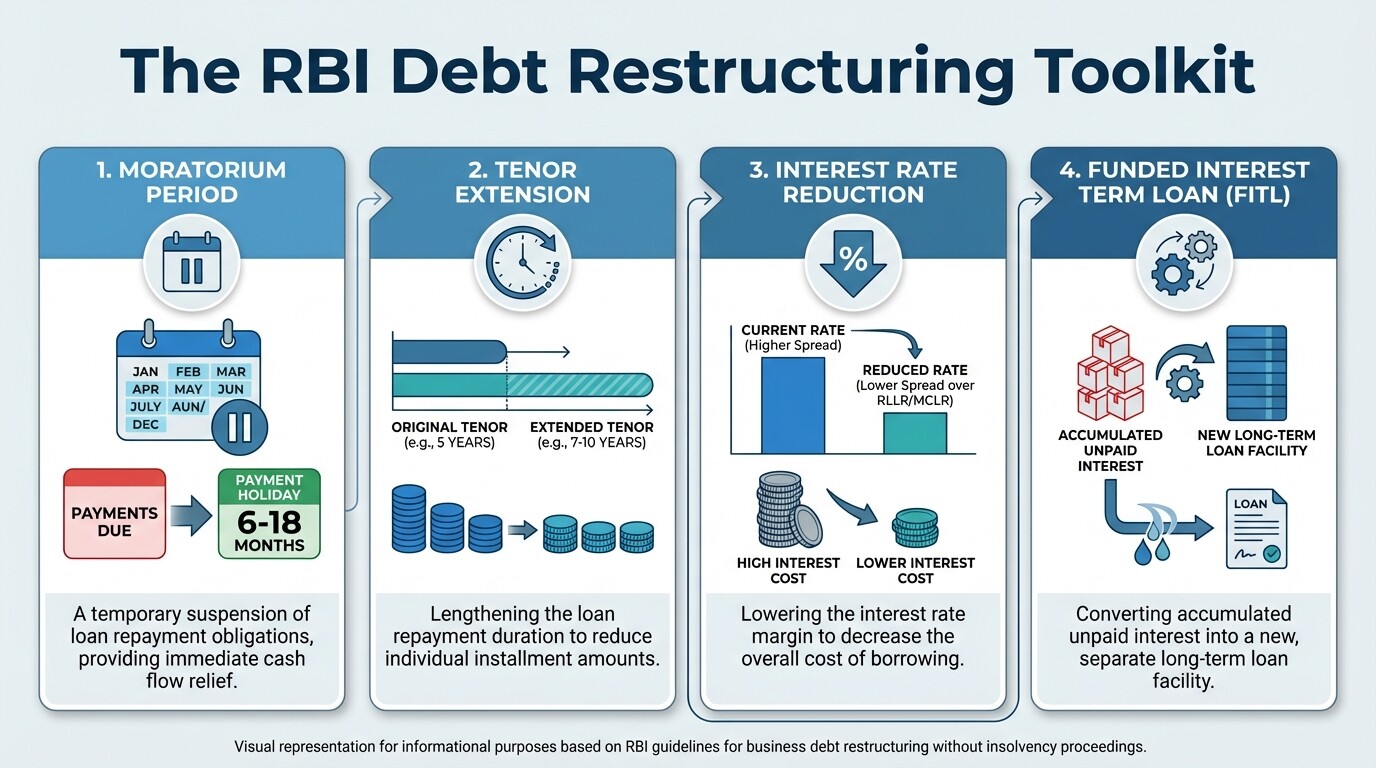

The process is highly regulated and follows a specific hierarchy of tools:

- Moratorium Period: Requesting a "payment holiday" (typically 6 to 18 months) where the company only pays interest or nothing at all, allowing cash flow to stabilize.

- Tenor Extension: Stretching a 5-year loan into a 7 or 10-year loan to reduce the Monthly Installment (EMI) burden.

- Interest Rate Reduction: Negotiating a lower "Spread" over the bank's Repo-Linked Lending Rate (RLLR) or MCLR.

- Funded Interest Term Loan (FITL): Converting unpaid interest into a new loan that is repaid over a longer period, preventing an immediate NPA classification.

What documents are required for an RBI restructuring? Lenders will require a Techno-Economic Viability (TEV) Report and a detailed Resolution Plan. These documents must prove that the business remains viable and that the temporary cash flow issues are "systemic" (due to market conditions) rather than "idiosyncratic" (due to bad management).

