- Jurisdiction is determined by "habitual residence" or "domicile," meaning you do not need to be a British citizen to divorce in England or Wales.

- The UK court views all global assets, including foreign real estate and offshore pensions, as part of a single "matrimonial pot" available for division.

- A "No-Fault" divorce system is the standard, requiring a minimum cooling-off period of 26 weeks from application to final order.

- Mediation is a legal prerequisite for most cases; you must attend a Mediation Information and Assessment Meeting (MIAM) before a court will hear financial or child-related disputes.

- Enforcement of UK orders abroad depends on reciprocal treaties, such as the Reciprocal Enforcement of Maintenance Orders (REMO).

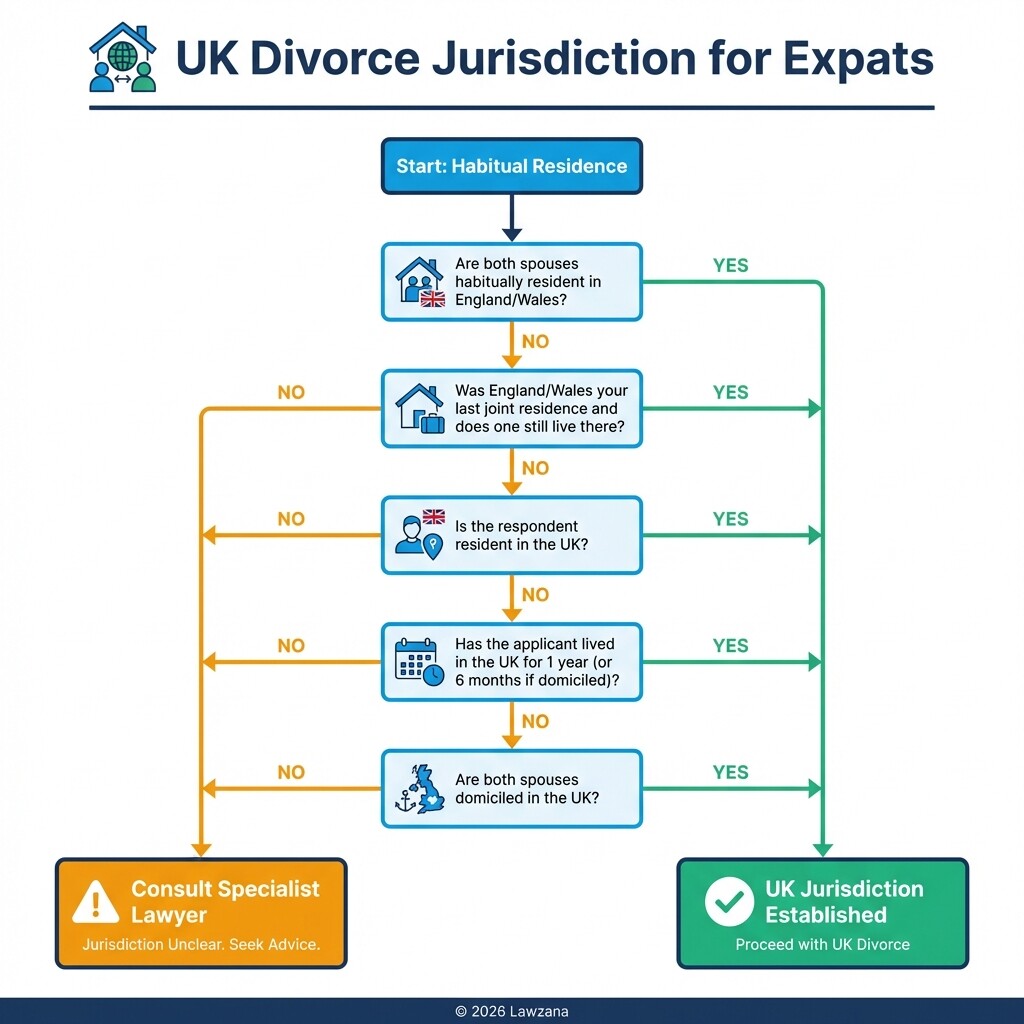

Can you file for divorce in the UK if you are an expat?

You can file for divorce in England and Wales if you or your spouse meet specific jurisdictional requirements based on habitual residence or domicile. Generally, at least one party must have lived in the jurisdiction for a year, or the UK must be considered the permanent home (domicile) of at least one spouse.

To establish jurisdiction, the court looks for a "sufficient connection" to the country. This is vital in international cases because the "race to court" determines which country's laws apply. England and Wales are often seen as a favorable jurisdiction for the financially weaker spouse due to the court's wide discretion to ensure "fairness."

Criteria for Establishing Jurisdiction:

- Both spouses are habitually resident in England or Wales.

- Both spouses were last habitually resident in England or Wales, and one still lives there.

- The respondent is habitually resident in England or Wales.

- The applicant is habitually resident and has lived there for at least one year.