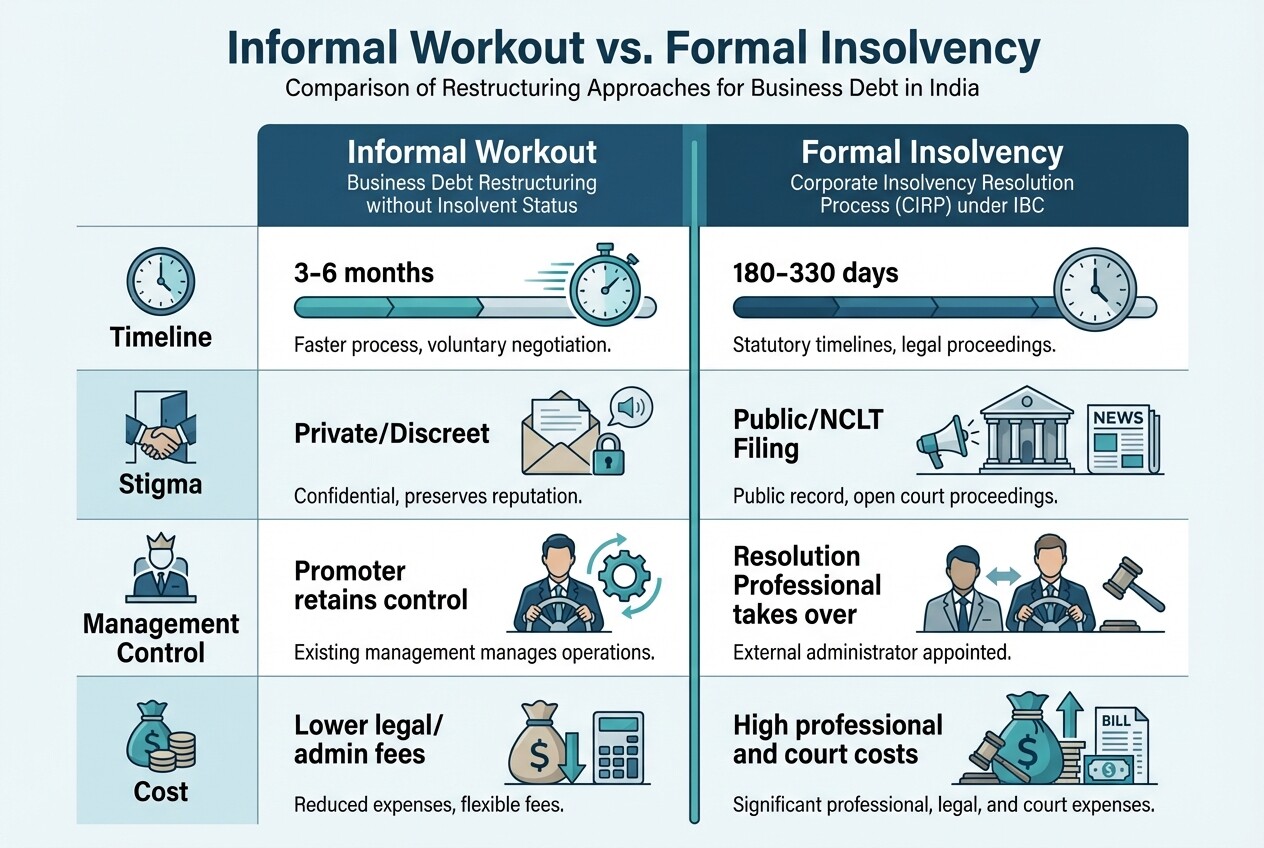

How do informal workouts and one-time settlements (OTS) work in India?

Informal workouts involve negotiating directly with creditors outside of the court system to reach a mutually beneficial settlement, often through a One-Time Settlement (OTS). In an OTS, the bank agrees to accept a single payment that is lower than the total outstanding amount to "close" the loan account and release the mortgage.

This is a preferred route for many SMEs because it avoids the public stigma and long timelines of the NCLT. The steps typically include:

- The Proposal: Submitting a formal letter offering a specific percentage of the principal (usually 70% to 90%) while requesting a waiver of penal interest and charges.

- Source of Funds: Demonstrating where the settlement money will come from-such as the sale of a non-core asset or an infusion of fresh capital from an investor.

- Inter-Creditor Agreement (ICA): If multiple banks are involved, they must sign an ICA under the RBI framework to act as a unified block, preventing one small creditor from derailing the settlement.