- The applicant is domiciled in England or Wales and has lived there for at least six months.

- Both spouses are domiciled in England or Wales.

How does the UK court treat overseas property and pensions?

The courts in England and Wales exercise "global jurisdiction," meaning they have the power to include all worldwide assets in a financial settlement. Regardless of where a house is located or where a pension was earned, the court expects full and frank disclosure of all international holdings to ensure an equitable distribution.

While the court can order the transfer of a foreign property, actually enforcing that order in a different country can be complex. Often, the court will use "offsetting," where one spouse keeps the UK-based assets (like the family home) to compensate for the other spouse keeping the overseas assets (like a foreign business or villa).

Treatment of Specific Global Assets

| Asset Type | UK Court Approach |

|---|---|

| Foreign Real Estate | Valued at current market rates; often handled via "offsetting" to avoid foreign land registry complications. |

| Overseas Pensions | Treated as a matrimonial asset, but UK "pension sharing orders" are rarely recognized by foreign providers. |

| Offshore Investments | Fully discoverable; the court can draw adverse inferences if assets are hidden in tax havens. |

| Foreign Business Interests | Expert valuations are typically required to determine the liquidity and value of the shareholding. |

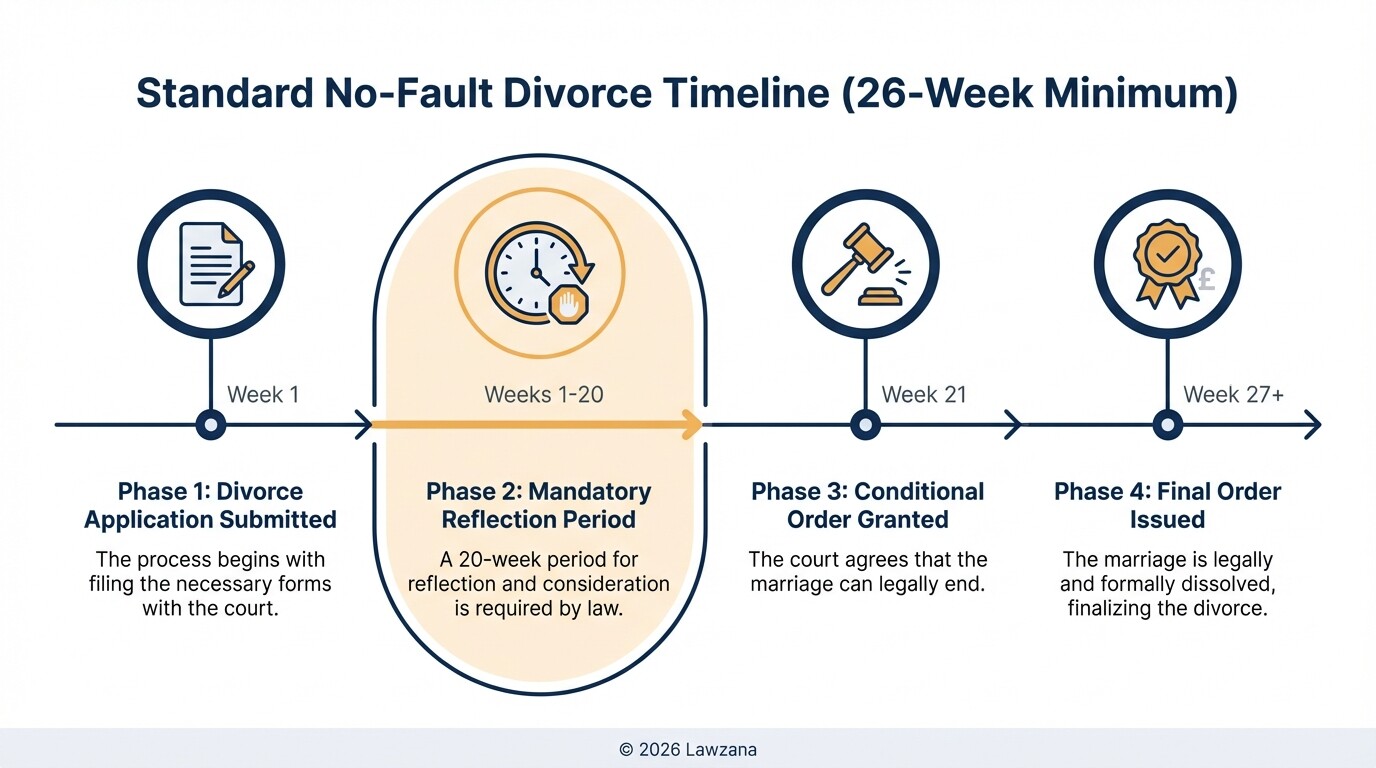

What is the timeline for a no-fault divorce in 2026?