Can mediation be used for business debt? Yes, India has recently emphasized Commercial Mediation. Under the Companies Act, businesses can opt for mediation to settle disputes with suppliers or vendors, which can prevent those creditors from filing "Operational Creditor" insolvency petitions.

How does restructuring affect personal guarantees and promoter liability in India?

Restructuring the business debt does not automatically release the personal guarantees provided by promoters or directors. In India, the legal trend, backed by Supreme Court rulings, allows creditors to proceed against the personal assets of the guarantor even if the company's debt is being restructured or settled.

Promoters must be extremely cautious during negotiations:

- Release of Guarantee Clause: When negotiating an OTS or a restructuring plan, promoters should explicitly ask for a "Release of Personal Guarantee" as a condition of the settlement.

- Personal Insolvency Rules: Under the IBC, there are separate provisions for the insolvency of personal guarantors. If the company debt is too high, the promoter may need to file for personal insolvency simultaneously to protect a basic standard of living.

- Asset Mapping: Banks in India often conduct "Asset Tracing" to find personal properties, bank accounts, and shares held by promoters to use as leverage during debt negotiations.

Can a promoter be barred from the restructuring process? Yes, under Section 29A of the IBC, "Willful Defaulters" or those whose accounts have been NPAs for more than a year are generally prohibited from submitting a resolution plan to take back their own company.

When should an Indian business hire a restructuring and insolvency lawyer?

A restructuring lawyer should be engaged as soon as the business realizes it will miss a debt repayment within the next 30 to 60 days. Early legal counsel ensures that communication with the bank is "without prejudice" and that the business does not inadvertently admit to a default that could be used against it in court.

A legal expert provides value in several specific areas:

- Drafting the Resolution Plan: Ensuring the plan complies with the RBI's Prudential Framework.

- Protection from SARFAESI: Filing applications before the Debt Recovery Tribunal (DRT) to stay the physical repossession of factories or offices.

- MSME Pre-Pack (PPIRP): Guiding eligible MSMEs through the Ministry of Corporate Affairs process for pre-packaged insolvency, which is faster and cheaper than a standard filing.

- Negotiating Covenants: Reviewing loan agreements to see if the bank has breached its own terms, providing leverage for the business.

What is the cost of legal help for debt restructuring in India? Costs vary significantly. For SMEs, many firms work on a "Success Fee" model or a fixed retainer ranging from ₹1,00,000 to ₹5,00,000 for the negotiation phase, depending on the complexity and the total debt involved.

Common Misconceptions About Debt Restructuring in India

Myth 1: Restructuring is the same as bankruptcy. Restructuring is a proactive strategy to avoid bankruptcy. It is a sign of responsible management attempting to save the business and its employees' jobs.

Myth 2: Banks must accept my OTS proposal. Banks are not legally obligated to accept an OTS. They will only do so if the "Recovery Value" in the OTS is higher than what they expect to get by selling the assets at an auction.

Myth 3: My credit score (CIBIL) won't be affected. Any restructuring or "Settled" status on a loan will be reported to credit bureaus. While it is better than a "Default" status, it will make getting new loans difficult for the next 2 to 3 years.

FAQ

How long does a typical debt restructuring take in India?

An informal workout or OTS can take between 3 to 6 months. A formal restructuring under the RBI framework usually requires 180 days from the date of the "Review Period" start.

What is the minimum debt required for an IBC filing?

As of current regulations, the minimum threshold of default to initiate insolvency proceedings under the IBC is ₹1 Crore (10 million INR). This protects smaller businesses from being dragged to court for minor defaults.

Can I sell part of my business to pay off debt during restructuring?

Yes, this is often a core component of a resolution plan. Selling "non-core" assets (like unused land or a secondary brand) is a signal to banks that the promoter is committed to repaying the debt.

When to Hire a Lawyer

You should consult a restructuring lawyer if:

- Your bank has issued a notice under Section 13(2) of the SARFAESI Act.

- An operational creditor (supplier) has sent a demand notice under Section 8 of the IBC.

- You need to negotiate a multi-bank Inter-Creditor Agreement.

- You are a promoter concerned about the invocation of your personal guarantees.

Next Steps

- Analyze your cash flow: Determine exactly how much of a "haircut" or interest reduction you need to remain viable.

- Review your loan documents: Look for clauses regarding default, personal guarantees, and collateral.

- Draft a formal proposal: Do not wait for the bank to call you; send a proactive restructuring proposal via your legal counsel.

- Gather the "Success Fee": Ensure you have some liquid cash available to pay the initial margin required by banks for any OTS or restructuring plan.