The modern UK divorce process follows a simplified "No-Fault" timeline that takes a minimum of 26 weeks to complete. This system, established by the Divorce, Dissolution and Separation Act 2020, eliminates the need to prove "blame" (such as adultery or desertion), focusing instead on a transparent, administrative progression.

The 2026 approach emphasizes stability for families, providing a mandatory reflection period to allow couples to discuss financial settlements and child arrangements before the marriage is legally ended.

The Standard Timeline:

- Application (Week 1): One or both spouses submit a joint or sole application stating the marriage has irretrievably broken down.

- Reflection Period (Weeks 1-20): A mandatory 20-week "cooling-off" period begins once the application is issued.

- Conditional Order (Week 21): The applicant can apply for a Conditional Order (formerly Decree Nisi), which is the court's confirmation that they are entitled to a divorce.

- Final Order (Week 27): Six weeks and one day after the Conditional Order, the applicant can apply for the Final Order (formerly Decree Absolute), which legally ends the marriage.

Can a UK maintenance order be enforced in another country?

UK maintenance orders can be enforced internationally through a network of treaties, most notably the Reciprocal Enforcement of Maintenance Orders (REMO) agreements. These allow the UK government to work with foreign courts to register and enforce financial support orders against a spouse living abroad.

If your ex-spouse lives in a country that is a signatory to the 2007 Hague Convention or has a bilateral agreement with the UK, you can apply through the Maintenance Enforcement Business Unit to collect payments.

Enforcement Steps:

- Identify the Treaty: Determine if the target country is a REMO signatory.

- Submit Application: File form REMO 1 or relevant documentation via the local Family Court.

- Transmission: The UK REMO unit sends the request to the foreign central authority.

- Foreign Hearing: The local court in the foreign jurisdiction takes steps to garnish wages or seize assets.

Is mediation mandatory before proceeding to court?

Before filing an application for a financial order or a child arrangements order in the UK, you are legally required to attend a Mediation Information and Assessment Meeting (MIAM). This meeting determines whether your dispute can be resolved through alternative dispute resolution rather than a contested court hearing.

Mediation is highly encouraged in international cases because it is often faster and less expensive than litigating across multiple jurisdictions. A mediator helps both parties reach a "Memorandum of Understanding," which can then be turned into a legally binding Consent Order by a judge.

Exceptions to the MIAM Requirement:

- Evidence of domestic abuse or violence.

- Urgent applications (e.g., risk of assets being moved abroad or child abduction).

- Bankruptcy of one of the parties.

- If the parties have already attended a MIAM in the previous four months.

Common Misconceptions About International Divorce

Myth: My prenuptial agreement from another country is automatically binding in the UK. In England and Wales, prenuptial agreements are not strictly "binding," but they are given "decisive weight" provided they were entered into voluntarily, both parties had legal advice, and the agreement is fair. If a foreign prenup leaves one spouse in financial hardship, the UK court may choose to ignore it.

Myth: I can hide my foreign assets because the UK court has no way of finding them. The duty of "full and frank disclosure" is absolute. If you fail to disclose overseas assets and are caught, the court can set aside the entire settlement, award the other spouse a higher percentage, or even hold you in contempt of court, which carries the risk of imprisonment.

FAQ

How much does it cost to file for divorce in the UK?

The current court fee for a divorce application in England and Wales is £593. This does not include legal fees, which vary based on the complexity of international asset division and whether the divorce is contested.

Which country's law applies to my divorce?

In England and Wales, the court almost always applies English law to the divorce process and financial division, even if the marriage took place abroad or the parties are foreign nationals, provided the UK court has jurisdiction.

Can I stop my spouse from moving our children to another country?

If there is a risk of international child abduction, you can apply for a Prohibited Steps Order. If the child has already been moved, the 1980 Hague Convention provides a legal framework for the return of children habitually resident in the UK.

How are foreign pensions shared?

UK courts cannot directly order a foreign pension provider to "split" a fund. Instead, the court will calculate the value of the foreign pension and "offset" that value by giving the other spouse a larger share of UK-based assets, like cash or property.

When to Hire a Lawyer

You should consult a specialist international family lawyer if:

- Your spouse has already initiated proceedings in another country (the "race to court").

- You own property, businesses, or pension funds in multiple jurisdictions.

- There is a significant power imbalance or lack of transparency regarding global finances.

- You are concerned that your spouse may relocate with your children without your consent.

- You have a foreign prenuptial agreement that you wish to enforce or challenge.

Next Steps

- Gather Documentation: Collect titles for foreign property, statements for international bank accounts, and details of overseas pension schemes.

- Check Jurisdiction: Confirm you meet the "habitual residence" or "domicile" criteria for England and Wales.

- Book a MIAM: Contact a certified mediator to complete your mandatory Mediation Information and Assessment Meeting.

- Seek Specialist Counsel: Engage a solicitor with specific experience in cross-border disputes to protect your global interests.

- Review the Official Guidance: Visit the UK Government's divorce portal to understand the latest filing procedures and fee structures.